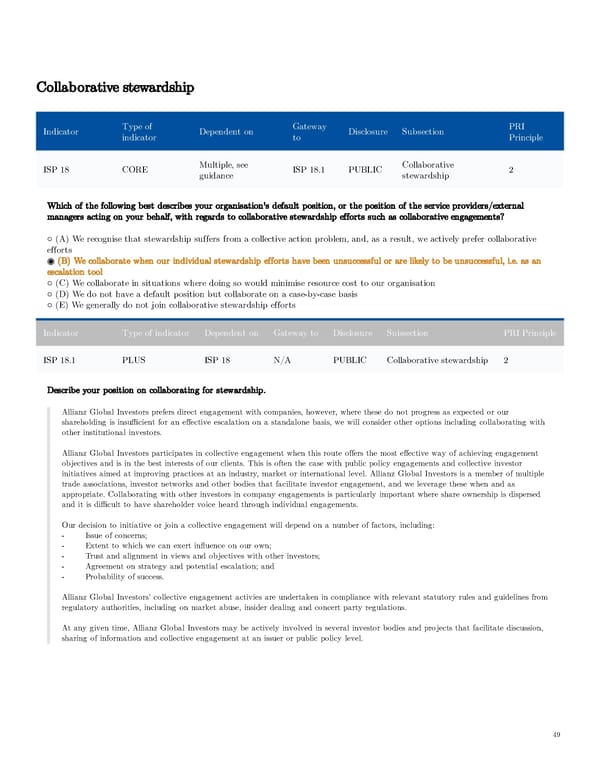

Collaborative stewardship Type of Gateway PRI Indicator Dependent on Disclosure Subsection indicator to Principle Multiple, see Collaborative ISP 18 CORE ISP 18.1 PUBLIC 2 guidance stewardship Which of the following best describes your organisation's default position, or the position of the service providers/external managers acting on your behalf, with regards to collaborative stewardship efforts such as collaborative engagements? ○ (A) We recognise that stewardship suffers from a collective action problem, and, as a result, we actively prefer collaborative efforts ◉ (B) We collaborate when our individual stewardship efforts have been unsuccessful or are likely to be unsuccessful, i.e. as an escalation tool ○ (C) We collaborate in situations where doing so would minimise resource cost to our organisation ○ (D) We do not have a default position but collaborate on a case-by-case basis ○ (E) We generally do not join collaborative stewardship efforts Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle ISP 18.1 PLUS ISP 18 N/A PUBLIC Collaborative stewardship 2 Describe your position on collaborating for stewardship. Allianz Global Investors prefers direct engagement with companies, however, where these do not progress as expected or our shareholding is insufficient for an effective escalation on a standalone basis, we will consider other options including collaborating with other institutional investors. Allianz Global Investors participates in collective engagement when this route offers the most effective way of achieving engagement objectives and is in the best interests of our clients. This is often the case with public policy engagements and collective investor initiatives aimed at improving practices at an industry, market or international level. Allianz Global Investors is a member of multiple trade associations, investor networks and other bodies that facilitate investor engagement, and we leverage these when and as appropriate. Collaborating with other investors in company engagements is particularly important where share ownership is dispersed and it is difficult to have shareholder voice heard through individual engagements. Our decision to initiative or join a collective engagement will depend on a number of factors, including: - Issue of concerns; - Extent to which we can exert influence on our own; - Trust and alignment in views and objectives with other investors; - Agreement on strategy and potential escalation; and - Probability of success. Allianz Global Investors’ collective engagement activies are undertaken in compliance with relevant statutory rules and guidelines from regulatory authorities, including on market abuse, insider dealing and concert party regulations. At any given time, Allianz Global Investors may be actively involved in several investor bodies and projects that facilitate discussion, sharing of information and collective engagement at an issuer or public policy level. 49

AGI Public RI Report Page 48 Page 50

AGI Public RI Report Page 48 Page 50