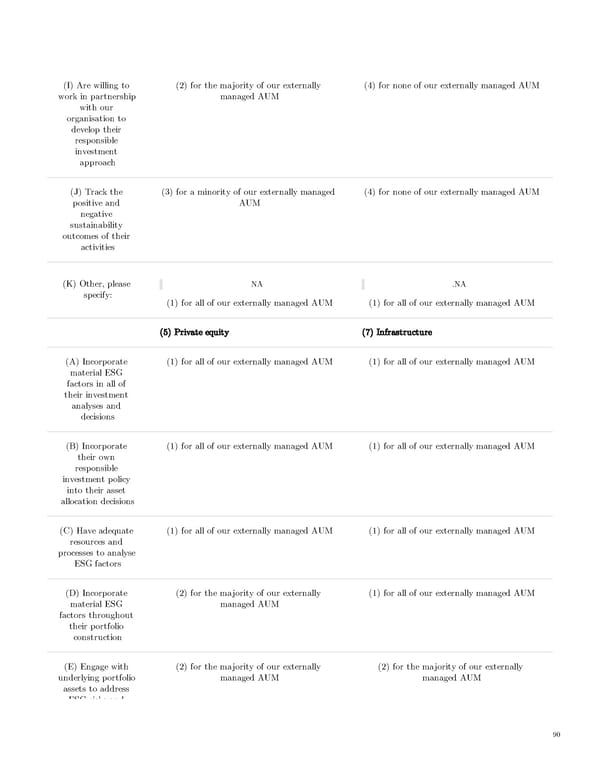

(I) Are willing to (2) for the majority of our externally (4) for none of our externally managed AUM work in partnership managed AUM with our organisation to develop their responsible investment approach (J) Track the (3) for a minority of our externally managed (4) for none of our externally managed AUM positive and AUM negative sustainability outcomes of their activities (K) Other, please NA .NA specify: (1) for all of our externally managed AUM (1) for all of our externally managed AUM (5) Private equity (7) Infrastructure (A) Incorporate (1) for all of our externally managed AUM (1) for all of our externally managed AUM material ESG factors in all of their investment analyses and decisions (B) Incorporate (1) for all of our externally managed AUM (1) for all of our externally managed AUM their own responsible investment policy into their asset allocation decisions (C) Have adequate (1) for all of our externally managed AUM (1) for all of our externally managed AUM resources and processes to analyse ESG factors (D) Incorporate (2) for the majority of our externally (1) for all of our externally managed AUM material ESG managed AUM factors throughout their portfolio construction (E) Engage with (2) for the majority of our externally (2) for the majority of our externally underlying portfolio managed AUM managed AUM assets to address ESGrisks and 90

AGI Public RI Report Page 89 Page 91

AGI Public RI Report Page 89 Page 91