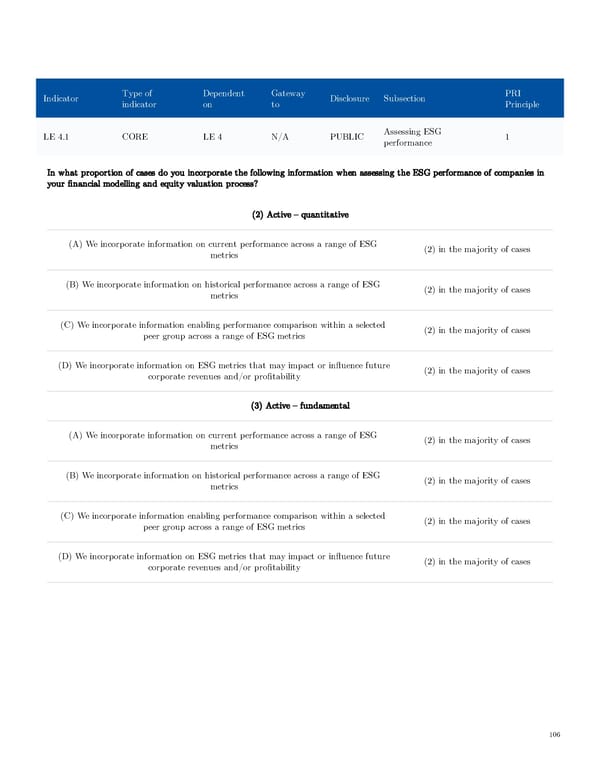

Type of Dependent Gateway PRI Indicator Disclosure Subsection indicator on to Principle Assessing ESG LE 4.1 CORE LE 4 N/A PUBLIC 1 performance In what proportion of cases do you incorporate the following information when assessing the ESG performance of companies in your financial modelling and equity valuation process? (2) Active – quantitative (A) We incorporate information on current performance across a range of ESG (2) in the majority of cases metrics (B) We incorporate information on historical performance across a range of ESG (2) in the majority of cases metrics (C) We incorporate information enabling performance comparison within a selected (2) in the majority of cases peer group across a range of ESG metrics (D) We incorporate information on ESG metrics that may impact or influence future (2) in the majority of cases corporate revenues and/or profitability (3) Active – fundamental (A) We incorporate information on current performance across a range of ESG (2) in the majority of cases metrics (B) We incorporate information on historical performance across a range of ESG (2) in the majority of cases metrics (C) We incorporate information enabling performance comparison within a selected (2) in the majority of cases peer group across a range of ESG metrics (D) We incorporate information on ESG metrics that may impact or influence future (2) in the majority of cases corporate revenues and/or profitability 106

AGI Public RI Report Page 105 Page 107

AGI Public RI Report Page 105 Page 107