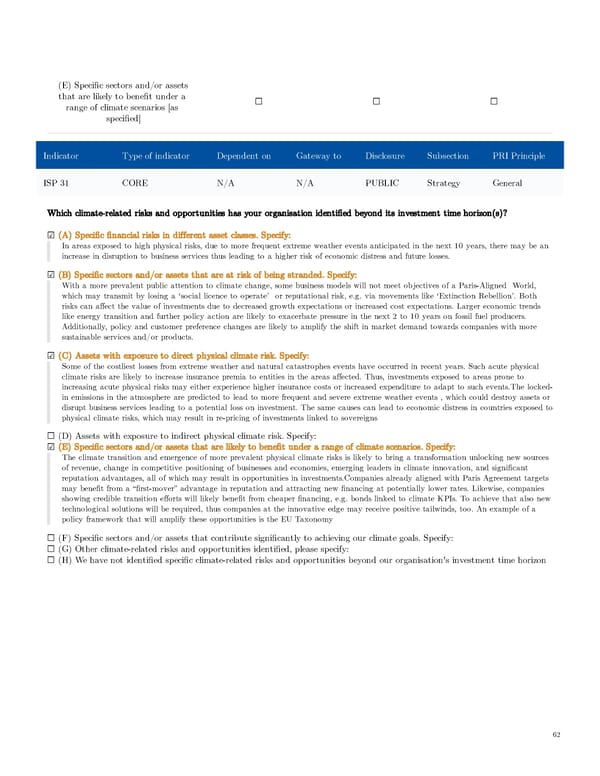

(E) Specific sectors and/or assets that are likely to benefit under a ☐ ☐ ☐ range of climate scenarios [as specified] Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle ISP 31 CORE N/A N/A PUBLIC Strategy General Which climate-related risks and opportunities has your organisation identified beyond its investment time horizon(s)? ☑ (A) Specific financial risks in different asset classes. Specify: In areas exposed to high physical risks, due to more frequent extreme weather events anticipated in the next 10 years, there may be an increase in disruption to business services thus leading to a higher risk of economic distress and future losses. ☑ (B) Specific sectors and/or assets that are at risk of being stranded. Specify: With a more prevalent public attention to climate change, some business models will not meet objectives of a Paris-Aligned World, which may transmit by losing a ‘social licence to operate’ or reputational risk, e.g. via movements like ‘Extinction Rebellion’. Both risks can affect the value of investments due to decreased growth expectations or increased cost expectations. Larger economic trends like energy transition and further policy action are likely to exacerbate pressure in the next 2 to 10 years on fossil fuel producers. Additionally, policy and customer preference changes are likely to amplify the shift in market demand towards companies with more sustainable services and/or products. ☑ (C) Assets with exposure to direct physical climate risk. Specify: Some of the costliest losses from extreme weather and natural catastrophes events have occurred in recent years. Such acute physical climate risks are likely to increase insurance premia to entities in the areas affected. Thus, investments exposed to areas prone to increasing acute physical risks may either experience higher insurance costs or increased expenditure to adapt to such events.The locked- in emissions in the atmosphere are predicted to lead to more frequent and severe extreme weather events , which could destroy assets or disrupt business services leading to a potential loss on investment. The same causes can lead to economic distress in countries exposed to physical climate risks, which may result in re-pricing of investments linked to sovereigns ☐ (D) Assets with exposure to indirect physical climate risk. Specify: ☑ (E) Specific sectors and/or assets that are likely to benefit under a range of climate scenarios. Specify: The climate transition and emergence of more prevalent physical climate risks is likely to bring a transformation unlocking new sources of revenue, change in competitive positioning of businesses and economies, emerging leaders in climate innovation, and significant reputation advantages, all of which may result in opportunities in investments.Companies already aligned with Paris Agreement targets may benefit from a “first-mover” advantage in reputation and attracting new financing at potentially lower rates. Likewise, companies showing credible transition efforts will likely benefit from cheaper financing, e.g. bonds linked to climate KPIs. To achieve that also new technological solutions will be required, thus companies at the innovative edge may receive positive tailwinds, too. An example of a policy framework that will amplify these opportunities is the EU Taxonomy ☐ (F) Specific sectors and/or assets that contribute significantly to achieving our climate goals. Specify: ☐ (G) Other climate-related risks and opportunities identified, please specify: ☐ (H) We have not identified specific climate-related risks and opportunities beyond our organisation's investment time horizon 62

AGI Public RI Report Page 61 Page 63

AGI Public RI Report Page 61 Page 63