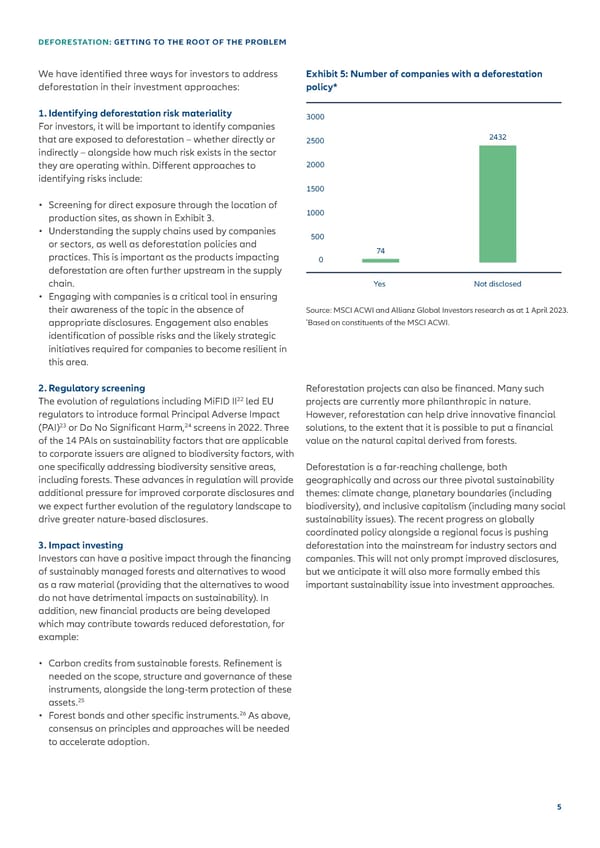

DEFORESTATION: GETTING TO THE ROOT OF THE PROBLEM We have identi昀椀ed three ways for investors to address Exhibit 5: Number of companies with a deforestation deforestation in their investment approaches: policy* 1. Identifying deforestation risk materiality 3000 For investors, it will be important to identify companies that are exposed to deforestation – whether directly or 2500 2432 indirectly – alongside how much risk exists in the sector they are operating within. Di昀昀erent approaches to 2000 identifying risks include: 1500 • Screening for direct exposure through the location of production sites, as shown in Exhibit 3. 1000 • Understanding the supply chains used by companies 500 or sectors, as well as deforestation policies and 74 practices. This is important as the products impacting 0 deforestation are often further upstream in the supply chain. Yes Not disclosed • Engaging with companies is a critical tool in ensuring their awareness of the topic in the absence of Source: MSCI ACWI and Allianz Global Investors research as at 1 April 2023. appropriate disclosures. Engagement also enables *Based on constituents of the MSCI ACWI. identi昀椀cation of possible risks and the likely strategic initiatives required for companies to become resilient in this area. 2. Regulatory screening Reforestation projects can also be financed. Many such 22 The evolution of regulations including MiFID II led EU projects are currently more philanthropic in nature. regulators to introduce formal Principal Adverse Impact However, reforestation can help drive innovative financial 23 24 (PAI) or Do No Signi昀椀cant Harm, screens in 2022. Three solutions, to the extent that it is possible to put a financial of the 14 PAIs on sustainability factors that are applicable value on the natural capital derived from forests. to corporate issuers are aligned to biodiversity factors, with one speci昀椀cally addressing biodiversity sensitive areas, Deforestation is a far-reaching challenge, both including forests. These advances in regulation will provide geographically and across our three pivotal sustainability additional pressure for improved corporate disclosures and themes: climate change, planetary boundaries (including we expect further evolution of the regulatory landscape to biodiversity), and inclusive capitalism (including many social drive greater nature-based disclosures. sustainability issues). The recent progress on globally coordinated policy alongside a regional focus is pushing 3. Impact investing deforestation into the mainstream for industry sectors and Investors can have a positive impact through the 昀椀nancing companies. This will not only prompt improved disclosures, of sustainably managed forests and alternatives to wood but we anticipate it will also more formally embed this as a raw material (providing that the alternatives to wood important sustainability issue into investment approaches. do not have detrimental impacts on sustainability). In addition, new 昀椀nancial products are being developed which may contribute towards reduced deforestation, for example: • Carbon credits from sustainable forests. Re昀椀nement is needed on the scope, structure and governance of these instruments, alongside the long-term protection of these assets.25 26 • Forest bonds and other speci昀椀c instruments. As above, consensus on principles and approaches will be needed to accelerate adoption. 5

Deforestation Page 4 Page 6

Deforestation Page 4 Page 6