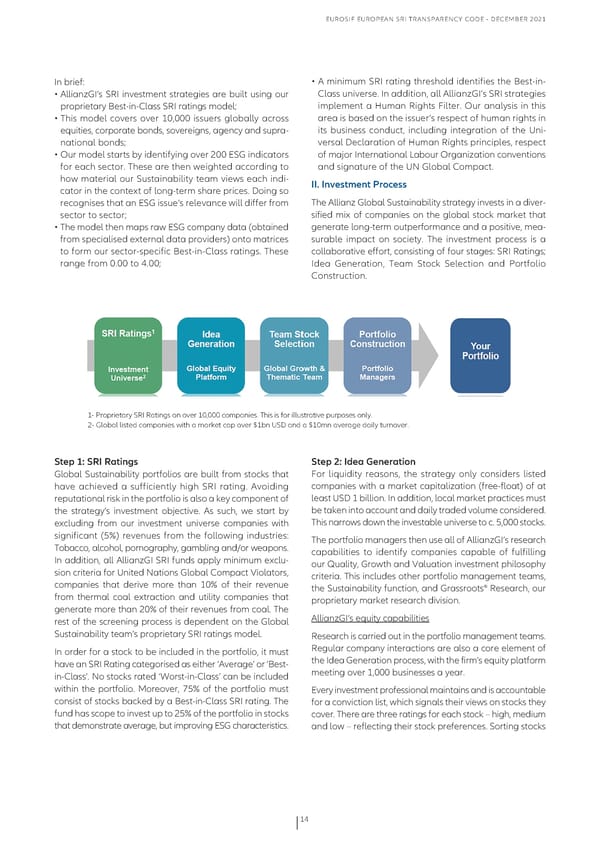

EuRoSIf EuRopEaN SRI TRaNSpaRENcy coDE - DEcEmbER 2021 In brief: • a minimum SRI rating threshold identifies the best-in- • allianzGI’s SRI investment strategies are built using our class universe. In addition, all allianzGI’s SRI strategies proprietary best-in-class SRI ratings model; implement a Human Rights filter. our analysis in this • This model covers over 10,000 issuers globally across area is based on the issuer’s respect of human rights in equities, corporate bonds, sovereigns, agency and supra- its business conduct, including integration of the uni- national bonds; versal Declaration of Human Rights principles, respect • our model starts by identifying over 200 ESG indicators of major International Labour organization conventions for each sector. These are then weighted according to and signature of the uN Global compact. how material our Sustainability team views each indi- II. Investment Process cator in the context of long-term share prices. Doing so recognises that an ESG issue’s relevance will differ from The allianz Global Sustainability strategy invests in a diver- sector to sector; sified mix of companies on the global stock market that • The model then maps raw ESG company data (obtained generate long-term outperformance and a positive, mea- from specialised external data providers) onto matrices surable impact on society. The investment process is a to form our sector-specific best-in-class ratings. These collaborative effort, consisting of four stages: SRI Ratings; range from 0.00 to 4.00; Idea Generation, Team Stock Selection and portfolio construction. 1- proprietary SRI Ratings on over 10,000 companies. This is for illustrative purposes only. 2- Global listed companies with a market cap over $1bn uSD and a $10mn average daily turnover. Step 1: SRI Ratings Step 2: Idea Generation Global Sustainability portfolios are built from stocks that for liquidity reasons, the strategy only considers listed have achieved a sufficiently high SRI rating. avoiding companies with a market capitalization (free-float) of at reputational risk in the portfolio is also a key component of least uSD 1 billion. In addition, local market practices must the strategy’s investment objective. as such, we start by be taken into account and daily traded volume considered. excluding from our investment universe companies with This narrows down the investable universe to c. 5,000 stocks. significant (5%) revenues from the following industries: The portfolio managers then use all of allianzGI’s research Tobacco, alcohol, pornography, gambling and/or weapons. capabilities to identify companies capable of fulfilling In addition, all allianzGI SRI funds apply minimum exclu- our Quality, Growth and Valuation investment philosophy sion criteria for united Nations Global compact Violators, criteria. This includes other portfolio management teams, companies that derive more than 10% of their revenue the Sustainability function, and Grassroots® Research, our from thermal coal extraction and utility companies that proprietary market research division. generate more than 20% of their revenues from coal. The rest of the screening process is dependent on the Global allianzGI’s equity capabilities Sustainability team’s proprietary SRI ratings model. Research is carried out in the portfolio management teams. In order for a stock to be included in the portfolio, it must Regular company interactions are also a core element of have an SRI Rating categorised as either ‘average’ or ‘best- the Idea Generation process, with the firm’s equity platform in-class’. No stocks rated ‘Worst-in-class’ can be included meeting over 1,000 businesses a year. within the portfolio. moreover, 75% of the portfolio must Every investment professional maintains and is accountable consist of stocks backed by a best-in-class SRI rating. The for a conviction list, which signals their views on stocks they fund has scope to invest up to 25% of the portfolio in stocks cover. There are three ratings for each stock – high, medium that demonstrate average, but improving ESG characteristics. and low – reflecting their stock preferences. Sorting stocks 14

Eurosif European SRI Transparency Code Page 13 Page 15

Eurosif European SRI Transparency Code Page 13 Page 15