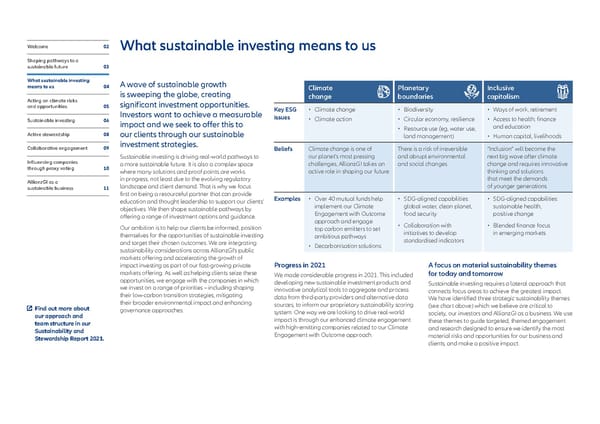

Welcome 02 What sustainable investing means to us Shaping pathways to a sustainable future 03 What sustainable investing A wave of sustainable growth means to us 04 Climate Planetary Inclusive is sweeping the globe, creating change boundaries capitalism Acting on climate risks significant investment opportunities. and opportunities 05 Key ESG • Climate change • Biodiversity • Ways of work, retirement Investors want to achieve a measurable issues • Climate action • Circular economy, resilience • Access to health, finance Sustainable investing 06 impact and we seek to offer this to • Resource use (eg, water use, and education Active stewardship 08 our clients through our sustainable land management) • Human capital, livelihoods Collaborative engagement 09 investment strategies. Beliefs Climate change is one of There is a risk of irreversible “Inclusion” will become the Sustainable investing is driving real-world pathways to our planet’s most pressing and abrupt environmental next big wave after climate Influencing companies a more sustainable future. It is also a complex space challenges, AllianzGI takes an and social changes change and requires innovative through proxy voting 10 where many solutions and proof points are works active role in shaping our future thinking and solutions AllianzGI as a in progress, not least due to the evolving regulatory that meet the demands sustainable business 11 landscape and client demand. That is why we focus of younger generations first on being a resourceful partner that can provide Examples • Over 40 mutual funds help • SDG-aligned capabilities: • SDG-aligned capabilities: education and thought leadership to support our clients’ implement our Climate global water, clean planet, sustainable health, objectives. We then shape sustainable pathways by Engagement with Outcome food security positive change offering a range of investment options and guidance. approach and engage Our ambition is to help our clients be informed, position top carbon emitters to set • Collaboration with • Blended finance focus themselves for the opportunities of sustainable investing ambitious pathways initiatives to develop in emerging markets and target their chosen outcomes. We are integrating standardised indicators sustainability considerations across AllianzGI’s public • Decarbonisation solutions markets offering and accelerating the growth of impact investing as part of our fast-growing private Progress in 2021 A focus on material sustainability themes markets offering. As well as helping clients seize these We made considerable progress in 2021. This included for today and tomorrow opportunities, we engage with the companies in which developing new sustainable investment products and Sustainable investing requires a lateral approach that we invest on a range of priorities – including shaping innovative analytical tools to aggregate and process connects focus areas to achieve the greatest impact. their low-carbon transition strategies, mitigating data from third-party providers and alternative data We have identified three strategic sustainability themes their broader environmental impact and enhancing sources, to inform our proprietary sustainability scoring (see chart above) which we believe are critical to Find out more about governance approaches. system. One way we are looking to drive real-world society, our investors and AllianzGI as a business. We use our approach and impact is through our enhanced climate engagement these themes to guide targeted, themed engagement team structure in our with high-emitting companies related to our Climate and research designed to ensure we identify the most Sustainability and Engagement with Outcome approach. material risks and opportunities for our business and Stewardship Report 2021. clients, and make a positive impact.

Executive summary - Sustainability and Stewardship Report 2021 Page 3 Page 5

Executive summary - Sustainability and Stewardship Report 2021 Page 3 Page 5