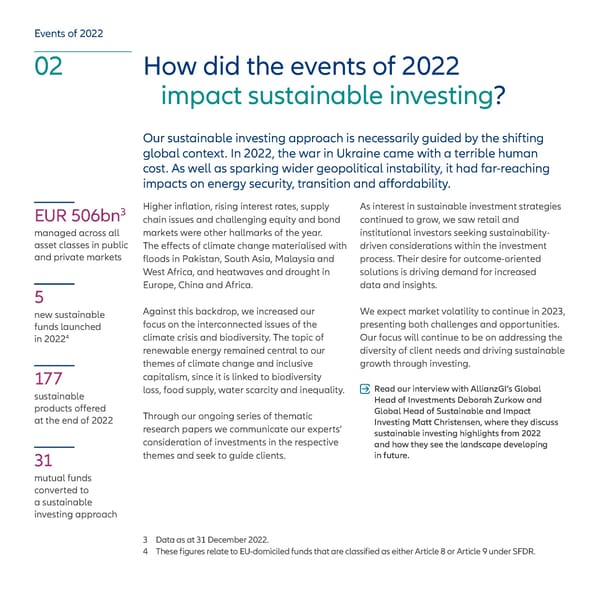

Events of 2022 02 How did the events of 2022 impact sustainable investing? Our sustainable investing approach is necessarily guided by the shifting global context. In 2022, the war in Ukraine came with a terrible human cost. As well as sparking wider geopolitical instability, it had far-reaching impacts on energy security, transition and affordability. EUR 506bn3 Higher inflation, rising interest rates, supply As interest in sustainable investment strategies chain issues and challenging equity and bond continued to grow, we saw retail and managed across all markets were other hallmarks of the year. institutional investors seeking sustainability- asset classes in public The effects of climate change materialised with driven considerations within the investment and private markets floods in Pakistan, South Asia, Malaysia and process. Their desire for outcome-oriented West Africa, and heatwaves and drought in solutions is driving demand for increased 5 Europe, China and Africa. data and insights. new sustainable Against this backdrop, we increased our We expect market volatility to continue in 2023, funds launched focus on the interconnected issues of the presenting both challenges and opportunities. 4 climate crisis and biodiversity. The topic of Our focus will continue to be on addressing the in 2022 renewable energy remained central to our diversity of client needs and driving sustainable themes of climate change and inclusive growth through investing. 177 capitalism, since it is linked to biodiversity sustainable loss, food supply, water scarcity and inequality. Read our interview with AllianzGI’s Global products offered Head of Investments Deborah Zurkow and Through our ongoing series of thematic Global Head of Sustainable and Impact at the end of 2022 research papers we communicate our experts’ Investing Matt Christensen, where they discuss sustainable investing highlights from 2022 consideration of investments in the respective and how they see the landscape developing 31 themes and seek to guide clients. in future. mutual funds converted to a sustainable investing approach 3 Data as at 31 December 2022. 4 These figures relate to EU-domiciled funds that are classified as either Article 8 or Article 9 under SFDR.

Factbook: Sustainability and Stewardship Report Page 8 Page 10

Factbook: Sustainability and Stewardship Report Page 8 Page 10