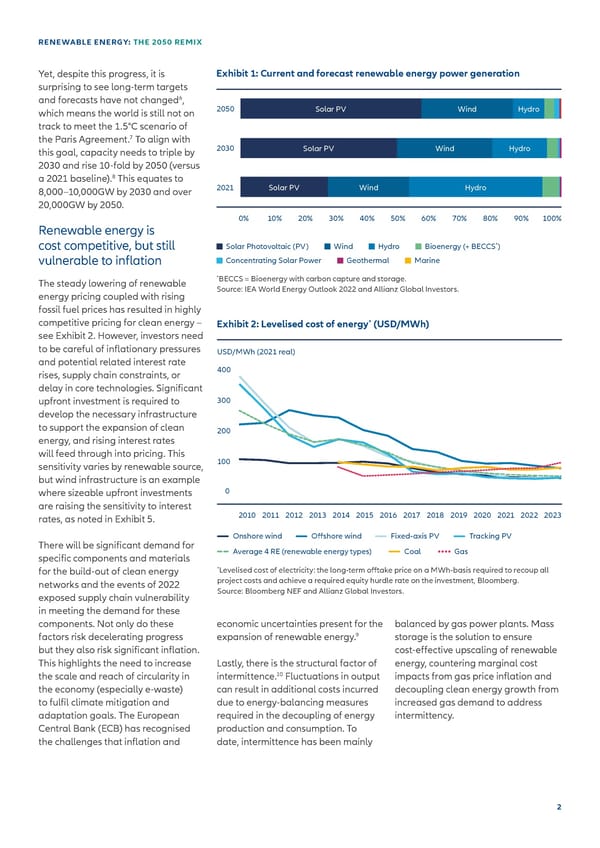

RENEWABLE ENERGY: THE 2050 REMIX Yet, despite this progress, it is Exhibit 1: Current and forecast renewable energy power generation surprising to see long-term targets and forecasts have not changed6, which means the world is still not on 2050 Solar PV Wind Hydro track to meet the 1.5°C scenario of 7 the Paris Agreement. To align with this goal, capacity needs to triple by 2030 Solar PV Wind Hydro 2030 and rise 10-fold by 2050 (versus 8 a 2021 baseline). This equates to 2021 Solar PV Wind Hydro 8,000–10,000GW by 2030 and over 20,000GW by 2050. 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Renewable energy is cost competitive, but still Solar Photovoltaic (PV) Wind Hydro Bioenergy (+ BECCS*) Concentrating Solar Power Geothermal Marine vulnerable to in昀氀ation * The steady lowering of renewable BECCS = Bioenergy with carbon capture and storage. energy pricing coupled with rising Source: IEA World Energy Outlook 2022 and Allianz Global Investors. fossil fuel prices has resulted in highly competitive pricing for clean energy – Exhibit 2: Levelised cost of energy* (USD/MWh) see Exhibit 2. However, investors need to be careful of in昀氀ationary pressures USD/MWh (2021 real) and potential related interest rate 400 rises, supply chain constraints, or delay in core technologies. Signi昀椀cant 300 upfront investment is required to develop the necessary infrastructure to support the expansion of clean 200 energy, and rising interest rates will feed through into pricing. This sensitivity varies by renewable source, 100 but wind infrastructure is an example where sizeable upfront investments 0 are raising the sensitivity to interest 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 rates, as noted in Exhibit 5. Onshore wind O昀昀shore wind Fixed-axis PV Tracking PV There will be signi昀椀cant demand for Average 4 RE (renewable energy types) Coal Gas speci昀椀c components and materials * for the build-out of clean energy Levelised cost of electricity: the long-term o昀昀take price on a MWh-basis required to recoup all networks and the events of 2022 project costs and achieve a required equity hurdle rate on the investment, Bloomberg. exposed supply chain vulnerability Source: Bloomberg NEF and Allianz Global Investors. in meeting the demand for these components. Not only do these economic uncertainties present for the balanced by gas power plants. Mass 9 factors risk decelerating progress expansion of renewable energy. storage is the solution to ensure but they also risk signi昀椀cant in昀氀ation. cost-e昀昀ective upscaling of renewable This highlights the need to increase Lastly, there is the structural factor of energy, countering marginal cost 10 the scale and reach of circularity in intermittence. Fluctuations in output impacts from gas price in昀氀ation and the economy (especially e-waste) can result in additional costs incurred decoupling clean energy growth from to ful昀椀l climate mitigation and due to energy-balancing measures increased gas demand to address adaptation goals. The European required in the decoupling of energy intermittency. Central Bank (ECB) has recognised production and consumption. To the challenges that in昀氀ation and date, intermittence has been mainly 2

Renewable energy Page 1 Page 3

Renewable energy Page 1 Page 3