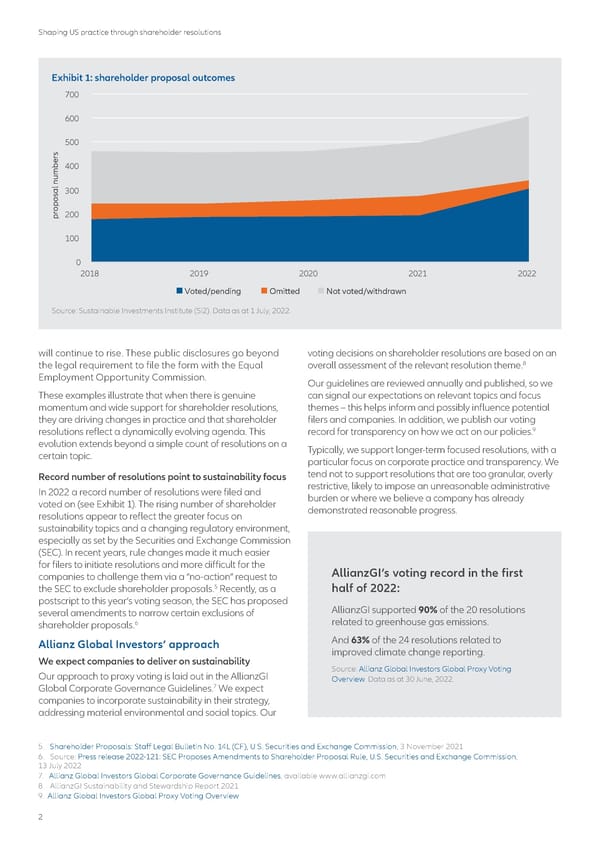

Shaping US practice through shareholder resolutions Exhibit 1: shareholder proposal outcomes 700 600 500 400 300 proposal numbers200 100 0 2018 2019 2020 2021 2022 Voted/pending Omitted Not voted/withdrawn Source: Sustainable Investments Institute (Si2). Data as at 1 July, 2022. will continue to rise. These public disclosures go beyond voting decisions on shareholder resolutions are based on an the legal requirement to file the form with the Equal overall assessment of the relevant resolution theme.8 Employment Opportunity Commission. Our guidelines are reviewed annually and published, so we These examples illustrate that when there is genuine can signal our expectations on relevant topics and focus momentum and wide support for shareholder resolutions, themes – this helps inform and possibly influence potential they are driving changes in practice and that shareholder filers and companies. In addition, we publish our voting 9 resolutions reflect a dynamically evolving agenda. This record for transparency on how we act on our policies. evolution extends beyond a simple count of resolutions on a Typically, we support longer-term focused resolutions, with a certain topic. particular focus on corporate practice and transparency. We Record number of resolutions point to sustainability focus tend not to support resolutions that are too granular, overly In 2022 a record number of resolutions were filed and restrictive, likely to impose an unreasonable administrative voted on (see Exhibit 1). The rising number of shareholder burden or where we believe a company has already resolutions appear to reflect the greater focus on demonstrated reasonable progress. sustainability topics and a changing regulatory environment, especially as set by the Securities and Exchange Commission (SEC). In recent years, rule changes made it much easier for filers to initiate resolutions and more difficult for the AllianzGI’s voting record in the first companies to challenge them via a “no-action” request to 5 the SEC to exclude shareholder proposals. Recently, as a half of 2022: postscript to this year’s voting season, the SEC has proposed AllianzGI supported 90% of the 20 resolutions several amendments to narrow certain exclusions of shareholder proposals.6 related to greenhouse gas emissions. Allianz Global Investors’ approach And 63% of the 24 resolutions related to We expect companies to deliver on sustainability improved climate change reporting. Our approach to proxy voting is laid out in the AllianzGI Source: Allianz Global Investors Global Proxy Voting Overview. Data as at 30 June, 2022. 7 Global Corporate Governance Guidelines. We expect companies to incorporate sustainability in their strategy, addressing material environmental and social topics. Our 5. Shareholder Proposals: Staff Legal Bulletin No. 14L (CF), U.S. Securities and Exchange Commission, 3 November 2021 6. Source: Press release 2022-121: SEC Proposes Amendments to Shareholder Proposal Rule, U.S. Securities and Exchange Commission, 13 July 2022 7. Allianz Global Investors Global Corporate Governance Guidelines, available www.allianzgi.com 8. AllianzGI Sustainability and Stewardship Report 2021 9. Allianz Global Investors Global Proxy Voting Overview 2

Shaping US practice through shareholder resolutions Page 1 Page 3

Shaping US practice through shareholder resolutions Page 1 Page 3