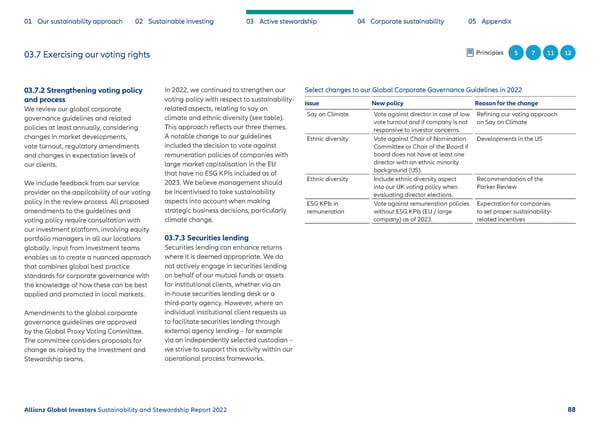

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 03.7 Exercising our voting rights Principles 5 7 11 12 03.7.2 Strengthening voting policy In 2022, we continued to strengthen our Select changes to our Global Corporate Governance Guidelines in 2022 and process voting policy with respect to sustainability- Issue New policy Reason for the change We review our global corporate related aspects, relating to say on Say on Climate Vote against director in case of low Refining our voting approach governance guidelines and related climate and ethnic diversity (see table). vote turnout and if company is not on Say on Climate policies at least annually, considering This approach reflects our three themes. responsive to investor concerns. changes in market developments, A notable change to our guidelines Ethnic diversity Vote against Chair of Nomination Developments in the US vote turnout, regulatory amendments included the decision to vote against Committee or Chair of the Board if and changes in expectation levels of remuneration policies of companies with board does not have at least one our clients. large market capitalisation in the EU director with an ethnic minority that have no ESG KPIs included as of background (US). We include feedback from our service 2023. We believe management should Ethnic diversity Include ethnic diversity aspect Recommendation of the provider on the applicability of our voting be incentivised to take sustainability into our UK voting policy when Parker Review evaluating director elections. policy in the review process. All proposed aspects into account when making ESG KPIs in Vote against remuneration policies Expectation for companies amendments to the guidelines and strategic business decisions, particularly remuneration without ESG KPIs (EU / large to set proper sustainability- voting policy require consultation with climate change. company) as of 2023. related incentives our investment platform, involving equity portfolio managers in all our locations 03.7.3 Securities lending globally. Input from Investment teams Securities lending can enhance returns enables us to create a nuanced approach where it is deemed appropriate. We do that combines global best practice not actively engage in securities lending standards for corporate governance with on behalf of our mutual funds or assets the knowledge of how these can be best for institutional clients, whether via an applied and promoted in local markets. in-house securities lending desk or a third-party agency. However, where an Amendments to the global corporate individual institutional client requests us governance guidelines are approved to facilitate securities lending through by the Global Proxy Voting Committee. external agency lending – for example The committee considers proposals for via an independently selected custodian – change as raised by the Investment and we strive to support this activity within our Stewardship teams. operational process frameworks. Allianz Global Investors Sustainability and Stewardship Report 2022 88

Sustainability & Stewardship Report | AllianzGI Page 88 Page 90

Sustainability & Stewardship Report | AllianzGI Page 88 Page 90