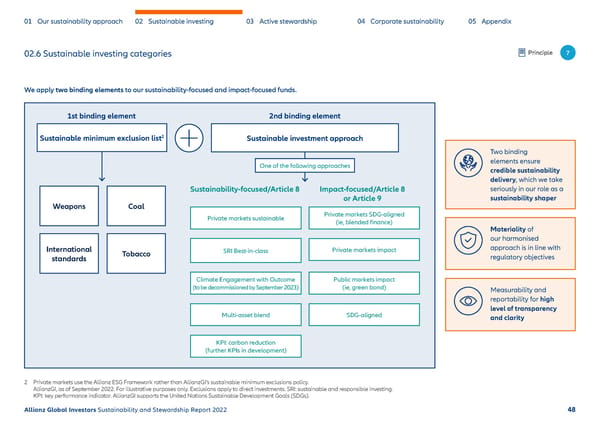

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 02.6 Sustainable investing categories Principle 7 We apply two binding elements to our sustainability-focused and impact-focused funds. 1st binding element 2nd binding element 2 Sustainable minimum exclusion list Sustainable investment approach Two binding One of the following approaches elements ensure credible sustainability delivery, which we take Sustainability-focused/Article 8 Impact-focused/Article 8 seriously in our role as a or Article 9 sustainability shaper Weapons Coal Private markets sustainable Private markets SDG-aligned (ie, blended finance) Materiality of our harmonised International Tobacco SRI Best-in-class Private markets impact approach is in line with standards regulatory objectives Climate Engagement with Outcome Public markets impact (to be decommissioned by September 2023) (ie, green bond) Measurability and reportability for high level of transparency Multi-asset blend SDG-aligned and clarity KPI: carbon reduction (further KPIs in development) 2 Private markets use the Allianz ESG Framework rather than AllianzGI’s sustainable minimum exclusions policy. AllianzGI, as of September 2022. For illustrative purposes only. Exclusions apply to direct investments. SRI: sustainable and responsible investing. KPI: key performance indicator. AllianzGI supports the United Nations Sustainable Development Goals (SDGs). Allianz Global Investors Sustainability and Stewardship Report 2022 48

Sustainability & Stewardship Report | AllianzGI Page 48 Page 50

Sustainability & Stewardship Report | AllianzGI Page 48 Page 50