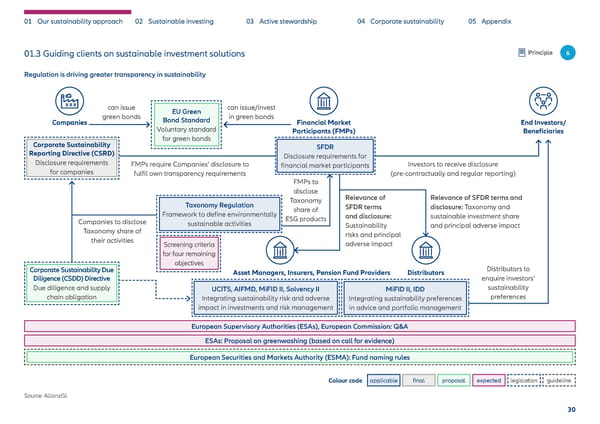

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 Regulation is driving greater transparency in sustainability can issue EU Green can issue/invest Companies green bonds Bond Standard in green bonds Financial Market End Investors/ Voluntary standard Participants (FMPs) Beneficiaries Corporate Sustainability for green bonds Reporting Directive (CSRD) SFDR Disclosure requirements for Disclosure requirements FMPs require Companies’ disclosure to financial market participants Investors to receive disclosure for companies fulfil own transparency requirements (pre-contractually and regular reporting) FMPs to disclose Taxonomy Relevance of Relevance of SFDR terms and Taxonomy Regulation share of SFDR terms disclosure: Taxonomy and Framework to define environmentally ESG products and disclosure: sustainable investment share Companies to disclose sustainable activities Sustainability and principal adverse impact Taxonomy share of risks and principal their activities Screening criteria adverse impact for four remaining objectives Distributors to Corporate Sustainability Due Asset Managers, Insurers, Pension Fund Providers Distributors Diligence (CSDD) Directive enquire investors’ Due diligence and supply UCITS, AIFMD, MiFID II, Solvency II MiFID II, IDD sustainability chain obligation Integrating sustainability risk and adverse Integrating sustainability preferences preferences impact in investments and risk management in advice and portfolio management European Supervisory Authorities (ESAs), European Commission: Q&A ESAs: Proposal on greenwashing (based on call for evidence) European Securities and Markets Authority (ESMA): Fund naming rules Colour code applicable final proposal expected legislation guideline Source: AllianzGI. 30

Sustainability & Stewardship Report | AllianzGI Page 30 Page 32

Sustainability & Stewardship Report | AllianzGI Page 30 Page 32