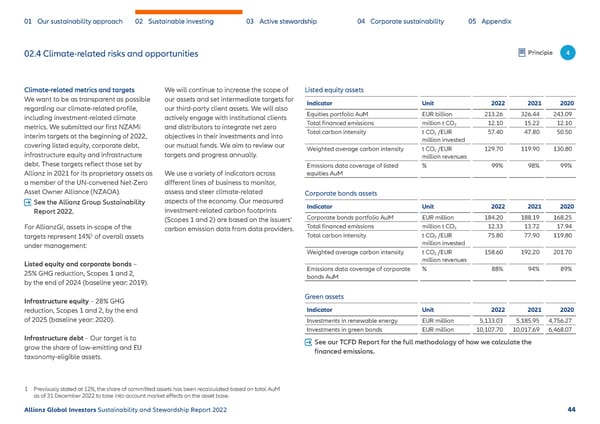

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 02.4 Climate-related risks and opportunities Principle 4 Climate-related metrics and targets We will continue to increase the scope of Listed equity assets We want to be as transparent as possible our assets and set intermediate targets for Indicator Unit 2022 2021 2020 regarding our climate-related profile, our third-party client assets. We will also Equities portfolio AuM EUR billion 213.26 326.44 243.09 including investment-related climate actively engage with institutional clients Total financed emissions million t CO 12.10 15.22 12.10 metrics. We submitted our first NZAMi and distributors to integrate net zero 2 interim targets at the beginning of 2022, objectives in their investments and into Total carbon intensity t CO2 /EUR 57.40 47.80 50.50 covering listed equity, corporate debt, our mutual funds. We aim to review our million invested infrastructure equity and infrastructure targets and progress annually. Weighted average carbon intensity t CO2 /EUR 129.70 119.90 130.80 million revenues debt. These targets reflect those set by Emissions data coverage of listed % 99% 98% 99% Allianz in 2021 for its proprietary assets as We use a variety of indicators across equities AuM a member of the UN-convened Net-Zero different lines of business to monitor, Asset Owner Alliance (NZAOA). assess and steer climate-related Corporate bonds assets See the Allianz Group Sustainability aspects of the economy. Our measured Indicator Unit 2022 2021 2020 Report 2022. investment-related carbon footprints (Scopes 1 and 2) are based on the issuers’ Corporate bonds portfolio AuM EUR million 184.20 188.19 168.25 Total financed emissions million t CO 12.33 13.72 17.94 For AllianzGI, assets in-scope of the carbon emission data from data providers. 2 targets represent 14%1 of overall assets Total carbon intensity t CO2 /EUR 75.80 77.90 119.80 under management: million invested Weighted average carbon intensity t CO2 /EUR 158.60 192.20 201.70 Listed equity and corporate bonds – million revenues 25% GHG reduction, Scopes 1 and 2, Emissions data coverage of corporate % 88% 94% 89% by the end of 2024 (baseline year: 2019). bonds AuM Infrastructure equity – 28% GHG Green assets reduction, Scopes 1 and 2, by the end Indicator Unit 2022 2021 2020 of 2025 (baseline year: 2020). Investments in renewable energy EUR million 5,133.03 5,185.95 4,756.27 Investments in green bonds EUR million 10,107.70 10,017.69 6,468.07 Infrastructure debt – Our target is to See our TCFD Report for the full methodology of how we calculate the grow the share of low-emitting and EU financed emissions. taxonomy-eligible assets. 1 Previously stated at 12%, the share of committed assets has been recalculated based on total AuM as of 31 December 2022 to take into account market effects on the asset base. Allianz Global Investors Sustainability and Stewardship Report 2022 44

Sustainability & Stewardship Report | AllianzGI Page 44 Page 46

Sustainability & Stewardship Report | AllianzGI Page 44 Page 46