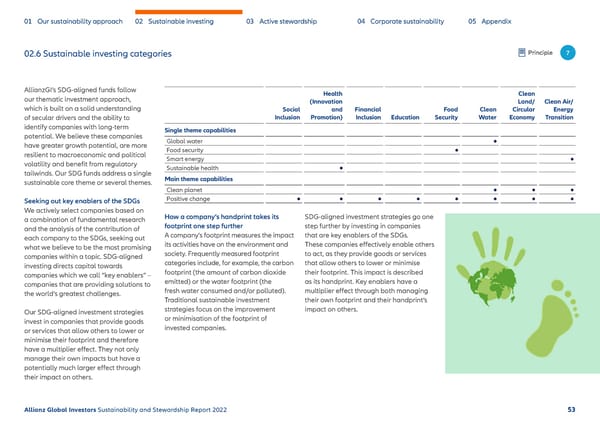

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 02.6 Sustainable investing categories Principle 7 AllianzGI’s SDG-aligned funds follow Health Clean our thematic investment approach, (Innovation Land/ Clean Air/ which is built on a solid understanding Social and Financial Food Clean Circular Energy of secular drivers and the ability to Inclusion Promotion) Inclusion Education Security Water Economy Transition identify companies with long-term Single theme capabilities potential. We believe these companies Global water have greater growth potential, are more Food security resilient to macroeconomic and political Smart energy volatility and benefit from regulatory Sustainable health tailwinds. Our SDG funds address a single Main theme capabilities sustainable core theme or several themes. Clean planet Seeking out key enablers of the SDGs Positive change We actively select companies based on How a company’s handprint takes its SDG-aligned investment strategies go one a combination of fundamental research footprint one step further step further by investing in companies and the analysis of the contribution of A company’s footprint measures the impact that are key enablers of the SDGs. each company to the SDGs, seeking out its activities have on the environment and These companies effectively enable others what we believe to be the most promising society. Frequently measured footprint to act, as they provide goods or services companies within a topic. SDG-aligned categories include, for example, the carbon that allow others to lower or minimise investing directs capital towards footprint (the amount of carbon dioxide their footprint. This impact is described companies which we call “key enablers” – emitted) or the water footprint (the as its handprint. Key enablers have a companies that are providing solutions to fresh water consumed and/or polluted). multiplier effect through both managing the world’s greatest challenges. Traditional sustainable investment their own footprint and their handprint’s Our SDG-aligned investment strategies strategies focus on the improvement impact on others. invest in companies that provide goods or minimisation of the footprint of or services that allow others to lower or invested companies. minimise their footprint and therefore have a multiplier effect. They not only manage their own impacts but have a potentially much larger effect through their impact on others. Allianz Global Investors Sustainability and Stewardship Report 2022 53

Sustainability & Stewardship Report | AllianzGI Page 53 Page 55

Sustainability & Stewardship Report | AllianzGI Page 53 Page 55