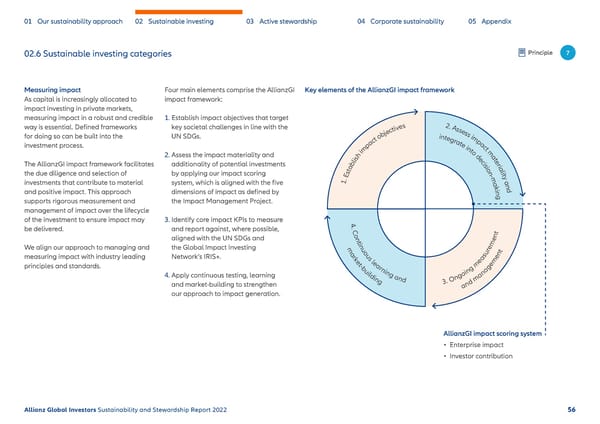

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 02.6 Sustainable investing categories Principle 7 Measuring impact Four main elements comprise the AllianzGI Key elements of the AllianzGI impact framework As capital is increasingly allocated to impact framework: impact investing in private markets, measuring impact in a robust and credible 1. Establish impact objectives that target s 2 . way is essential. Defined frameworks key societal challenges in line with the e v A i s t s c e e s j s b for doing so can be built into the UN SDGs. i i o n m t e t g p c r a a a t investment process. e c p i n t t m o m 2. Assess the impact materiality and i h d a s e t i c e The AllianzGI impact framework facilitates additionality of potential investments l i r b s i i a a o t n l s i the due diligence and selection of by applying our impact scoring - t E m y . a a investments that contribute to material system, which is aligned with the five 1 k n i d and positive impact. This approach dimensions of impact as defined by n supports rigorous measurement and the Impact Management Project. g management of impact over the lifecycle of the investment to ensure impact may 3. Identify core impact KPIs to measure 4. be delivered. and report against, where possible, Con nt aligned with the UN SDGs and tin e We align our approach to managing and the Global Impact Investing m u em measuring impact with industry leading Network’s IRIS+. ark ous sur ent et lea ea em principles and standards. -bu rni g m ag 4. Apply continuous testing, learning ildin ng and ngoin an and market-building to strengthen g 3. O nd m our approach to impact generation. a AllianzGI impact scoring system • Enterprise impact • Investor contribution Allianz Global Investors Sustainability and Stewardship Report 2022 56

Sustainability & Stewardship Report | AllianzGI Page 56 Page 58

Sustainability & Stewardship Report | AllianzGI Page 56 Page 58