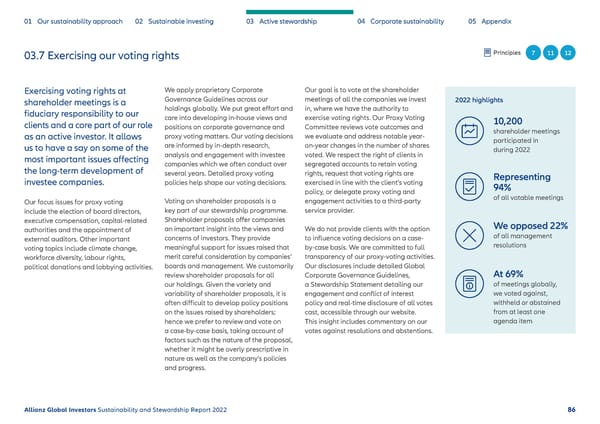

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 03.7 Exercising our voting rights Principles 7 11 12 Exercising voting rights at We apply proprietary Corporate Our goal is to vote at the shareholder shareholder meetings is a Governance Guidelines across our meetings of all the companies we invest 2022 highlights fiduciary responsibility to our holdings globally. We put great effort and in, where we have the authority to clients and a core part of our role care into developing in-house views and exercise voting rights. Our Proxy Voting 10,200 positions on corporate governance and Committee reviews vote outcomes and shareholder meetings as an active investor. It allows proxy voting matters. Our voting decisions we evaluate and address notable year- participated in us to have a say on some of the are informed by in-depth research, on-year changes in the number of shares during 2022 most important issues affecting analysis and engagement with investee voted. We respect the right of clients in the long-term development of companies which we often conduct over segregated accounts to retain voting several years. Detailed proxy voting rights, request that voting rights are Representing investee companies. policies help shape our voting decisions. exercised in line with the client’s voting 94% policy, or delegate proxy voting and of all votable meetings Our focus issues for proxy voting Voting on shareholder proposals is a engagement activities to a third-party include the election of board directors, key part of our stewardship programme. service provider. executive compensation, capital-related Shareholder proposals offer companies We opposed 22% authorities and the appointment of an important insight into the views and We do not provide clients with the option external auditors. Other important concerns of investors. They provide to influence voting decisions on a case- of all management voting topics include climate change, meaningful support for issues raised that by-case basis. We are committed to full resolutions workforce diversity, labour rights, merit careful consideration by companies’ transparency of our proxy-voting activities. political donations and lobbying activities. boards and management. We customarily Our disclosures include detailed Global At 69% review shareholder proposals for all Corporate Governance Guidelines, our holdings. Given the variety and a Stewardship Statement detailing our of meetings globally, variability of shareholder proposals, it is engagement and conflict of interest we voted against, often difficult to develop policy positions policy and real-time disclosure of all votes withheld or abstained on the issues raised by shareholders; cast, accessible through our website. from at least one hence we prefer to review and vote on This insight includes commentary on our agenda item a case-by-case basis, taking account of votes against resolutions and abstentions. factors such as the nature of the proposal, whether it might be overly prescriptive in nature as well as the company’s policies and progress. Allianz Global Investors Sustainability and Stewardship Report 2022 86

Sustainability & Stewardship Report | AllianzGI Page 86 Page 88

Sustainability & Stewardship Report | AllianzGI Page 86 Page 88