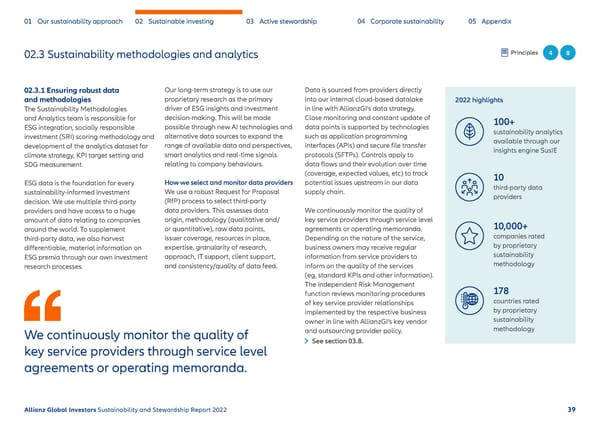

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 02.3 Sustainability methodologies and analytics Principles 4 8 02.3.1 Ensuring robust data Our long-term strategy is to use our Data is sourced from providers directly and methodologies proprietary research as the primary into our internal cloud-based datalake 2022 highlights The Sustainability Methodologies driver of ESG insights and investment in line with AllianzGI’s data strategy. and Analytics team is responsible for decision-making. This will be made Close monitoring and constant update of 100+ ESG integration, socially responsible possible through new AI technologies and data points is supported by technologies sustainability analytics investment (SRI) scoring methodology and alternative data sources to expand the such as application programming available through our development of the analytics dataset for range of available data and perspectives, interfaces (APIs) and secure file transfer insights engine SusIE climate strategy, KPI target setting and smart analytics and real-time signals protocols (SFTPs). Controls apply to SDG measurement. relating to company behaviours. data flows and their evolution over time (coverage, expected values, etc) to track 10 ESG data is the foundation for every How we select and monitor data providers potential issues upstream in our data third-party data sustainability-informed investment We use a robust Request for Proposal supply chain. providers decision. We use multiple third-party (RfP) process to select third-party providers and have access to a huge data providers. This assesses data We continuously monitor the quality of amount of data relating to companies origin, methodology (qualitative and/ key service providers through service level 10,000+ around the world. To supplement or quantitative), raw data points, agreements or operating memoranda. third-party data, we also harvest issuer coverage, resources in place, Depending on the nature of the service, companies rated differentiable, material information on expertise, granularity of research, business owners may receive regular by proprietary ESG premia through our own investment approach, IT support, client support, information from service providers to sustainability research processes. and consistency/quality of data feed. inform on the quality of the services methodology (eg, standard KPIs and other information). The independent Risk Management 178 function reviews monitoring procedures of key service provider relationships countries rated implemented by the respective business by proprietary owner in line with AllianzGI’s key vendor sustainability We continuously monitor the quality of and outsourcing provider policy. methodology See section 03.8. key service providers through service level agreements or operating memoranda. Allianz Global Investors Sustainability and Stewardship Report 2022 39

Sustainability & Stewardship Report | AllianzGI Page 39 Page 41

Sustainability & Stewardship Report | AllianzGI Page 39 Page 41