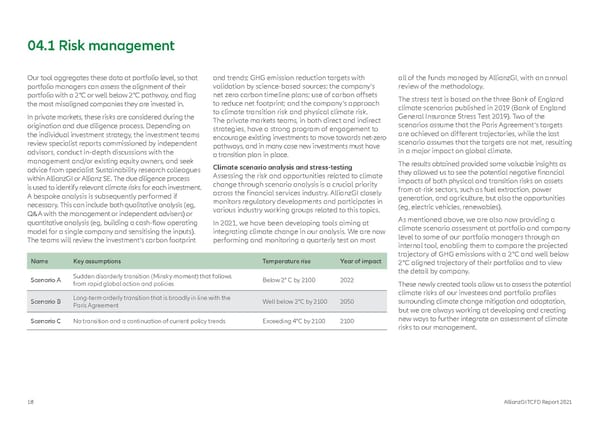

04.1 Risk management Our tool aggregates these data at portfolio level, so that and trends; GHG emission reduction targets with all of the funds managed by AllianzGI, with an annual portfolio managers can assess the alignment of their validation by science-based sources; the company’s review of the methodology. portfolio with a 2°C or well below 2°C pathway, and flag net zero carbon timeline plans; use of carbon offsets The stress test is based on the three Bank of England the most misaligned companies they are invested in. to reduce net footprint; and the company’s approach climate scenarios published in 2019 (Bank of England In private markets, these risks are considered during the to climate transition risk and physical climate risk. General Insurance Stress Test 2019). Two of the origination and due diligence process. Depending on The private markets teams, in both direct and indirect scenarios assume that the Paris Agreement’s targets the individual investment strategy, the investment teams strategies, have a strong program of engagement to are achieved on different trajectories, while the last review specialist reports commissioned by independent encourage existing investments to move towards net-zero scenario assumes that the targets are not met, resulting advisors, conduct in-depth discussions with the pathways, and in many case new investments must have in a major impact on global climate. a transition plan in place. management and/or existing equity owners, and seek Climate scenario analysis and stress-testing The results obtained provided some valuable insights as advice from specialist Sustainability research colleagues Assessing the risk and opportunities related to climate they allowed us to see the potential negative financial within AllianzGI or Allianz SE. The due diligence process change through scenario analysis is a crucial priority impacts of both physical and transition risks on assets is used to identify relevant climate risks for each investment. across the financial services industry. AllianzGI closely from at-risk sectors, such as fuel extraction, power A bespoke analysis is subsequently performed if monitors regulatory developments and participates in generation, and agriculture, but also the opportunities necessary. This can include both qualitative analysis (eg, various industry working groups related to this topics. (eg, electric vehicles, renewables). Q&A with the management or independent advisers) or As mentioned above, we are also now providing a quantitative analysis (eg, building a cash-flow operating In 2021, we have been developing tools aiming at climate scenario assessment at portfolio and company model for a single company and sensitising the inputs). integrating climate change in our analysis. We are now level to some of our portfolio managers through an The teams will review the investment’s carbon footprint performing and monitoring a quarterly test on most internal tool, enabling them to compare the projected trajectory of GHG emissions with a 2°C and well below Name Key assumptions Temperature rise Year of impact 2°C aligned trajectory of their portfolios and to view Sudden disorderly transition (Minsky moment) that follows the detail by company. Scenario A from rapid global action and policies Below 2° C by 2100 2022 These newly created tools allow us to assess the potential Long-term orderly transition that is broadly in line with the climate risks of our investees and portfolio profiles Scenario B Paris Agreement Well below 2°C by 2100 2050 surrounding climate change mitigation and adaptation, but we are always working at developing and creating Scenario C No transition and a continuation of current policy trends Exceeding 4°C by 2100 2100 new ways to further integrate an assessment of climate risks to our management. 18 AllianzGI TCFD Report 2021

TCFD Report Page 17 Page 19

TCFD Report Page 17 Page 19