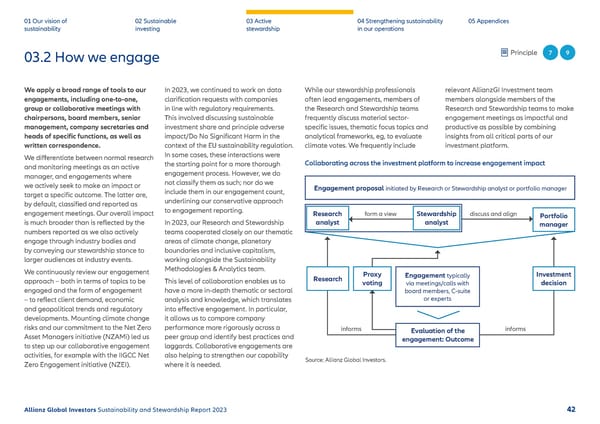

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 03.2 How we engage Principle 7 9 We apply a broad range of tools to our In 2023, we continued to work on data While our stewardship professionals relevant AllianzGI Investment team engagements, including one-to-one, clari昀椀cation requests with companies often lead engagements, members of members alongside members of the group or collaborative meetings with in line with regulatory requirements. the Research and Stewardship teams Research and Stewardship teams to make chairpersons, board members, senior This involved discussing sustainable frequently discuss material sector- engagement meetings as impactful and management, company secretaries and investment share and principle adverse speci昀椀c issues, thematic focus topics and productive as possible by combining heads of speci昀椀c functions, as well as impact/Do No Signi昀椀cant Harm in the analytical frameworks, eg, to evaluate insights from all critical parts of our written correspondence. context of the EU sustainability regulation. climate votes. We frequently include investment platform. We di昀昀erentiate between normal research In some cases, these interactions were and monitoring meetings as an active the starting point for a more thorough Collaborating across the investment platform to increase engagement impact manager, and engagements where engagement process. However, we do we actively seek to make an impact or not classify them as such; nor do we Engagement proposal initiated by Research or Stewardship analyst or portfolio manager target a speci昀椀c outcome. The latter are, include them in our engagement count, by default, classi昀椀ed and reported as underlining our conservative approach engagement meetings. Our overall impact to engagement reporting. Research form a view Stewardship discuss and align Portfolio is much broader than is re昀氀ected by the In 2023, our Research and Stewardship analyst analyst manager numbers reported as we also actively teams cooperated closely on our thematic engage through industry bodies and areas of climate change, planetary by conveying our stewardship stance to boundaries and inclusive capitalism, larger audiences at industry events. working alongside the Sustainability We continuously review our engagement Methodologies & Analytics team. Proxy Engagement typically Investment approach – both in terms of topics to be This level of collaboration enables us to Research voting via meetings/calls with decision engaged and the form of engagement have a more in-depth thematic or sectoral board members, C-suite – to re昀氀ect client demand, economic analysis and knowledge, which translates or experts and geopolitical trends and regulatory into e昀昀ective engagement. In particular, developments. Mounting climate change it allows us to compare company risks and our commitment to the Net Zero performance more rigorously across a informs Evaluation of the informs Asset Managers initiative (NZAMi) led us peer group and identify best practices and engagement: Outcome to step up our collaborative engagement laggards. Collaborative engagements are activities, for example with the IIGCC Net also helping to strengthen our capability Source: Allianz Global Investors. Zero Engagement initiative (NZEI). where it is needed. Allianz Global Investors Sustainability and Stewardship Report 2023 42

2023 | Sustainability Report Page 42 Page 44

2023 | Sustainability Report Page 42 Page 44