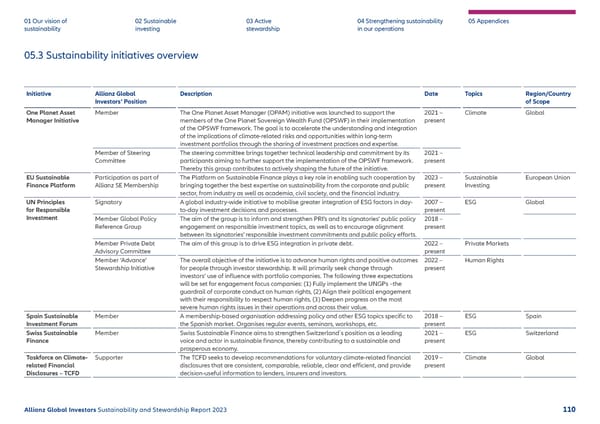

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 05.3 Sustainability initiatives overview Initiative Allianz Global Description Date Topics Region/Country Investors‘ Position of Scope One Planet Asset Member The One Planet Asset Manager (OPAM) initiative was launched to support the 2021 – Climate Global Manager Initiative members of the One Planet Sovereign Wealth Fund (OPSWF) in their implementation present of the OPSWF framework. The goal is to accelerate the understanding and integration of the implications of climate-related risks and opportunities within long-term investment portfolios through the sharing of investment practices and expertise. Member of Steering The steering committee brings together technical leadership and commitment by its 2021 – Committee participants aiming to further support the implementation of the OPSWF framework. present Thereby this group contributes to actively shaping the future of the initiative. EU Sustainable Participation as part of The Platform on Sustainable Finance plays a key role in enabling such cooperation by 2023 – Sustainable European Union Finance Platform Allianz SE Membership bringing together the best expertise on sustainability from the corporate and public present Investing sector, from industry as well as academia, civil society, and the 昀椀nancial industry. UN Principles Signatory A global industry-wide initiative to mobilise greater integration of ESG factors in day- 2007 – ESG Global for Responsible to-day investment decisions and processes. present Investment Member Global Policy The aim of the group is to inform and strengthen PRI's and its signatories' public policy 2018 – Reference Group engagement on responsible investment topics, as well as to encourage alignment present between its signatories' responsible investment commitments and public policy e昀昀orts. Member Private Debt The aim of this group is to drive ESG integration in private debt. 2022 – Private Markets Advisory Committee present Member ‘Advance’ The overall objective of the initiative is to advance human rights and positive outcomes 2022 – Human Rights Stewardship Initiative for people through investor stewardship. It will primarily seek change through present investors’ use of in昀氀uence with portfolio companies. The following three expectations will be set for engagement focus companies: (1) Fully implement the UNGPs –the guardrail of corporate conduct on human rights, (2) Align their political engagement with their responsibility to respect human rights, (3) Deepen progress on the most severe human rights issues in their operations and across their value. Spain Sustainable Member A membership-based organisation addressing policy and other ESG topics speci昀椀c to 2018 – ESG Spain Investment Forum the Spanish market. Organises regular events, seminars, workshops, etc. present Swiss Sustainable Member Swiss Sustainable Finance aims to strengthen Switzerland´s position as a leading 2021 – ESG Switzerland Finance voice and actor in sustainable 昀椀nance, thereby contributing to a sustainable and present prosperous economy. Taskforce on Climate- Supporter The TCFD seeks to develop recommendations for voluntary climate-related 昀椀nancial 2019 – Climate Global related Financial disclosures that are consistent, comparable, reliable, clear and e昀케cient, and provide present Disclosures – TCFD decision-useful information to lenders, insurers and investors. Allianz Global Investors Sustainability and Stewardship Report 2023 110

2023 | Sustainability Report Page 110 Page 112

2023 | Sustainability Report Page 110 Page 112