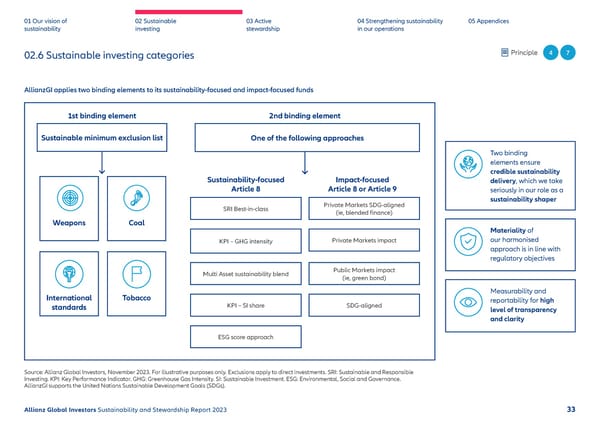

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 02.6 Sustainable investing categories Principle 4 7 AllianzGI applies two binding elements to its sustainability-focused and impact-focused funds 1st binding element 2nd binding element Sustainable minimum exclusion list One of the following approaches Two binding elements ensure credible sustainability Sustainability-focused Impact-focused delivery, which we take Article 8 Article 8 or Article 9 seriously in our role as a Private Markets SDG-aligned sustainability shaper SRI Best-in-class (ie, blended 昀椀nance) Weapons Coal Materiality of KPI – GHG intensity Private Markets impact our harmonised approach is in line with regulatory objectives Multi Asset sustainability blend Public Markets impact (ie, green bond) International Tobacco Measurability and standards KPI – SI share SDG-aligned reportability for high level of transparency and clarity ESG score approach Source: Allianz Global Investors, November 2023. For illustrative purposes only. Exclusions apply to direct investments. SRI: Sustainable and Responsible Investing. KPI: Key Performance Indicator. GHG: Greenhouse Gas Intensity. SI: Sustainable Investment. ESG: Environmental, Social and Governance. AllianzGI supports the United Nations Sustainable Development Goals (SDGs). Allianz Global Investors Sustainability and Stewardship Report 2023 33

2023 | Sustainability Report Page 33 Page 35

2023 | Sustainability Report Page 33 Page 35