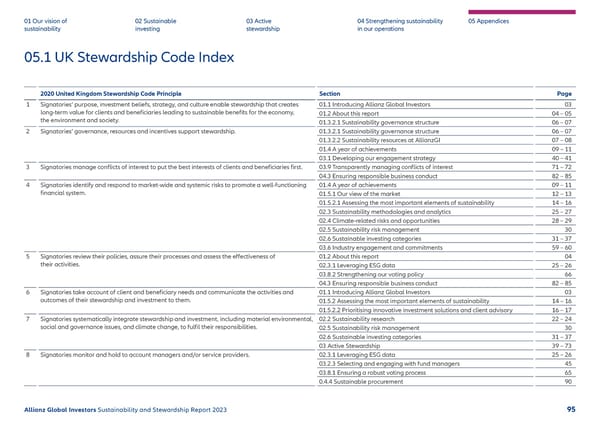

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 05.1 UK Stewardship Code Index 2020 United Kingdom Stewardship Code Principle Section Page 1 Signatories’ purpose, investment beliefs, strategy, and culture enable stewardship that creates 01.1 Introducing Allianz Global Investors 03 long-term value for clients and bene昀椀ciaries leading to sustainable bene昀椀ts for the economy, 01.2 About this report 04 – 05 the environment and society. 01.3.2.1 Sustainability governance structure 06 – 07 2 Signatories’ governance, resources and incentives support stewardship. 01.3.2.1 Sustainability governance structure 06 – 07 01.3.2.2 Sustainability resources at AllianzGI 07 – 08 01.4 A year of achievements 09 – 11 03.1 Developing our engagement strategy 40 – 41 3 Signatories manage con昀氀icts of interest to put the best interests of clients and bene昀椀ciaries 昀椀rst. 03.9 Transparently managing con昀氀icts of interest 71 – 72 04.3 Ensuring responsible business conduct 82 – 85 4 Signatories identify and respond to market-wide and systemic risks to promote a well-functioning 01.4 A year of achievements 09 – 11 昀椀nancial system. 01.5.1 Our view of the market 12 – 13 01.5.2.1 Assessing the most important elements of sustainability 14 – 16 02.3 Sustainability methodologies and analytics 25 – 27 02.4 Climate-related risks and opportunities 28 – 29 02.5 Sustainability risk management 30 02.6 Sustainable investing categories 31 – 37 03.6 Industry engagement and commitments 59 – 60 5 Signatories review their policies, assure their processes and assess the e昀昀ectiveness of 01.2 About this report 04 their activities. 02.3.1 Leveraging ESG data 25 – 26 03.8.2 Strengthening our voting policy 66 04.3 Ensuring responsible business conduct 82 – 85 6 Signatories take account of client and bene昀椀ciary needs and communicate the activities and 01.1 Introducing Allianz Global Investors 03 outcomes of their stewardship and investment to them. 01.5.2 Assessing the most important elements of sustainability 14 – 16 01.5.2.2 Prioritising innovative investment solutions and client advisory 16 – 17 7 Signatories systematically integrate stewardship and investment, including material environmental, 02.2 Sustainability research 22 – 24 social and governance issues, and climate change, to ful昀椀l their responsibilities. 02.5 Sustainability risk management 30 02.6 Sustainable investing categories 31 – 37 03 Active Stewardship 39 – 73 8 Signatories monitor and hold to account managers and/or service providers. 02.3.1 Leveraging ESG data 25 – 26 03.2.3 Selecting and engaging with fund managers 45 03.8.1 Ensuring a robust voting process 65 0.4.4 Sustainable procurement 90 Allianz Global Investors Sustainability and Stewardship Report 2023 95

2023 | Sustainability Report Page 95 Page 97

2023 | Sustainability Report Page 95 Page 97