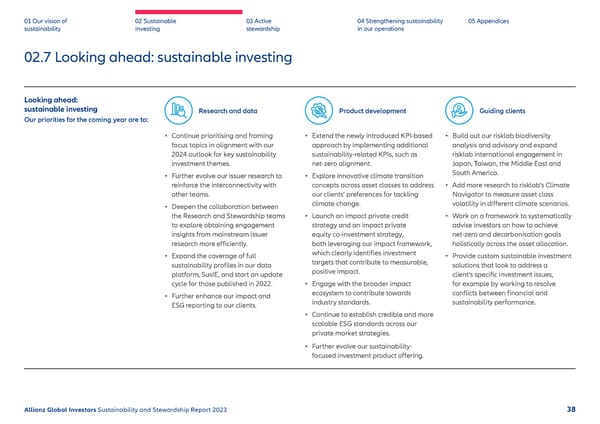

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 02.7 Looking ahead: sustainable investing Looking ahead: sustainable investing Research and data Product development Guiding clients Our priorities for the coming year are to: • Continue prioritising and framing • Extend the newly introduced KPI-based • Build out our risklab biodiversity focus topics in alignment with our approach by implementing additional analysis and advisory and expand 2024 outlook for key sustainability sustainability-related KPIs, such as risklab international engagement in investment themes. net-zero alignment. Japan, Taiwan, the Middle East and • Further evolve our issuer research to • Explore innovative climate transition South America. reinforce the interconnectivity with concepts across asset classes to address • Add more research to risklab’s Climate other teams. our clients’ preferences for tackling Navigator to measure asset class • Deepen the collaboration between climate change. volatility in different climate scenarios. the Research and Stewardship teams • Launch an impact private credit • Work on a framework to systematically to explore obtaining engagement strategy and an impact private advise investors on how to achieve insights from mainstream issuer equity co-investment strategy, net-zero and decarbonisation goals research more efficiently. both leveraging our impact framework, holistically across the asset allocation. • Expand the coverage of full which clearly identifies investment • Provide custom sustainable investment sustainability profiles in our data targets that contribute to measurable, solutions that look to address a platform, SusIE, and start an update positive impact. client’s specific investment issues, cycle for those published in 2022. • Engage with the broader impact for example by working to resolve • Further enhance our impact and ecosystem to contribute towards conflicts between financial and ESG reporting to our clients. industry standards. sustainability performance. • Continue to establish credible and more scalable ESG standards across our private market strategies. • Further evolve our sustainability- focused investment product offering. Allianz Global Investors Sustainability and Stewardship Report 2023 38

2023 | Sustainability Report Page 38 Page 40

2023 | Sustainability Report Page 38 Page 40