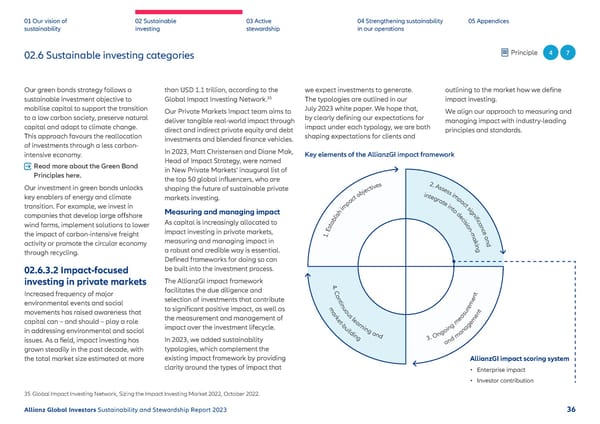

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 02.6 Sustainable investing categories Principle 4 7 Our green bonds strategy follows a than USD 1.1 trillion, according to the we expect investments to generate. outlining to the market how we de昀椀ne sustainable investment objective to Global Impact Investing Network.35 The typologies are outlined in our impact investing. mobilise capital to support the transition Our Private Markets Impact team aims to July 2023 white paper. We hope that, We align our approach to measuring and to a low carbon society, preserve natural deliver tangible real-world impact through by clearly de昀椀ning our expectations for managing impact with industry-leading capital and adapt to climate change. direct and indirect private equity and debt impact under each typology, we are both principles and standards. This approach favours the reallocation investments and blended 昀椀nance vehicles. shaping expectations for clients and of investments through a less carbon- In 2023, Matt Christensen and Diane Mak, intensive economy. Head of Impact Strategy, were named Key elements of the AllianzGI impact framework Read more about the Green Bond in New Private Markets’ inaugural list of Principles here. the top 50 global in昀氀uencers, who are s 2 . e A v s Our investment in green bonds unlocks i s shaping the future of sustainable private t e c s e j s b i i o n m t key enablers of energy and climate t e markets investing. c g p r a a a t c p e t i transition. For example, we invest in m n s i t i o g Measuring and managing impact h s d n companies that develop large o昀昀shore i e i l c 昀椀 b i c As capital is increasingly allocated to a s a i wind farms, implement solutions to lower t o n s n c E - e impact investing in private markets, m the impact of carbon-intensive freight . 1 a a measuring and managing impact in k n activity or promote the circular economy in d through recycling. a robust and credible way is essential. g De昀椀ned frameworks for doing so can 02.6.3.2 Impact-focused be built into the investment process. investing in private markets The AllianzGI impact framework 4 . facilitates the due diligence and C Increased frequency of major selection of investments that contribute ont ent environmental events and social m inu em movements has raised awareness that to signi昀椀cant positive impact, as well as ar ous sur nt capital can – and should – play a role the measurement and management of ket lea ea me impact over the investment lifecycle. -bu rni g m ge in addressing environmental and social ildi ng an goin ana ng d 3. On m issues. As a 昀椀eld, impact investing has In 2023, we added sustainability and grown steadily in the past decade, with typologies, which complement the the total market size estimated at more existing impact framework by providing AllianzGI impact scoring system clarity around the types of impact that • Enterprise impact • Investor contribution 35 Global Impact Investing Network, Sizing the Impact Investing Market 2022, October 2022. Allianz Global Investors Sustainability and Stewardship Report 2023 36

2023 | Sustainability Report Page 36 Page 38

2023 | Sustainability Report Page 36 Page 38