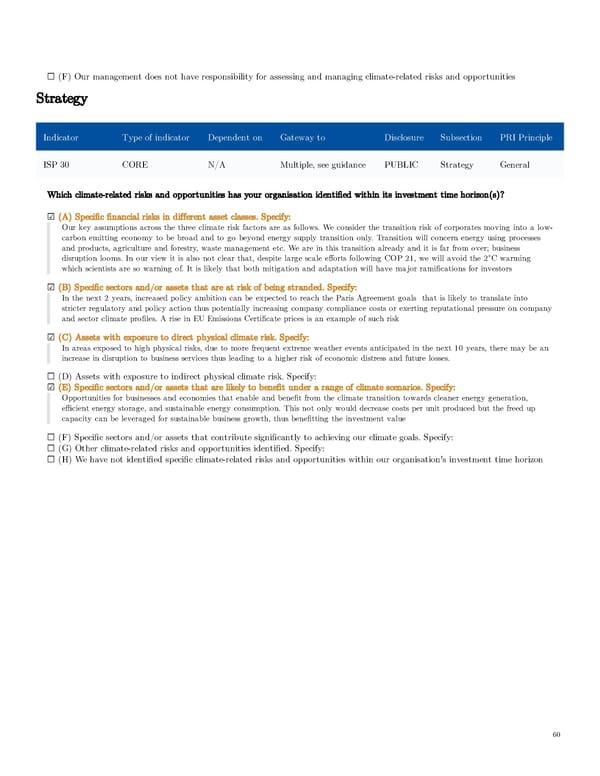

☐ (F) Our management does not have responsibility for assessing and managing climate-related risks and opportunities Strategy Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle ISP 30 CORE N/A Multiple, see guidance PUBLIC Strategy General Which climate-related risks and opportunities has your organisation identified within its investment time horizon(s)? ☑ (A) Specific financial risks in different asset classes. Specify: Our key assumptions across the three climate risk factors are as follows. We consider the transition risk of corporates moving into a low- carbon emitting economy to be broad and to go beyond energy supply transition only. Transition will concern energy using processes and products, agriculture and forestry, waste management etc. We are in this transition already and it is far from over; business disruption looms. In our view it is also not clear that, despite large scale efforts following COP 21, we will avoid the 2°C warming which scientists are so warning of. It is likely that both mitigation and adaptation will have major ramifications for investors ☑ (B) Specific sectors and/or assets that are at risk of being stranded. Specify: In the next 2 years, increased policy ambition can be expected to reach the Paris Agreement goals that is likely to translate into stricter regulatory and policy action thus potentially increasing company compliance costs or exerting reputational pressure on company and sector climate profiles. A rise in EU Emissions Certificate prices is an example of such risk ☑ (C) Assets with exposure to direct physical climate risk. Specify: In areas exposed to high physical risks, due to more frequent extreme weather events anticipated in the next 10 years, there may be an increase in disruption to business services thus leading to a higher risk of economic distress and future losses. ☐ (D) Assets with exposure to indirect physical climate risk. Specify: ☑ (E) Specific sectors and/or assets that are likely to benefit under a range of climate scenarios. Specify: Opportunities for businesses and economies that enable and benefit from the climate transition towards cleaner energy generation, efficient energy storage, and sustainable energy consumption. This not only would decrease costs per unit produced but the freed up capacity can be leveraged for sustainable business growth, thus benefitting the investment value ☐ (F) Specific sectors and/or assets that contribute significantly to achieving our climate goals. Specify: ☐ (G) Other climate-related risks and opportunities identified. Specify: ☐ (H) We have not identified specific climate-related risks and opportunities within our organisation's investment time horizon 60

AGI Public RI Report Page 59 Page 61

AGI Public RI Report Page 59 Page 61