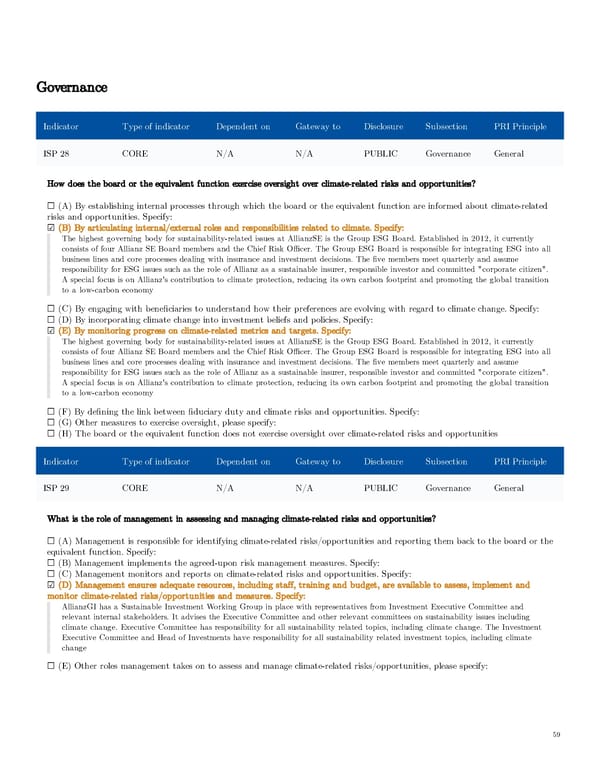

Governance Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle ISP 28 CORE N/A N/A PUBLIC Governance General How does the board or the equivalent function exercise oversight over climate-related risks and opportunities? ☐ (A) By establishing internal processes through which the board or the equivalent function are informed about climate-related risks and opportunities. Specify: ☑ (B) By articulating internal/external roles and responsibilities related to climate. Specify: The highest governing body for sustainability-related issues at AllianzSE is the Group ESG Board. Established in 2012, it currently consists of four Allianz SE Board members and the Chief Risk Officer. The Group ESG Board is responsible for integrating ESG into all business lines and core processes dealing with insurance and investment decisions. The five members meet quarterly and assume responsibility for ESG issues such as the role of Allianz as a sustainable insurer, responsible investor and committed "corporate citizen". A special focus is on Allianz's contribution to climate protection, reducing its own carbon footprint and promoting the global transition to a low-carbon economy ☐ (C) By engaging with beneficiaries to understand how their preferences are evolving with regard to climate change. Specify: ☐ (D) By incorporating climate change into investment beliefs and policies. Specify: ☑ (E) By monitoring progress on climate-related metrics and targets. Specify: The highest governing body for sustainability-related issues at AllianzSE is the Group ESG Board. Established in 2012, it currently consists of four Allianz SE Board members and the Chief Risk Officer. The Group ESG Board is responsible for integrating ESG into all business lines and core processes dealing with insurance and investment decisions. The five members meet quarterly and assume responsibility for ESG issues such as the role of Allianz as a sustainable insurer, responsible investor and committed "corporate citizen". A special focus is on Allianz's contribution to climate protection, reducing its own carbon footprint and promoting the global transition to a low-carbon economy ☐ (F) By defining the link between fiduciary duty and climate risks and opportunities. Specify: ☐ (G) Other measures to exercise oversight, please specify: ☐ (H) The board or the equivalent function does not exercise oversight over climate-related risks and opportunities Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle ISP 29 CORE N/A N/A PUBLIC Governance General What is the role of management in assessing and managing climate-related risks and opportunities? ☐ (A) Management is responsible for identifying climate-related risks/opportunities and reporting them back to the board or the equivalent function. Specify: ☐ (B) Management implements the agreed-upon risk management measures. Specify: ☐ (C) Management monitors and reports on climate-related risks and opportunities. Specify: ☑ (D) Management ensures adequate resources, including staff, training and budget, are available to assess, implement and monitor climate-related risks/opportunities and measures. Specify: AllianzGI has a Sustainable Investment Working Group in place with representatives from Investment Executive Committee and relevant internal stakeholders. It advises the Executive Committee and other relevant committees on sustainability issues including climate change. Executive Committee has responsibility for all sustainability related topics, including climate change. The Investment Executive Committee and Head of Investments have responsibility for all sustainability related investment topics, including climate change ☐ (E) Other roles management takes on to assess and manage climate-related risks/opportunities, please specify: 59

AGI Public RI Report Page 58 Page 60

AGI Public RI Report Page 58 Page 60