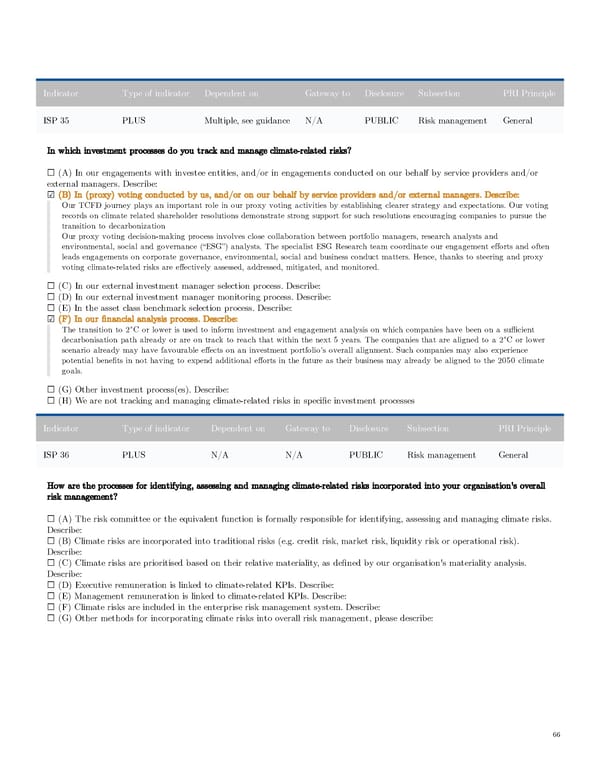

Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle ISP 35 PLUS Multiple, see guidance N/A PUBLIC Risk management General In which investment processes do you track and manage climate-related risks? ☐ (A) In our engagements with investee entities, and/or in engagements conducted on our behalf by service providers and/or external managers. Describe: ☑ (B) In (proxy) voting conducted by us, and/or on our behalf by service providers and/or external managers. Describe: Our TCFD journey plays an important role in our proxy voting activities by establishing clearer strategy and expectations. Our voting records on climate related shareholder resolutions demonstrate strong support for such resolutions encouraging companies to pursue the transition to decarbonization Our proxy voting decision-making process involves close collaboration between portfolio managers, research analysts and environmental, social and governance (“ESG”) analysts. The specialist ESG Research team coordinate our engagement efforts and often leads engagements on corporate governance, environmental, social and business conduct matters. Hence, thanks to steering and proxy voting climate-related risks are effectively assessed, addressed, mitigated, and monitored. ☐ (C) In our external investment manager selection process. Describe: ☐ (D) In our external investment manager monitoring process. Describe: ☐ (E) In the asset class benchmark selection process. Describe: ☑ (F) In our financial analysis process. Describe: The transition to 2°C or lower is used to inform investment and engagement analysis on which companies have been on a sufficient decarbonisation path already or are on track to reach that within the next 5 years. The companies that are aligned to a 2°C or lower scenario already may have favourable effects on an investment portfolio’s overall alignment. Such companies may also experience potential benefits in not having to expend additional efforts in the future as their business may already be aligned to the 2050 climate goals. ☐ (G) Other investment process(es). Describe: ☐ (H) We are not tracking and managing climate-related risks in specific investment processes Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle ISP 36 PLUS N/A N/A PUBLIC Risk management General How are the processes for identifying, assessing and managing climate-related risks incorporated into your organisation's overall risk management? ☐ (A) The risk committee or the equivalent function is formally responsible for identifying, assessing and managing climate risks. Describe: ☐ (B) Climate risks are incorporated into traditional risks (e.g. credit risk, market risk, liquidity risk or operational risk). Describe: ☐ (C) Climate risks are prioritised based on their relative materiality, as defined by our organisation's materiality analysis. Describe: ☐ (D) Executive remuneration is linked to climate-related KPIs. Describe: ☐ (E) Management remuneration is linked to climate-related KPIs. Describe: ☐ (F) Climate risks are included in the enterprise risk management system. Describe: ☐ (G) Other methods for incorporating climate risks into overall risk management, please describe: 66

AGI Public RI Report Page 65 Page 67

AGI Public RI Report Page 65 Page 67