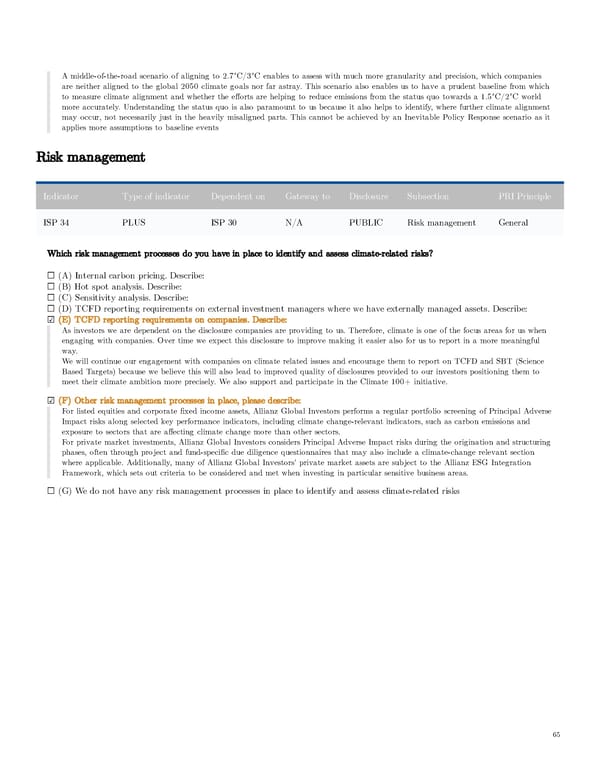

A middle-of-the-road scenario of aligning to 2.7°C/3°C enables to assess with much more granularity and precision, which companies are neither aligned to the global 2050 climate goals nor far astray. This scenario also enables us to have a prudent baseline from which to measure climate alignment and whether the efforts are helping to reduce emissions from the status quo towards a 1.5°C/2°C world more accurately. Understanding the status quo is also paramount to us because it also helps to identify, where further climate alignment may occur, not necessarily just in the heavily misaligned parts. This cannot be achieved by an Inevitable Policy Response scenario as it applies more assumptions to baseline events Risk management Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle ISP 34 PLUS ISP 30 N/A PUBLIC Risk management General Which risk management processes do you have in place to identify and assess climate-related risks? ☐ (A) Internal carbon pricing. Describe: ☐ (B) Hot spot analysis. Describe: ☐ (C) Sensitivity analysis. Describe: ☐ (D) TCFD reporting requirements on external investment managers where we have externally managed assets. Describe: ☑ (E) TCFD reporting requirements on companies. Describe: As investors we are dependent on the disclosure companies are providing to us. Therefore, climate is one of the focus areas for us when engaging with companies. Over time we expect this disclosure to improve making it easier also for us to report in a more meaningful way. We will continue our engagement with companies on climate related issues and encourage them to report on TCFD and SBT (Science Based Targets) because we believe this will also lead to improved quality of disclosures provided to our investors positioning them to meet their climate ambition more precisely. We also support and participate in the Climate 100+ initiative. ☑ (F) Other risk management processes in place, please describe: For listed equities and corporate fixed income assets, Allianz Global Investors performs a regular portfolio screening of Principal Adverse Impact risks along selected key performance indicators, including climate change-relevant indicators, such as carbon emissions and exposure to sectors that are affecting climate change more than other sectors. For private market investments, Allianz Global Investors considers Principal Adverse Impact risks during the origination and structuring phases, often through project and fund-specific due diligence questionnaires that may also include a climate-change relevant section where applicable. Additionally, many of Allianz Global Investors’ private market assets are subject to the Allianz ESG Integration Framework, which sets out criteria to be considered and met when investing in particular sensitive business areas. ☐ (G) We do not have any risk management processes in place to identify and assess climate-related risks 65

AGI Public RI Report Page 64 Page 66

AGI Public RI Report Page 64 Page 66