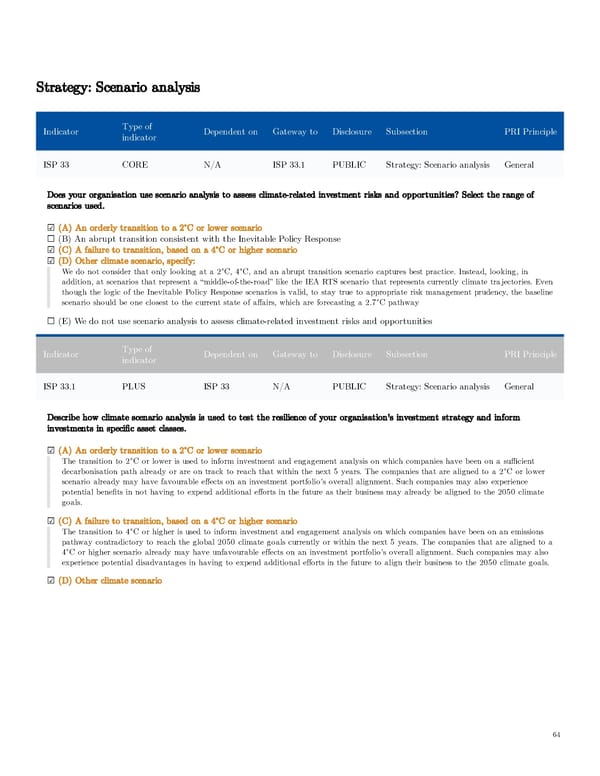

Strategy: Scenario analysis Type of Indicator Dependent on Gateway to Disclosure Subsection PRI Principle indicator ISP 33 CORE N/A ISP 33.1 PUBLIC Strategy: Scenario analysis General Does your organisation use scenario analysis to assess climate-related investment risks and opportunities? Select the range of scenarios used. ☑ (A) An orderly transition to a 2°C or lower scenario ☐ (B) An abrupt transition consistent with the Inevitable Policy Response ☑ (C) A failure to transition, based on a 4°C or higher scenario ☑ (D) Other climate scenario, specify: We do not consider that only looking at a 2°C, 4°C, and an abrupt transition scenario captures best practice. Instead, looking, in addition, at scenarios that represent a “middle-of-the-road” like the IEA RTS scenario that represents currently climate trajectories. Even though the logic of the Inevitable Policy Response scenarios is valid, to stay true to appropriate risk management prudency, the baseline scenario should be one closest to the current state of affairs, which are forecasting a 2.7°C pathway ☐ (E) We do not use scenario analysis to assess climate-related investment risks and opportunities Type of Indicator Dependent on Gateway to Disclosure Subsection PRI Principle indicator ISP 33.1 PLUS ISP 33 N/A PUBLIC Strategy: Scenario analysis General Describe how climate scenario analysis is used to test the resilience of your organisation's investment strategy and inform investments in specific asset classes. ☑ (A) An orderly transition to a 2°C or lower scenario The transition to 2°C or lower is used to inform investment and engagement analysis on which companies have been on a sufficient decarbonisation path already or are on track to reach that within the next 5 years. The companies that are aligned to a 2°C or lower scenario already may have favourable effects on an investment portfolio’s overall alignment. Such companies may also experience potential benefits in not having to expend additional efforts in the future as their business may already be aligned to the 2050 climate goals. ☑ (C) A failure to transition, based on a 4°C or higher scenario The transition to 4°C or higher is used to inform investment and engagement analysis on which companies have been on an emissions pathway contradictory to reach the global 2050 climate goals currently or within the next 5 years. The companies that are aligned to a 4°C or higher scenario already may have unfavourable effects on an investment portfolio’s overall alignment. Such companies may also experience potential disadvantages in having to expend additional efforts in the future to align their business to the 2050 climate goals. ☑ (D) Other climate scenario 64

AGI Public RI Report Page 63 Page 65

AGI Public RI Report Page 63 Page 65