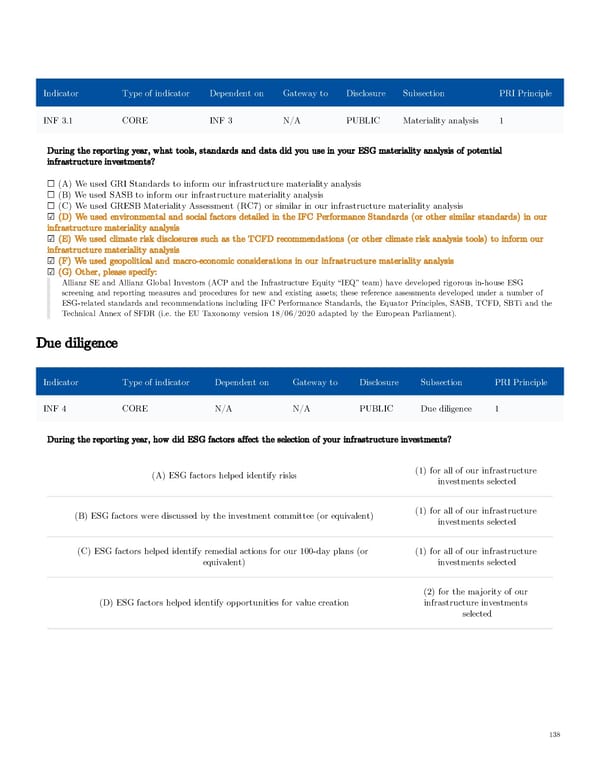

Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle INF 3.1 CORE INF 3 N/A PUBLIC Materiality analysis 1 During the reporting year, what tools, standards and data did you use in your ESG materiality analysis of potential infrastructure investments? ☐ (A) We used GRI Standards to inform our infrastructure materiality analysis ☐ (B) We used SASB to inform our infrastructure materiality analysis ☐ (C) We used GRESB Materiality Assessment (RC7) or similar in our infrastructure materiality analysis ☑ (D) We used environmental and social factors detailed in the IFC Performance Standards (or other similar standards) in our infrastructure materiality analysis ☑ (E) We used climate risk disclosures such as the TCFD recommendations (or other climate risk analysis tools) to inform our infrastructure materiality analysis ☑ (F) We used geopolitical and macro-economic considerations in our infrastructure materiality analysis ☑ (G) Other, please specify: Allianz SE and Allianz Global Investors (ACP and the Infrastructure Equity “IEQ” team) have developed rigorous in-house ESG screening and reporting measures and procedures for new and existing assets; these reference assessments developed under a number of ESG-related standards and recommendations including IFC Performance Standards, the Equator Principles, SASB, TCFD, SBTi and the Technical Annex of SFDR (i.e. the EU Taxonomy version 18/06/2020 adapted by the European Parliament). Due diligence Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle INF 4 CORE N/A N/A PUBLIC Due diligence 1 During the reporting year, how did ESG factors affect the selection of your infrastructure investments? (1) for all of our infrastructure (A) ESG factors helped identify risks investments selected (1) for all of our infrastructure (B) ESG factors were discussed by the investment committee (or equivalent) investments selected (C) ESG factors helped identify remedial actions for our 100-day plans (or (1) for all of our infrastructure equivalent) investments selected (2) for the majority of our (D) ESG factors helped identify opportunities for value creation infrastructure investments selected 138

AGI Public RI Report Page 137 Page 139

AGI Public RI Report Page 137 Page 139