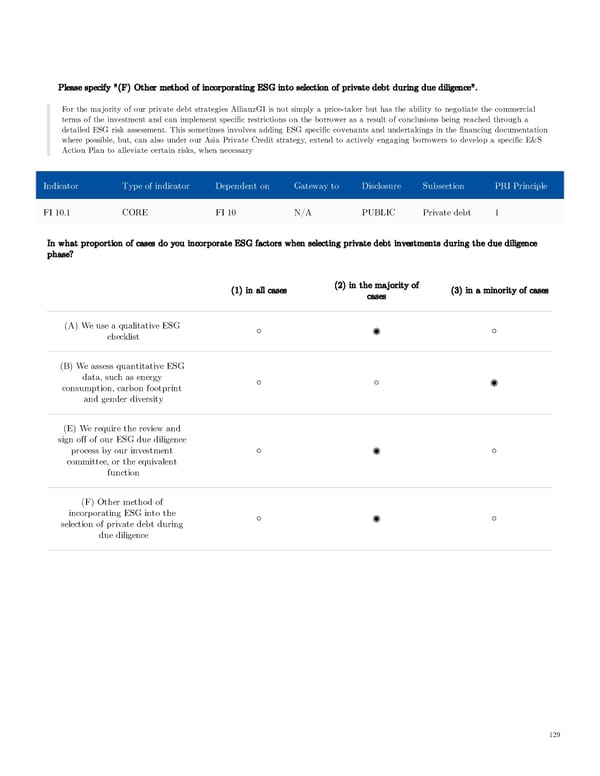

Please specify "(F) Other method of incorporating ESG into selection of private debt during due diligence". For the majority of our private debt strategies AllianzGI is not simply a price-taker but has the ability to negotiate the commercial terms of the investment and can implement specific restrictions on the borrower as a result of conclusions being reached through a detailed ESG risk assessment. This sometimes involves adding ESG specific covenants and undertakings in the financing documentation where possible, but, can also under our Asia Private Credit strategy, extend to actively engaging borrowers to develop a specific E&S Action Plan to alleviate certain risks, when necessary Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle FI 10.1 CORE FI 10 N/A PUBLIC Private debt 1 In what proportion of cases do you incorporate ESG factors when selecting private debt investments during the due diligence phase? (2) in the majority of (1) in all cases (3) in a minority of cases cases (A) We use a qualitative ESG ○ ◉ ○ checklist (B) We assess quantitative ESG data, such as energy ○ ○ ◉ consumption, carbon footprint and gender diversity (E) We require the review and sign off of our ESG due diligence process by our investment ○ ◉ ○ committee, or the equivalent function (F) Other method of incorporating ESG into the ○ ◉ ○ selection of private debt during due diligence 129

AGI Public RI Report Page 128 Page 130

AGI Public RI Report Page 128 Page 130