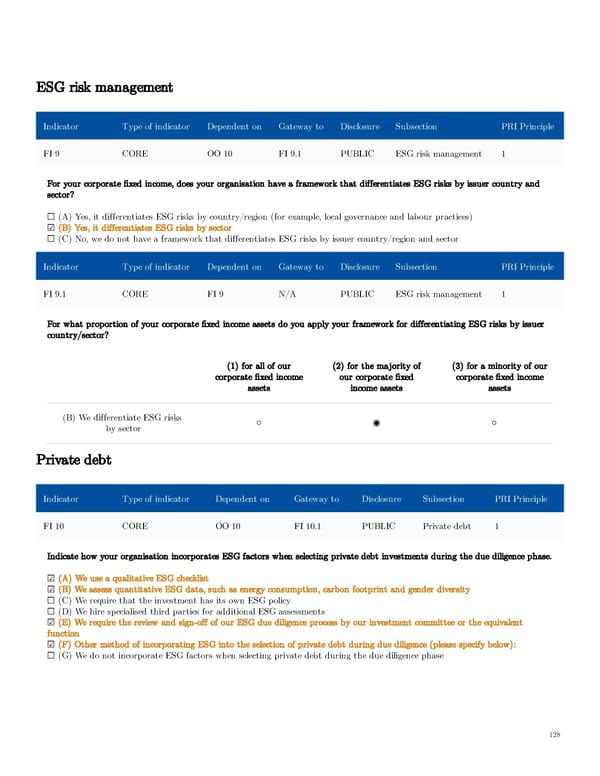

ESG risk management Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle FI 9 CORE OO 10 FI 9.1 PUBLIC ESG risk management 1 For your corporate fixed income, does your organisation have a framework that differentiates ESG risks by issuer country and sector? ☐ (A) Yes, it differentiates ESG risks by country/region (for example, local governance and labour practices) ☑ (B) Yes, it differentiates ESG risks by sector ☐ (C) No, we do not have a framework that differentiates ESG risks by issuer country/region and sector Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle FI 9.1 CORE FI 9 N/A PUBLIC ESG risk management 1 For what proportion of your corporate fixed income assets do you apply your framework for differentiating ESG risks by issuer country/sector? (1) for all of our (2) for the majority of (3) for a minority of our corporate fixed income our corporate fixed corporate fixed income assets income assets assets (B) We differentiate ESG risks ○ ◉ ○ by sector Private debt Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle FI 10 CORE OO 10 FI 10.1 PUBLIC Private debt 1 Indicate how your organisation incorporates ESG factors when selecting private debt investments during the due diligence phase. ☑ (A) We use a qualitative ESG checklist ☑ (B) We assess quantitative ESG data, such as energy consumption, carbon footprint and gender diversity ☐ (C) We require that the investment has its own ESG policy ☐ (D) We hire specialised third parties for additional ESG assessments ☑ (E) We require the review and sign-off of our ESG due diligence process by our investment committee or the equivalent function ☑ (F) Other method of incorporating ESG into the selection of private debt during due diligence (please specify below): ☐ (G) We do not incorporate ESG factors when selecting private debt during the due diligence phase 128

AGI Public RI Report Page 127 Page 129

AGI Public RI Report Page 127 Page 129