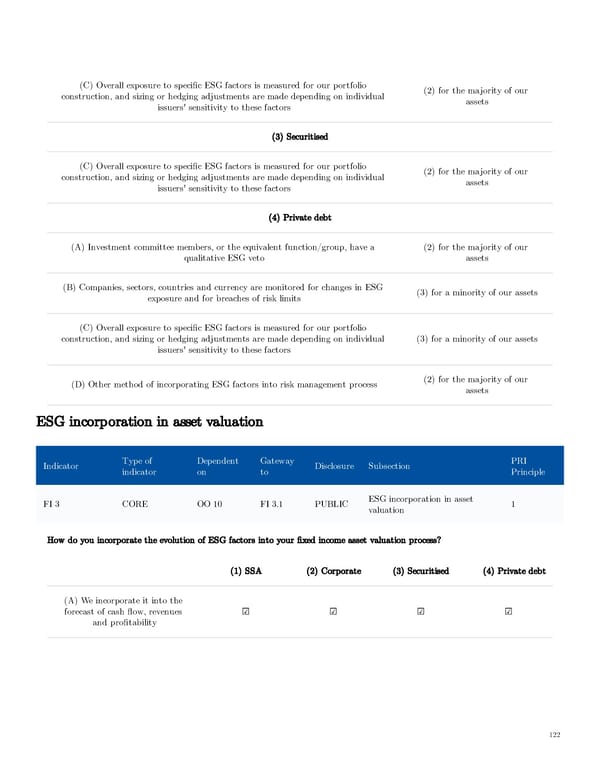

(C) Overall exposure to specific ESG factors is measured for our portfolio (2) for the majority of our construction, and sizing or hedging adjustments are made depending on individual assets issuers' sensitivity to these factors (3) Securitised (C) Overall exposure to specific ESG factors is measured for our portfolio (2) for the majority of our construction, and sizing or hedging adjustments are made depending on individual assets issuers' sensitivity to these factors (4) Private debt (A) Investment committee members, or the equivalent function/group, have a (2) for the majority of our qualitative ESG veto assets (B) Companies, sectors, countries and currency are monitored for changes in ESG (3) for a minority of our assets exposure and for breaches of risk limits (C) Overall exposure to specific ESG factors is measured for our portfolio construction, and sizing or hedging adjustments are made depending on individual (3) for a minority of our assets issuers' sensitivity to these factors (2) for the majority of our (D) Other method of incorporating ESG factors into risk management process assets ESG incorporation in asset valuation Type of Dependent Gateway PRI Indicator Disclosure Subsection indicator on to Principle ESG incorporation in asset FI 3 CORE OO 10 FI 3.1 PUBLIC 1 valuation How do you incorporate the evolution of ESG factors into your fixed income asset valuation process? (1) SSA (2) Corporate (3) Securitised (4) Private debt (A) We incorporate it into the forecast of cash flow, revenues ☑ ☑ ☑ ☑ and profitability 122

AGI Public RI Report Page 121 Page 123

AGI Public RI Report Page 121 Page 123