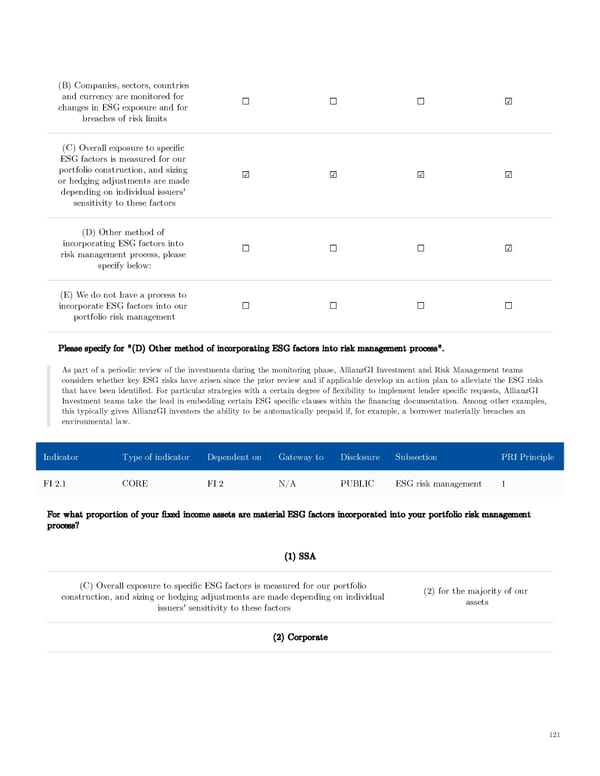

(B) Companies, sectors, countries and currency are monitored for ☐ ☐ ☐ ☑ changes in ESG exposure and for breaches of risk limits (C) Overall exposure to specific ESG factors is measured for our portfolio construction, and sizing ☑ ☑ ☑ ☑ or hedging adjustments are made depending on individual issuers' sensitivity to these factors (D) Other method of incorporating ESG factors into ☐ ☐ ☐ ☑ risk management process, please specify below: (E) We do not have a process to incorporate ESG factors into our ☐ ☐ ☐ ☐ portfolio risk management Please specify for "(D) Other method of incorporating ESG factors into risk management process". As part of a periodic review of the investments during the monitoring phase, AllianzGI Investment and Risk Management teams considers whether key ESG risks have arisen since the prior review and if applicable develop an action plan to alleviate the ESG risks that have been identified. For particular strategies with a certain degree of flexibility to implement lender specific requests, AllianzGI Investment teams take the lead in embedding certain ESG specific clauses within the financing documentation. Among other examples, this typically gives AllianzGI investors the ability to be automatically prepaid if, for example, a borrower materially breaches an environmental law. Indicator Type of indicator Dependent on Gateway to Disclosure Subsection PRI Principle FI 2.1 CORE FI 2 N/A PUBLIC ESG risk management 1 For what proportion of your fixed income assets are material ESG factors incorporated into your portfolio risk management process? (1) SSA (C) Overall exposure to specific ESG factors is measured for our portfolio (2) for the majority of our construction, and sizing or hedging adjustments are made depending on individual assets issuers' sensitivity to these factors (2) Corporate 121

AGI Public RI Report Page 120 Page 122

AGI Public RI Report Page 120 Page 122