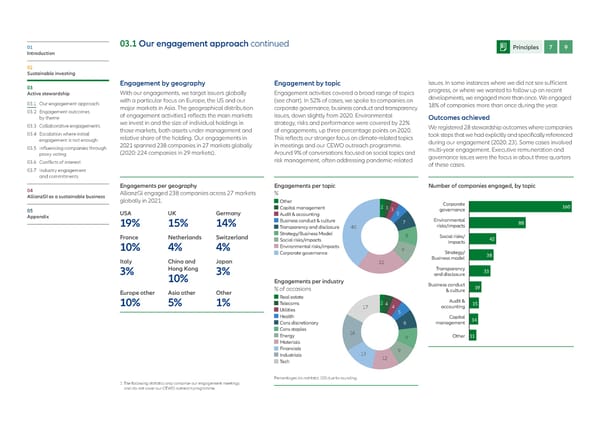

01 03.1 Our engagement approach continued Principles 7 9 Introduction 02 Sustainable investing 03 Engagement by geography Engagement by topic issues. In some instances where we did not see sufficient Active stewardship With our engagements, we target issuers globally Engagement activities covered a broad range of topics progress, or where we wanted to follow up on recent with a particular focus on Europe, the US and our (see chart). In 52% of cases, we spoke to companies on developments, we engaged more than once. We engaged 03.1 Our engagement approach major markets in Asia. The geographical distribution corporate governance, business conduct and transparency 18% of companies more than once during the year. 03.2 Engagement outcomes of engagement activities1 reflects the main markets issues, down slightly from 2020. Environmental by theme Outcomes achieved 03.3 Collaborative engagements we invest in and the size of individual holdings in strategy, risks and performance were covered by 22% We registered 28 stewardship outcomes where companies 03.4 E scalation where initial those markets, both assets under management and of engagements, up three percentage points on 2020. took steps that we had explicitly and specifically referenced engagement is not enough relative share of the holding. Our engagements in This reflects our stronger focus on climate-related topics during our engagement (2020: 23). Some cases involved 03.5 I nfluencing companies through 2021 spanned 238 companies in 27 markets globally in meetings and our CEWO outreach programme. multi-year engagement. Executive remuneration and proxy voting (2020: 224 companies in 29 markets). Around 9% of conversations focused on social topics and governance issues were the focus in about three quarters 03.6 Conflicts of interest risk management, often addressing pandemic-related of these cases. 03.7 Industry engagement and commitments Engagements per geography Engagements per topic Number of companies engaged, by topic 04 AllianzGI engaged 238 companies across 27 markets % AllianzGI as a sustainable business globally in 2021. Other Corporate 05 Capital management 2 3 3 governance 16 Appendix USA UK Germany Audit & accounting 5 19% 15% 14% Business conduct & culture 7 Environmental Transparency and disclosure 40 risks/impacts France Netherlands Switzerland Strategy/Business Model 8 Social risks/ Social risks/impacts impacts 10% 4% 4% Environmental risks/impacts 9 Corporate governance Strategy/ Italy China and Japan 22 Business model 3% Hong Kong 3% Transparency 10% and disclosure Engagements per industry Business conduct % of occasions & culture 1 Europe other Asia other Other Real estate 10% 5% 1% Telecoms 2 4 Audit & 1 Utilities 17 4 accounting Health 5 Capital 1 Cons discretionary 8 management Cons staples 16 Energy 9 Other 11 Materials Financials 9 Industrials 13 Tech 12 Percentages do not total 100 due to rounding. 1 The following statistics only comprise our engagement meetings and do not cover our CEWO outreach programme.

Allianz GI Sustainability and Stewardship Report 2021 Page 43 Page 45

Allianz GI Sustainability and Stewardship Report 2021 Page 43 Page 45