Allianz GI Sustainability and Stewardship Report 2021

2021 | 92 pages

Value. Shared.

About this report How to read this report Our Sustainability and Stewardship Report 2021 comes in four primary sections plus an appendix, reflecting our commitments as a sustainable investor, an active steward, and a sustainable business. Learn more about AllianzGI and Introduction hear from our CEO and Head of Sustainable and Impact Investing on their vision for the future. Read about our investment offering Sustainable that aims to position us as a shaper investing of sustainable investing solutions We shape pathways that seek to secure the future across public and private markets. for our clients, for our business and for society. Read examples of our active Active approach to engaging with investee stewardship companies and see details of our Allianz Global Investors (AllianzGI) is We have incorporated UK Stewardship Code reporting voting record as a shareholder. an active investment management firm to demonstrate our active ownership approach and Learn about our focus on integration of stewardship1 into our sustainable and part of Allianz Group. Sustainable investment activities. As part of our commitment to Sustainable sustainability in our own business investing is a core part of our strategy transparency and accessibility, we have produced business – from reducing our environmental a separate Task Force on Climate-Related Financial impacts to building an inclusive to shape pathways that secure the Disclosures (TCFD) Report. This describes our climate- and diverse culture. future – for our clients, for our business related risks and opportunities and how we integrate UK Stewardship Code indexing and for society as a whole. them into the business. Where report content specifically addresses the A unified approach to transparency Read the TCFD Report 2021 here Principles of the UK Stewardship Code we have We began our sustainable investing journey over Report scope and boundaries marked the relevant pages. For the full indexing 20 years ago and published our first Responsible see page 74. Investing Report in 2018. Our sustainability reporting The content of this report relates to all AllianzGI now incorporates our investment activities and activities and locations. All measures, activities and Principle 1 commitment to environmental, social and governance figures refer to the 2021 fiscal year (1 January 2021 (ESG) practices and active stewardship across our to 31 December 2021) unless otherwise stated. business operations. Principles 2 3 1 AllianzGI has applied to be a signatory to the UK Stewardship Code, pending formal approval from the FRC (Financial Reporting Council).

What’s inside? 01 02 03 39 05 73 Introduction Active stewardship Appendix 01.1 In co nversation with Tobias Pross 03.1 Our engagement approach 40 05.1 U K Stewardship Code index 74 and Matt Christensen 03 03.2 E ngagement outcomes by theme 43 05.2 Engagements 76 01.2 A bout AllianzGI 06 03.3 Co llaborative engagements 48 05.3 S ustainability initiatives overview 82 01.3 What sustainable investing means to us 08 03.4 Escalation where initial engagement is 05.4 U N Sustainable Development Goals key 88 01.4 Acting on climate risks and opportunities 11 not enough 50 01.5 Sustainability governance 13 03.5 Influencing companies through proxy voting 51 01.6 Shaping sustainable investing with 03.6 Conflicts of interest 58 our clients 16 03.7 Industry engagement and commitments 59 02 21 04 61 Find out more Sustainable investing AllianzGI as a Read more about our approach to sustainability 02.1 Building our approach to sustainable business and explore our latest research via our website. sustainable investing 22 04.1 Building our approach to You will also find our key policy documents and 02.2 Sustainability research and data and sustainable investing 62 reports, including our latest TCFD Report. analytics – our strong foundation 25 04.2 D eveloping a shared vision for For information on the sustainability commitments 02.3 Sustainability risk management 29 inclusion and diversity 63 and performance of Allianz, please refer to the 04.3 Pr omoting employee health and wellbeing Allianz Group Sustainability Report 2021. 02.4 S ustainable investing categories 30 in a hybrid work environment 65 AllianzGI website 04.4 Business conduct and operational AllianzGI TCFD Report 2021 risk management 67 Allianz Group Sustainability Report 2021 04.5 Managing the environmental impact of our operations 69 04.6 Corporate citizenship 72

01 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI 01.3 W hat sustainable investing means to us 01.4 Acting on climate risks and opportunities 01.5 Sustainability governance 01.6 Shaping sustainable investing with our clients 02 Sustainable investing 03 Active stewardship 04 AllianzGI as a sustainable business 05 Appendix Allianz Global Investors (AllianzGI) Working in 23 locations, we manage is an active investment management EUR 673 billion of assets on behalf of firm and part of Allianz Group. institutional and retail clients worldwide –from pension funds and blue-chip multinationals to charitable foundations, family offices and individuals. 01 Introduction

This is a modal window.

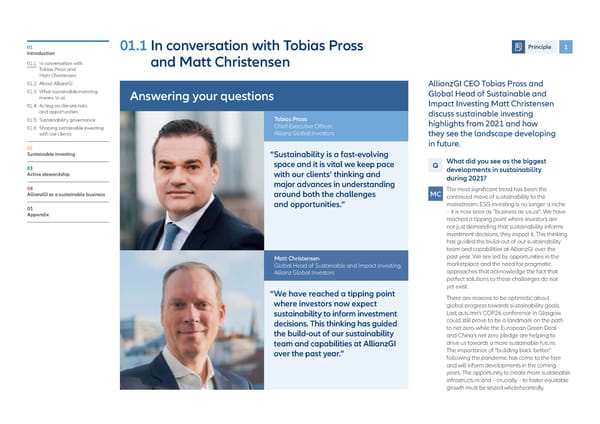

01 01.1 In conversation with Tobias Pross Principle 1 Introduction 01.1 In conversation with and Matt Christensen Tobias Pross and Matt Christensen 01.2 About AllianzGI AllianzGI CEO Tobias Pross and 01.3 W hat sustainable investing Global Head of Sustainable and means to us Answering your questions Impact Investing Matt Christensen 01.4 Acting on climate risks and opportunities discuss sustainable investing 01.5 Sustainability governance Tobias Pross highlights from 2021 and how 01.6 Shaping sustainable investing Chief Executive Officer, with our clients Allianz Global Investors they see the landscape developing 02 in future. Sustainable investing “ Sustainability is a fast-evolving space and it is vital we keep pace Q What did you see as the biggest 03 developments in sustainability Active stewardship with our clients’ thinking and during 2021? 04 major advances in understanding The most significant trend has been the AllianzGI as a sustainable business around both the challenges MC continued move of sustainability to the 05 and opportunities.” mainstream. ESG investing is no longer a niche Appendix – it is now seen as “business as usual”. We have reached a tipping point where investors are not just demanding that sustainability informs investment decisions, they expect it. This thinking has guided the build-out of our sustainability team and capabilities at AllianzGI over the Matt Christensen past year. We are led by opportunities in the Global Head of Sustainable and Impact Investing, marketplace and the need for pragmatic Allianz Global Investors approaches that acknowledge the fact that perfect solutions to these challenges do not yet exist. “ We have reached a tipping point There are reasons to be optimistic about where investors now expect global progress towards sustainability goals. sustainability to inform investment Last autumn’s COP26 conference in Glasgow decisions. This thinking has guided could still prove to be a landmark on the path the build-out of our sustainability to net zero, while the European Green Deal and China’s net zero pledge are helping to team and capabilities at AllianzGI drive us towards a more sustainable future. over the past year.” The importance of “building back better” following the pandemic has come to the fore and will inform developments in the coming years. The opportunity to create more sustainable infrastructure and – crucially – to foster equitable growth must be seized wholeheartedly.

01 01.1 In conversation with Tobias Pross and Matt Christensen continued Principle 1 Introduction 01.1 I n conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI TP I agree that 2021 was a year that truly shone At the UN Climate Conference in Glasgow, MC When looking at how we frame those goals 01.3 What sustainable investing a light on the challenges facing the planet and we launched a strategy, built around a public- and solutions, we have identified three key means to us the urgency with which we must face them. private partnership that will invest in climate- themes that we see as the most urgent 01.4 Acting on climate risks Collaborative action will be vital to develop the focused private equity funds and projects active challenges globally and which will be integral and opportunities right solutions and I am pleased we played a in emerging markets and developing countries. to sustainable businesses in the future – climate 01.5 Sustainability governance part in some major initiatives and cross-industry Our clients will benefit from this commitment change, planetary boundaries and inclusive 01.6 Shaping sustainable investing collaborations. With our parent company, through the co-investment opportunities that capitalism. These themes guide targeted with our clients Allianz, we have committed to measurably exist with Allianz. Through these and other research and engagement to identify the most reduce the carbon footprint of our real assets initiatives, we are partnering with clients to tackle material risks and opportunities for our business 02 portfolio by growing our share in low greenhouse the most pressing sustainability issues and create and our clients. Sustainable investing gas (GHG)-emitting assets and engaging on a better future for all. Our participation in these decarbonisation with the companies in which we organisations and programmes complements We also see impact investing as a core area 03 are invested. In March 2021, we joined the Net the various industry bodies in which we play an of opportunity, aligned with client motivation. Active stewardship When constructing investment products and Zero Asset Managers initiative which supports active role. portfolios, impact will eventually become a 04 the goal of net zero emissions by 2050, in line What do you see as the most significant third dimension for measuring investment AllianzGI as a sustainable business with global efforts to limit warming to 1.5°C. Q This aligns us with the commitments made by future trends around sustainability? performance, next to risk and return. Therefore, 05 Allianz as a founding member of the Net Zero Sustainability is a fast-evolving space and it it becomes increasingly important that we are Appendix Asset Owner Alliance in 2019. TP is vital we keep pace with our clients’ thinking able to measure impact – of private markets as and major advances in understanding around well as public markets investments – and we are With Allianz, we are also co-developing both the challenges and opportunities. We are developing a framework for this. dedicated impact investment strategies that proud of our long track record in sustainable How do you define AllianzGI’s role in foster the energy transition in both developed investing, launching our first SRI fund in 1999. Q shaping the future? and developing markets, often partnering with We plan to expand our sustainable investment global development banks and organisations. offering, from innovative impact-focused funds We want to provide our clients with access For example in November 2021, together with TP to the growth opportunities of a sustainable the International Finance Corporation and Hong to tailored solutions for our clients, including future. US Special Presidential Envoy for Kong Monetary Authority, we set up the world’s through our risklab team (an advisory service Climate John Kerry said that 50% of the carbon first cross-sectoral portfolio of emerging-market within AllianzGI) where we added a dedicated reductions needed to get to net zero will come loans aligned with the Paris Agreement. The sustainable investment advisory offering in 2021. from technologies that have not yet been strategy supports the IFC and Allianz in making While being excited by these initiatives and invented. With our clients, we will be investing 1.5°C-aligned investments in emerging markets. confident in our expertise, we aim to be modest at the cutting edge to enable the development and pragmatic in our approach. We do not claim of these technologies. Our approach is both to have all of the answers, but we are committed optimistic and realistic. This can be clearly to making progress in pursuit of the goals that seen in our engagements, as we seek to work our clients – and society – seek. with the companies we invest in to shape their transition pathways to a more sustainable future. Generating these improvements and progress needs to be a collective endeavour.

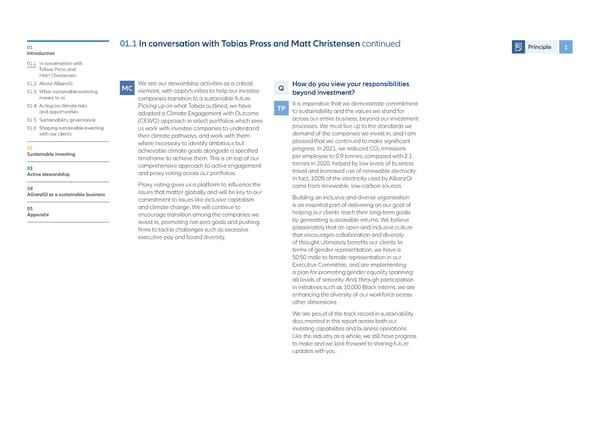

01 01.1 In conversation with Tobias Pross and Matt Christensen continued Principle 1 Introduction 01.1 I n conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI We see our stewardship activities as a critical Q How do you view your responsibilities 01.3 What sustainable investing MC element, with opportunities to help our investee beyond investment? means to us companies transition to a sustainable future. 01.4 Acting on climate risks Picking up on what Tobias outlined, we have TP It is imperative that we demonstrate commitment and opportunities adopted a Climate Engagement with Outcome to sustainability and the values we stand for 01.5 Sustainability governance (CEWO) approach in select portfolios which sees across our entire business, beyond our investment 01.6 Shaping sustainable investing us work with investee companies to understand processes. We must live up to the standards we with our clients their climate pathways, and work with them demand of the companies we invest in, and I am where necessary to identify ambitious but pleased that we continued to make significant 02 progress. In 2021, we reduced CO emissions achievable climate goals alongside a specified 2 Sustainable investing timeframe to achieve them. This is on top of our per employee to 0.9 tonnes, compared with 2.1 comprehensive approach to active engagement tonnes in 2020, helped by low levels of business 03 and proxy voting across our portfolios. travel and increased use of renewable electricity. Active stewardship In fact, 100% of the electricity used by AllianzGI 04 Proxy voting gives us a platform to influence the came from renewable, low-carbon sources. AllianzGI as a sustainable business issues that matter globally and will be key to our Building an inclusive and diverse organisation commitment to issues like inclusive capitalism is an essential part of delivering on our goal of 05 and climate change. We will continue to helping our clients reach their long-term goals Appendix encourage transition among the companies we invest in, promoting net-zero goals and pushing by generating sustainable returns. We believe firms to tackle challenges such as excessive passionately that an open and inclusive culture executive pay and board diversity. that encourages collaboration and diversity of thought ultimately benefits our clients. In terms of gender representation, we have a 50:50 male to female representation in our Executive Committee, and are implementing a plan for promoting gender equality spanning all levels of seniority. And, through participation in initiatives such as 10,000 Black Interns, we are enhancing the diversity of our workforce across other dimensions. We are proud of the track record in sustainability documented in this report across both our investing capabilities and business operations. Like the industry as a whole, we still have progress to make and we look forward to sharing future updates with you.

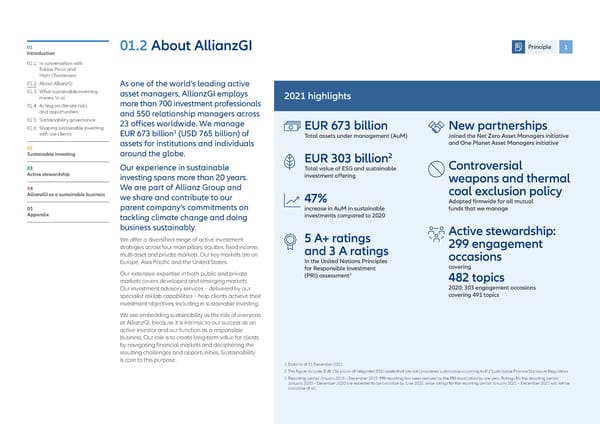

01 01.2 About AllianzGI Principle 1 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI As one of the world’s leading active 01.3 W hat sustainable investing asset managers, AllianzGI employs 2021 highlights means to us more than 700 investment professionals 01.4 Acting on climate risks and opportunities and 550 relationship managers across 01.5 Sustainability governance 23 offices worldwide. We manage 01.6 Shaping sustainable investing 1 EUR 673 billion New partnerships with our clients EUR 673 billion (USD 765 billion) of Total assets under management (AuM) Joined the Net Zero Asset Managers initiative assets for institutions and individuals and One Planet Asset Managers initiative 02 Sustainable investing around the globe. 2 EUR 303 billion Controversial 03 Our experience in sustainable Total value of ESG and sustainable Active stewardship investing spans more than 20 years. investment offering weapons and thermal 04 We are part of Allianz Group and coal exclusion policy AllianzGI as a sustainable business we share and contribute to our 47% parent company’s commitments on Adopted firmwide for all mutual 05 increase in AuM in sustainable funds that we manage Appendix tackling climate change and doing investments compared to 2020 business sustainably. Active stewardship: We offer a diversified range of active investment 5 A+ ratings 299 engagement strategies across four main pillars: equities, fixed income, and 3 A ratings multi asset and private markets. Our key markets are on occasions Europe, Asia Pacific and the United States. In the United Nations Principles for Responsible Investment covering Our extensive expertise in both public and private 3 (PRI) assessment 482 topics markets covers developed and emerging markets. Our investment advisory services – delivered by our 2020: 303 engagement occasions specialist risklab capabilities – help clients achieve their covering 491 topics investment objectives, including in sustainable investing. We see embedding sustainability as the role of everyone at AllianzGI, because it is intrinsic to our success as an active investor and our function as a responsible business. Our role is to create long-term value for clients by navigating financial markets and deciphering the resulting challenges and opportunities. Sustainability is core to this purpose. 1 Data as at 31 December 2021. 2 This figure includes EUR 156 billion of integrated ESG assets that are not considered sustainable according to EU Sustainable Finance Disclosure Regulation. 3 Reporting period January 2019 – December 2019. PRI reporting has been delayed by the PRI Association by one year. Ratings for the reporting period January 2020 – December 2020 are expected to be available by June 2022, while ratings for the reporting period January 2021 – December 2021 will not be available at all.

01 01.2 About AllianzGI continued Principles 1 4 6 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Evolving our strategic approach 01.3 W hat sustainable investing Creating long-term, sustainable value 3 Foster a fulfilling work environment Sustainability is at the forefront of our decision-making means to us Our mission is to help our clients reach their long-term and activities. With the appointment of Matt Christensen 01.4 Acting on climate risks goals by generating sustainable returns. Our clients for employees as our Head of Sustainable and Impact Investing in and opportunities are our centre of gravity. We generate value for them We motivate our people by fostering a merit- December 2020, we accelerated our progress in anchoring 01.5 Sustainability governance – and with them – by partnering to meet their needs based, values-driven, inclusive culture and sustainability into our investment process. 01.6 Shaping sustainable investing and those of wider society. Together with our clients, providing the right technology and support. with our clients we aim to drive lasting change across the investment The annual global Allianz Engagement We take a structured approach to identifying the major value chain using our expertise, influence and impact- Survey is our main tool for assessing employee long-term opportunities for our clients. Our annual 02 focused investing. satisfaction. The results highlight what is Investment Positioning Dialogues (IPD), instigated in Sustainable investing working well and where we need to improve 2020, bring together our senior investors and distribution 03 We focus on five principal business objectives: (see section 04.3). leads globally to discuss the most significant risks and Active stewardship opportunities for clients. First, we convene the two groups 1 separately to sound out their latest thinking and reflect 04 Generate strong investment returns the views on risk and opportunity from the different AllianzGI as a sustainable business for our clients 4 Grow our company organically regions, client types and areas of the market. Then the We measure our strategies’ asset-weighted and sustainably entire group meets to develop a final list of priority topics. 05 performance against their benchmarks over We measure our growth in terms of revenues The outcome is a set of deeply interconnected “investable Appendix one-year and three-year periods. We also track and net cash flow to gauge the extent to themes” that provide a guiding focus for our business, how strategies are performing against peers. which we are offering clients the most relevant currently Achieving Sustainability; Navigating Rates; and and attractive capabilities. Appreciating China. These themes drive our research and product development effort. 2 Provide excellent client service We repeat the IPD process annually to revalidate the list 5 Generate profitable growth and revise and add themes as needed. In 2022, we will We measure client satisfaction through an for our shareholders add a fourth theme – Embracing Disruption – to reflect the annual survey carried out by independent All five objectives are interlinked. By serving evolution of a trend that began in the technology sector consultants Coalition Greenwich. It assesses our clients well and motivating our employees but increasingly pervades every aspect of our lives and is how our institutional and intermediary clients to excel, our company will grow sustainably closely aligned with sustainability. view our investment and client services. and deliver strong results for our shareholders We aim to achieve first-quartile performance The insights of our Global Investment Council (GIC) are a and we use the feedback to identify areas over the long term. critical input. Led by our Economics and Strategy team, the where we can strengthen our offerings. Since GIC provides a forum where our strategists can share their 2018, Coalition Greenwich has also conducted view on macro risks and opportunities with our investment client interviews to measure clients’ perception teams, allowing these insights to be implemented within of our sustainable investing capabilities (see our investment processes as appropriate. The GIC is held page 17). Through our client forums in select monthly and additionally on an ad hoc basis as market markets, we promote two-way feedback and events dictate. shared learnings.

01 01.3 What sustainable investing means to us Principle 1 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI 01.3 What sustainable investing “ Our ambition is to help our clients be informed and position themselves for means to us 01.4 Acting on climate risks the opportunities of sustainable investing and the outcomes they seek.” and opportunities 01.5 Sustainability governance 01.6 Shaping sustainable investing with our clients We are integrating sustainability considerations want to achieve a measurable impact with their across AllianzGI’s offering and accelerating the money which we seek to demonstrate to our clients 02 growth of impact investing as part of our fast-growing with our sustainable investment strategies Sustainable investing private markets offering. We made considerable progress in 2021, developing new sustainable We also engage with the companies in which 03 investment products and innovative analytical we invest on a range of priorities – shaping their Active stewardship tools and methods to aggregate and process data low-carbon transition strategies, mitigating their from third-party providers and alternative data broader environmental impact and enhancing 04 sources, informing our proprietary sustainability governance approaches. AllianzGI as a sustainable business scoring system. To achieve all of this, we built out In our view, this kind of active stewardship is essential, 05 the resources and organisational structure of our because simply divesting from so-called “offenders” Appendix Sustainable and Impact Investing team to advance limits opportunities to drive change. Instead, we our strategy and support data, research and engage with companies to develop constructive stewardship activities. routes to a more sustainable future, recognising that Sustainability is an area filled with innovative and meaningful progress often happens incrementally progressive approaches, but it is also a complex rather than in big, transformative bounds. space where many of the solutions and proof points Climate transition pathways are works in progress, not least due to the evolving One way we are looking to drive real-world impact regulatory landscape and client demand. That is why is through our enhanced climate engagement with we focus first on being a resourceful partner that can high emitting companies highlighted by the launch provide education and thought leadership to our of our Climate Engagement with Outcome approach. clients to help them focus their efforts. We then shape This enables us to use expanding data coverage sustainable pathways for our clients by offering a to fully scope the climate profiles of the highest range of investment options and guidance in public carbon emitters in portfolios and engage more fully and increasingly in private markets with them to identify and develop climate transition New wave of sustainable growth pathways. The most important part of this approach We observe that a large number of our clients are is its real-world impact across all topics, beyond convinced of the necessity and value of investing just carbon emissions. We also gain insights into sustainably. For those ready to make the journey, climate transition efforts across regions and sectors the potential is vast. A wave of sustainable growth which allows us to identify progress of our invested is sweeping the globe, creating significant investable companies in a consistent and comparable way. opportunities. At the same time, investors increasingly Read more on page 32.

This is a modal window.

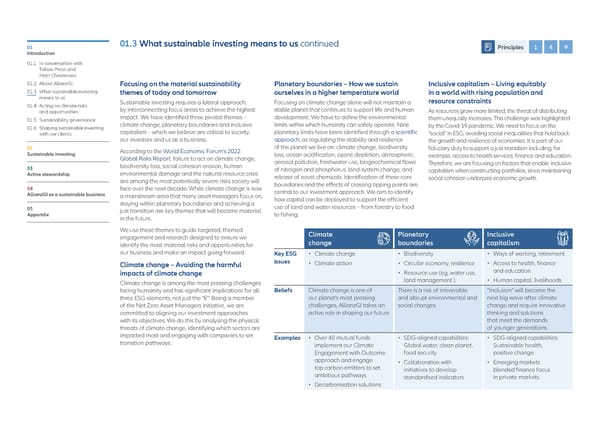

01 01.3 What sustainable investing means to us continued Principles 1 4 9 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Focusing on the material sustainability Planetary boundaries – How we sustain Inclusive capitalism – Living equitably 01.3 What sustainable investing themes of today and tomorrow ourselves in a higher temperature world in a world with rising population and means to us Sustainable investing requires a lateral approach, Focusing on climate change alone will not maintain a resource constraints 01.4 Acting on climate risks by interconnecting focus areas to achieve the highest stable planet that continues to support life and human and opportunities As resources grow more limited, the threat of distributing 01.5 Sustainability governance impact. We have identified three pivotal themes – development. We have to define the environmental them unequally increases. This challenge was highlighted 01.6 Shaping sustainable investing climate change, planetary boundaries and inclusive limits within which humanity can safely operate. Nine by the Covid-19 pandemic. We need to focus on the with our clients capitalism – which we believe are critical to society, planetary limits have been identified through a scientific “social” in ESG, avoiding social inequalities that hold back our investors and us as a business. approach, as regulating the stability and resilience the growth and resilience of economies. It is part of our 02 According to the World Economic Forum’s 2022 of the planet we live on: climate change, biodiversity fiduciary duty to support a just transition including, for Sustainable investing Global Risks Report, failure to act on climate change, loss, ocean acidification, ozone depletion, atmospheric example, access to health services, finance and education. biodiversity loss, social cohesion erosion, human aerosol pollution, freshwater use, biogeochemical flows Therefore, we are focusing on factors that enable inclusive 03 of nitrogen and phosphorus, land-system change, and capitalism when constructing portfolios, since maintaining Active stewardship environmental damage and the natural resource crisis release of novel chemicals. Identification of these core social cohesion underpins economic growth. are among the most potentially severe risks society will boundaries and the effects of crossing tipping points are 04 face over the next decade. While climate change is now central to our investment approach. We aim to identify AllianzGI as a sustainable business a mainstream area that many asset managers focus on, how capital can be deployed to support the efficient staying within planetary boundaries and achieving a use of land and water resources – from forestry to food 05 just transition are key themes that will become material Appendix in the future. to fishing. We use these themes to guide targeted, themed Climate Planetary Inclusive engagement and research designed to ensure we change boundaries capitalism identify the most material risks and opportunities for our business and make an impact going forward. Key ESG • Climate change • Biodiversity • Ways of working, retirement Climate change – Avoiding the harmful issues • Climate action • Circular economy, resilience • Access to health, finance impacts of climate change • Resource use (eg, water use, and education Climate change is among the most pressing challenges land management ) • Human capital, livelihoods facing humanity and has significant implications for all Beliefs Climate change is one of There is a risk of irreversible “Inclusion” will become the three ESG elements, not just the “E”. Being a member our planet’s most pressing and abrupt environmental and next big wave after climate of the Net Zero Asset Managers initiative, we are challenges, AllianzGI takes an social changes change and require innovative committed to aligning our investment approaches active role in shaping our future thinking and solutions with its objectives. We do this by analysing the physical that meet the demands threats of climate change, identifying which sectors are of younger generations impacted most and engaging with companies to set Examples • Over 40 mutual funds • SDG-aligned capabilities: • SDG-aligned capabilities: transition pathways. implement our Climate Global water, clean planet, Sustainable health, Engagement with Outcome food security positive change approach and engage • Collaboration with • Emerging markets top carbon emitters to set initiatives to develop blended finance focus ambitious pathways standardised indicators in private markets • Decarbonisation solutions

01 01.3 What sustainable investing means to us continued Principles 1 4 6 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI How active asset management supports • Advising on sustainability risks and engineering active 01.3 W hat sustainable investing the transition to a better future investment solutions that meet our clients’ individual means to us Our commitment to active asset management is objectives, powered by an innovative approach to 01.4 Acting on climate risks unequivocal. We think being an active asset manager allocation and a deep understanding of risk. With 60 and opportunities offers unique advantages in today’s investment investment advisers globally, risklab – an advisory team 01.5 Sustainability governance environment – whatever the asset class, geographic within AllianzGI – helps our clients to meet their 01.6 Shaping sustainable investing scope or investment style. Being active also allows us to investment goals through specialist advice and solutions. with our clients stay ahead of our clients’ future needs and to manage In 2021, we added sustainability-specific capabilities emerging and developing risks and opportunities when within risklab – (see case study on page 18). 02 Sustainable investing it comes to sustainable investing. • Financing the United Nations Sustainable In 2021, we implemented a number of sustainability- Development Goals (SDGs) by incorporating ESG 03 related initiatives in our investment and advisory considerations in our active investment decisions. Active stewardship We partner with our clients to mobilise capital to functions – and enhanced existing ones – as part of meet multiple sustainability-related goals, such 04 our active approach: as those set out in the UN SDGs. Our SDG-aligned AllianzGI as a sustainable business • Identifying our three key sustainability themes strategies specifically address the financing of the 05 – climate, planetary boundaries and inclusive SDGs. These strategies have grown to EUR 2.9 billion Appendix capitalism – that will shape our research and over the past year. engagement activities (see page 09). Capital allocation and company engagement are • Integrating ESG risk considerations into all our key drivers of positive change, and active stewardship investment processes and active stewardship continues to be a core action across our product approach (see page 39). strategies. In 2021, we engaged with 238 companies • Constructing portfolios designed for strong across 11 different sectors and 27 countries. We sustainability performance (see page 16). participated in 10,190 shareholder meetings in 2021, representing 95% of all votable meetings. We voted • Enhancing the ESG approach in private markets against, withheld, or abstained from at least one alongside creating an Impact Management agenda item at 68% of all meetings globally; and and Measurement team. This team has built the overall we opposed 21% of all resolutions globally AllianzGI Impact framework for private markets (see page 51). impact strategies to ensure investments generate material and measurable positive impact for our clients (see page 36).

01 01.4 Acting on climate risks and opportunities Principle 4 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI As an active investor, we look for Climate strategy • In the short term, policy and reputational risks of our 01.3 W hat sustainable investing innovative ways to reallocate capital According to the World Economic Forum’s Global Risks investee companies are the leading climate-related means to us Report 2022, failure of climate change mitigation and risks that may affect investments. 01.4 Acting on climate risks to support a climate transition that adaption come first in a list of the top ten global risks • In the medium term, market and technology risks and opportunities meets the goals of the Paris Agreement. over the next decade in the report’s annual survey 01.5 Sustainability governance associated with the climate transition may develop 01.6 Shaping sustainable investing As part of our commitment to increase of perceptions. more substantially, while acute physical risks may with our clients transparency and performance across In this context, we help our clients reflect climate risks emerge more frequently. our sustainable investment approach, and opportunities in their holdings. As a committed • In the long term, chronic physical climate risks could 02 member of the Net Zero Asset Manager initiative, we become more substantial. Sustainable investing we joined the Net Zero Asset Managers are supporting the goal of net-zero GHG emissions initiative in 2021 and published our first by 2050 in line with global efforts to limit warming to When it comes to the opportunities, initiatives that 03 1.5°C. Next to mainstream strategies, we offer climate enable and benefit from the climate transition are the Active stewardship annual Task Force on Climate-Related leading climate-related opportunities that may affect Financial Disclosures (TCFD) report. thematic and impact-driven opportunities such as green investments in the short term. In the medium and long 04 bonds, climate transition equity and private markets term, climate-related investment opportunities will arise AllianzGI as a sustainable business For investors to be able to make informed decisions, renewable energy investments. These specialised assets companies must report comprehensively on how they contribute to the alignment of an asset owner’s portfolio from competitive positioning and climate innovation. 05 are tackling dominant global long-term trends such as and its compatibility with climate transition targets. Integration of climate risks and opportunities Appendix climate change. The climate transition will create both investment opportunities and risks across all sectors A key belief in our philosophy surrounding climate in investment processes of the economy. Our industry has a crucial role to play investments is that public corporate disclosures AllianzGI’s dedicated sustainable investment team, in addressing climate change risks and opportunities on climate are not yet in-depth enough to inform portfolio managers and analysts collectively monitor through investment decisions and influencing investee simple rules-based strategies. We believe market and assess the science, regulatory response and companies and other institutions. inefficiencies on climate risks and opportunities exist, business implications of climate change (see page 22). and active research and corporate engagement are We examine the implications for individual issuers and For more information see our Climate Policy Framework necessary to tackle the dominant long-term global sectors and the ways in which climate change can be on our website trends comprehensively. a driver of investment performance. We will continue Climate-related risks and opportunities our engagement with companies on climate-related Climate risks are a crucial consideration when assessing issues and encourage them to report on TCFD and potential investments. As an active investor, we look for Science Based Targets(SBTs) to improve the quality of innovative ways to allocate new capital – and reallocate disclosures provided to our investors, positioning them existing capital – towards a climate transition that meets to meet their climate ambitions more precisely. Climate the Paris Agreement goals. change-relevant indicators are part of our Principal Adverse Impact assessment (see page 22). We support Transition and physical climate factors may pose a and implement the recommendations of the TCFD. For significant risk or opportunity in the short, medium and more information on climate-related risk management long term through the value of assets we manage on process, please read our 2021 report. behalf of our clients, the investment products at the core Read the TCFD report 2021 here of our business, and how we operate as a corporation.

01 01.4 Acting on climate risks and opportunities continued Principle 4 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Climate-related metrics and targets Investment-related climate metrics 01.3 W hat sustainable investing We aim to be as transparent as possible in our climate- Indicator Unit 2021 YOY 2020 2019 means to us related profile, including the disclosure of our investment- 01.4 Acting on climate risks related climate metrics. As a committed signatory of the Listed equity assets and opportunities Net Zero Asset Managers initiative (NZAM), we support Total financed emissions million t CO 15.22 25.8% 12.10 15.27 01.5 Sustainability governance 2 the goal of net-zero greenhouse gas (GHG) emissions by Total carbon intensity t CO /€ million invested 47.80 -5.3% 50.50 76.20 01.6 Shaping sustainable investing 2050 – in line with global efforts to limit warming to 1.5°C. 2 with our clients Weighted average carbon intensity t CO /€ million revenues 119.90 -8.3% 130.80 142.30 2 After becoming a NZAM signatory in 2021, we submitted Emissions data coverage of 02 first interim targets at the beginning of 2022. As the first listed equities AuM % 98% – 99% 97% Sustainable investing step, these targets cover listed equity, corporate debt, infrastructure equity, and infrastructure debt, and reflect Corporate bonds assets 03 Total financed emissions million t CO 13.72 -23.5% 17.94 16.87 Active stewardship the targets set in 2021 by Allianz for its proprietary 2 assets based on its commitment as a member of the Total carbon intensity t CO /€ million invested 77.90 -35.0% 119.80 118.70 2 04 UN-convened Net-Zero Asset Owner Alliance. Weighted average carbon intensity t CO /€ million revenues 192.20 -4.7% 201.70 206.90 AllianzGI as a sustainable business 2 The assets in-scope for these targets represent 12% Emissions data coverage of 05 of AllianzGI’s overall assets under management. corporate bonds AuM % 94% – 89% 86% Appendix The submitted targets include: Green assets Listed equity and corporate bonds – 25% GHG Investments in renewable energy € million 5,185.95 9.0% 4,756.27 5,307.00 reduction, Scopes 1 and 2, by the end of 2024 (baseline Investments in green bonds € million 10,017.69 54.9% 6,468.07 4,557.00 year: 2019). Infrastructure equity – 28% GHG reduction, Scopes 1 • For metrics related to our business operations, market standard following its adoption by the EU and 2, by the end of 2025 (baseline year: 2020). see page 69. Technical Expert Group on Sustainable Finance Infrastructure debt – Our target is to grow the share of • For more information see our separate TCFD and the EU Benchmarks Regulation. We have also low-emitting and EU taxonomy-eligible assets. report 2021 implemented a new waterfall process that allows us to improve data coverage of emissions, combining MSCI For more information on the Net-Zero Asset Owner Read the TCFD report 2021 here and Refinitiv data. Data for 2019 and 2020 has been Alliance commitment of Allianz, please see the Allianz recalculated using this new methodology to provide Group Sustainability Report. For our Sustainability and Stewardship Report 2021, comparable results. At AllianzGI, we will focus continuously on our net- we have changed the methodology for calculating the financed emissions. We have replaced the use of See our TCFD Report for the full methodology of how zero commitment as a signatory of NZAM. In the enterprise value (EV) with enterprise value including we calculate the financed emissions. near future, we will increase the scope of our assets cash (EVIC) as the latter is expected to become a and set intermediate targets for our third-party client assets. We will continue to actively engage with our institutional clients and distributors on integrating net-zero objectives in their investments and into our mutual funds. We plan to review our targets and progress annually.

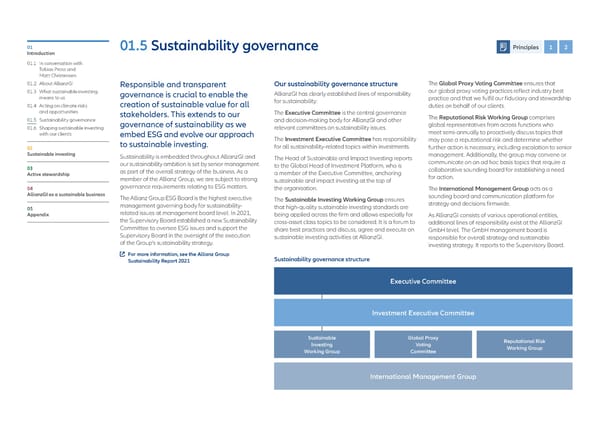

01 01.5 Sustainability governance Principles 1 2 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Responsible and transparent Our sustainability governance structure The Global Proxy Voting Committee ensures that 01.3 What sustainable investing governance is crucial to enable the AllianzGI has clearly established lines of responsibility our global proxy voting practices reflect industry best means to us for sustainability: practice and that we fulfil our fiduciary and stewardship 01.4 Acting on climate risks creation of sustainable value for all duties on behalf of our clients. and opportunities stakeholders. This extends to our The Executive Committee is the central governance 01.5 Sustainability governance and decision-making body for AllianzGI and other The Reputational Risk Working Group comprises 01.6 Shaping sustainable investing governance of sustainability as we relevant committees on sustainability issues. global representatives from across functions who with our clients embed ESG and evolve our approach meet semi-annually to proactively discuss topics that to sustainable investing. The Investment Executive Committee has responsibility may pose a reputational risk and determine whether 02 for all sustainability-related topics within investments. further action is necessary, including escalation to senior Sustainable investing Sustainability is embedded throughout AllianzGI and The Head of Sustainable and Impact Investing reports management. Additionally, the group may convene or our sustainability ambition is set by senior management to the Global Head of Investment Platform, who is communicate on an ad hoc basis topics that require a 03 as part of the overall strategy of the business. As a a member of the Executive Committee, anchoring collaborative sounding board for establishing a need Active stewardship member of the Allianz Group, we are subject to strong for action. sustainable and impact investing at the top of 04 governance requirements relating to ESG matters. the organisation. The International Management Group acts as a AllianzGI as a sustainable business The Allianz Group ESG Board is the highest executive The Sustainable Investing Working Group ensures sounding board and communication platform for management governing body for sustainability- that high-quality sustainable investing standards are strategy and decisions firmwide. 05 related issues at management board level. In 2021, Appendix being applied across the firm and allows especially for As AllianzGI consists of various operational entities, the Supervisory Board established a new Sustainability cross-asset class topics to be considered. It is a forum to additional lines of responsibility exist at the AllianzGI Committee to oversee ESG issues and support the share best practices and discuss, agree and execute on GmbH level. The GmbH management board is Supervisory Board in the oversight of the execution sustainable investing activities at AllianzGI. responsible for overall strategy and sustainable of the Group’s sustainability strategy. investing strategy. It reports to the Supervisory Board. For more information, see the Allianz Group Sustainability governance structure Sustainability Report 2021 Executive Committee Investment Executive Committee Sustainable Global Proxy Reputational Risk Investing Voting Working Group Working Group Committee International Management Group

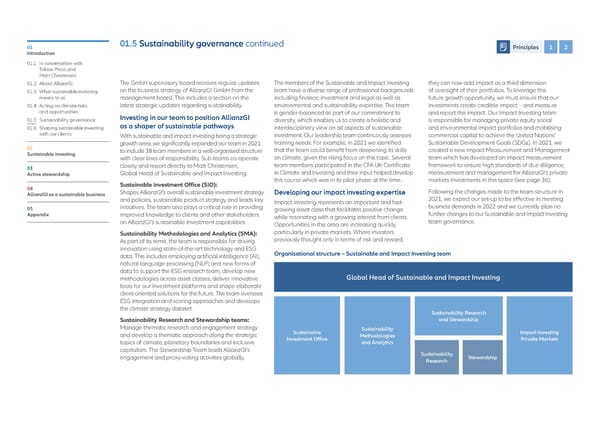

01 01.5 Sustainability governance continued Principles 1 2 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI The GmbH supervisory board receives regular updates The members of the Sustainable and Impact Investing they can now add impact as a third dimension 01.3 What sustainable investing on the business strategy of AllianzGI GmbH from the team have a diverse range of professional backgrounds of oversight of their portfolios. To leverage this means to us management board. This includes a section on the including finance, investment and legal as well as future growth opportunity, we must ensure that our 01.4 Acting on climate risks latest strategic updates regarding sustainability. environmental and sustainability expertise. The team investments create credible impact – and measure and opportunities Investing in our team to position AllianzGI is gender-balanced as part of our commitment to and report this impact. Our Impact Investing team 01.5 Sustainability governance diversity, which enables us to create a holistic and is responsible for managing private equity social 01.6 Shaping sustainable investing as a shaper of sustainable pathways interdisciplinary view on all aspects of sustainable and environmental impact portfolios and mobilising with our clients With sustainable and impact investing being a strategic investment. Our leadership team continuously assesses commercial capital to achieve the United Nations’ growth area, we significantly expanded our team in 2021 training needs. For example, in 2021 we identified Sustainable Development Goals (SDGs). In 2021, we 02 to include 38 team members in a well-organised structure that the team could benefit from deepening its skills created a new Impact Measurement and Management Sustainable investing with clear lines of responsibility. Sub-teams co-operate on climate, given the rising focus on this topic. Several team which has developed an impact measurement 03 closely and report directly to Matt Christensen, team members participated in the CFA UK Certificate framework to ensure high standards of due diligence, Active stewardship Global Head of Sustainable and Impact Investing. in Climate and Investing and their input helped develop measurement and management for AllianzGI’s private Sustainable Investment Office (SIO): this course which was in its pilot phase at the time. markets investments in this space (see page 36). 04 Shapes AllianzGI’s overall sustainable investment strategy Developing our impact investing expertise Following the changes made to the team structure in AllianzGI as a sustainable business 2021, we expect our set-up to be effective in meeting and policies, sustainable product strategy and leads key Impact investing represents an important and fast- 05 initiatives. The team also plays a critical role in providing growing asset class that facilitates positive change business demands in 2022 and we currently plan no Appendix improved knowledge to clients and other stakeholders while resonating with a growing interest from clients. further changes to our Sustainable and Impact Investing on AllianzGI’s sustainable investment capabilities. Opportunities in this area are increasing quickly, team governance. Sustainability Methodologies and Analytics (SMA): particularly in private markets. Where investors As part of its remit, the team is responsible for driving previously thought only in terms of risk and reward, innovation using state-of-the-art technology and ESG Organisational structure – Sustainable and Impact Investing team data. This includes employing artificial intelligence (AI), natural language processing (NLP) and new forms of data to support the ESG research team, develop new methodologies across asset classes, deliver innovative Global Head of Sustainable and Impact Investing tools for our investment platforms and shape elaborate client-oriented solutions for the future. The team oversees ESG integration and scoring approaches and develops the climate strategy dataset. Sustainability Research Sustainability Research and Stewardship teams: and Stewardship Manage thematic research and engagement strategy Sustainable Sustainability Impact Investing and develop a thematic approach along the strategic Investment Office Methodologies Private Markets topics of climate, planetary boundaries and inclusive and Analytics capitalism. The Stewardship Team leads AllianzGI’s Sustainability engagement and proxy-voting activities globally. Research Stewardship

01 01.5 Sustainability governance continued Principles 1 2 5 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Linking sustainability with remuneration All review processes are based on the regulatory 01.3 What sustainable investing Our International Management Group – comprising requirements and developments in the jurisdictions in means to us senior functional heads from across the firm – has which we operate. To be at the forefront of sustainability 01.4 Acting on climate risks sustainability embedded into its goals through the regulation, we set up a separate global regulation and opportunities firmwide global solidarity goals. A specific sustainability workstream to implement sustainability-related 01.5 Sustainability governance goal was introduced in 2021 and will be implemented regulation into our investment approach. This has a 01.6 Shaping sustainable investing in 2022. This goal targets sustainability achievement focus on implementation projects to comply with the with our clients as measured by our delivery of above peer average EU Sustainable Finance Disclosure Regulation (SFDR) PRI results. Achievement of the global solidarity goals (see page 23) as well as Markets in Financial Instruments 02 influences the firmwide remuneration pool. Directive (MiFID) II sustainability preferences as part of Sustainable investing the suitability assessment. 03 AllianzGI functions are also embedding sustainability In 2021, we commissioned an audit to review our Active stewardship considerations into team and individual goals. For sustainability policies and processes for the first time. instance, the investment platform has implemented This was performed by an external audit firm with the 04 goals that specifically reflect the sustainability journey remit to identify potential weaknesses in our reporting AllianzGI as a sustainable business and focus areas of each team. and processes. The Sustainable Investing Working 05 Review and assurance Group discussed the key findings and recommended Appendix The credibility of our approach, as reflected in our actions to the Executive Committee. internal processes and external reporting, is crucial to AllianzGI’s Executive Committee reviewed and ensure trust in our company. We have sound processes approved this Sustainability and Stewardship Report in place to review ESG-related policies and procedures 2021. In doing so, they consider the report to provide a at least annually to ensure continuous improvement. fair and balanced view of our approach to sustainability In 2021, this included strengthening our exclusion policy investing and stewardship activities. Initial input was (see page 22), climate policy statement and proxy provided by the respective teams responsible for the voting policy (see page 51). We also reviewed our various activities, with overall review by the Sustainability processes to meet the requirements of sustainability and Impact Investing team given the changes in our labels for our funds when it comes to engagement. reporting structure. This review process was considered Review processes are led by our Sustainable Investment the most effective in consolidating our sustainability Office and Stewardship team. In 2021, we developed and stewardship reporting. our Global Sustainability Risk Policy and established a Reputational Risk Working Group to ensure that we analyse emerging sustainability-related reputational risks in a timely manner.

01 01.6 Shaping sustainable investing with our clients Principle 6 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI 01.3 What sustainable investing Our global asset and client mix (EUR billion, as at 31 December 2021) means to us Asset class split Client split Managed per region Distributed per region 01.4 Acting on climate risks and opportunities Fixed income Institutional EMEA EMEA 01.5 Sustainability governance Equities 93 business US 48 US 104 01.6 Shaping sustainable investing Multi-asset Retail Asia Pacific Asia Pacific with our clients Private 211 business 209 128 markets 47 02 179 Sustainable investing 464 496 03 522 Active stewardship 190 04 AllianzGI as a sustainable business Guiding clients on sustainable These capabilities are increasingly important to both We provide thought leadership and investment 05 investment solutions retail and professional investor clients. The recent health expertise in client meetings and host regular client Appendix crisis and natural catastrophes, and the ensuing market events on sustainable investing. These events provide As an active asset manager, we seek to create volatility, have intensified the already growing positive a platform for renowned keynote speakers and solutions and products that address our clients’ sentiment for ESG priorities. In 2021, our Request for AllianzGI’s own sustainable investment experts to evolving investment objectives. We manage EUR Proposal (RfP) team answered over 100 dedicated discuss the opportunities and challenges of sustainable 673 billion across all asset classes in public and ESG questionnaires from clients – a strong proof point investing, the emerging regulatory framework and the private markets for our global client base. for the increasing client focus on sustainable investing. measurability of sustainable and impact investments. We aim to give investors access to a broad range of Engaging with clients is a key element of helping them sustainable investment strategies. Since the inception to understand their sustainable investing preferences of our first sustainable investment strategy in 1999, and objectives. In our regular client meetings, we also our number of sustainable products had increased discuss stewardship activities and gain important insights to 150 by the end of 2021, up from 36 at the end of into the engagement themes that clients would like us 2020. In 2021, we converted 102 mutual funds to a to prioritise. For certain portfolios, we hold dedicated sustainable investing approach and launched 12 new ESG feedback meetings to discuss the decarbonisation funds – a path we aim to continue in 2022 for a range pathway of the portfolio as well as the outcomes of 1 of additional funds . engagement and voting. The climate strategies of the companies we invest in are a particular focus of these meetings. 1 These figures relate to EU-domiciled funds that are classified as either Article 8 or Article 9 under SFDR.

01 01.6 Shaping sustainable investing with our clients continued Principle 6 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Supporting institutional clients to set 01.3 What sustainable investing Maintaining our position as Highlights from the 2021 Coalition their sustainability agenda means to us a client service leader Greenwich Report: It is part of our fiduciary duty to help institutional 01.4 Acting on climate risks Our focus on providing guidance on sustainable • Eleventh consecutive year as Greenwich Quality Leader clients understand and fulfil their long-term financial and opportunities investment solutions is part of a wider commitment to in institutional investment management in Germany, obligations and navigate their present and future 01.5 Sustainability governance clients. We look beyond pure economic gain to develop and fourth consecutive year in Continental Europe. investment challenges. 01.6 Shaping sustainable investing strong and enduring partnerships with them. This has • Fourth consecutive year as Greenwich Quality Leader with our clients been especially important against the backdrop of the Institutional clients have seen rising regulatory pressure pandemic and the resulting economic uncertainty and in overall European intermediary distribution quality. around the disclosure of sustainable investment activities, 02 market volatility. • Sole Greenwich Quality Leader in intermediary particularly in the EU. There is also a bigger drive to align Sustainable investing investment activities with specific values and long-term Our aim is to create value together and we believe every services in Asia. 03 sustainability convictions. Consequently, our clients are Active stewardship interaction should support this goal. We want to elevate • The leading ESG investment manager for institutional looking for a strong partner in solving challenges around our clients’ investing experience by understanding their clients in Continental Europe. ESG risks and seek to capture opportunities, aligning with 04 individual needs, providing the right solutions and always carbon-reduction commitments and assessing which AllianzGI as a sustainable business acting in their best interests. Drawing on our toolkit of activities they want to finance or divest. Our goal is to capabilities, we create solutions that help clients achieve help clients implement investment solutions that fit their 05 their investment objectives, today and in the future. own value framework. Appendix We are proud that independent client satisfaction Our track record in sustainable investing allows us to share surveys consistently highlight client service as one of knowledge and best practices with our clients to support our main strengths. Historically, AllianzGI has ranked in them in setting their sustainable investment objectives and the first quartile against competitors across all relevant finding the most appropriate investment solutions. major markets in the annual Coalition Greenwich survey. As part of this engagement, we help clients understand We are a quality leader – as recognised by Coalition current sustainability developments and regulatory Greenwich for more than a decade – with technological changes. We typically analyse the sustainability features capabilities and client service procedures that ensure we of their current portfolios, help to formulate their ESG stay close to clients. We actively use the findings of these approach and discuss how it can be implemented or surveys to continually enhance our service. further enhanced. 50+ dedicated ESG workshops and training sessions with institutional clients globally on various sustainable investing topics in 2021.

01 01.6 Shaping sustainable investing with our clients continued Principles 2 6 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI 01.3 What sustainable investing Shaping pathways for a sustainable future Shaping pathways for a sustainable future means to us 01.4 Acting on climate risks Building on our sustainable advisory Advising clients on a and opportunities capabilities with risklab strategy to reduce a 01.5 Sustainability governance 01.6 Shaping sustainable investing portfolio’s CO footprint with our clients 2 02 Sustainable investing In 2021, we expanded our offering by implementing and varying motivations, but all of them want to We performed a long-term strategic asset a dedicated expertise in sustainable investing within understand the impact of ESG on the risk and return allocation optimisation for the pensions team 03 risklab – AllianzGI’s unit offering customised analysis of their asset allocation. We aim to build on risklab’s of a global technology and optics manufacturer. Active stewardship and investment solutions – with a focus on asset longstanding expertise to provide transparency The company has committed to a carbon 04 allocation, risk management and private markets on the interaction of complex investment decisions neutrality goal. To contribute to this goal AllianzGI as a sustainable business implementation. We identified three pillars of and the long-term impact on traditional investment with the company’s pension assets, an equity this analysis: metrics while enhancing for sustainability metrics. investments sleeve was identified as a starting 05 • Sustainability transparency aims to help In 2022, we will continue to build out our institutional- point. We performed an analysis of available Appendix investors understand the sustainability quality grade sustainable investment advice that helps sustainable investment strategies and advised of their investment and best practices. investors view sustainability as a third dimension in the client on a choice that incorporated risk, addition to risk and return, by integrating ESG metrics return, ESG metrics and the carbon footprint of • Actionable advice focuses on establishing into our capital markets model. Our ambition is a the equity investment. The result was a change sustainability goals and implementing those goals level of transparency that allows for the display of bi- of the investment strategy and benchmark that through asset allocation changes, while keeping in directional implications of sustainability and financial will lead to a reduction of the carbon footprint mind the impact on risk and return characteristics metrics, ie, the implications of financial decisions on of the portfolio by 14,410 mtCO2e annually, of the portfolio. sustainability KPIs and the impact of a sustainability- as measured by financed Scope 1 and Scope • Customised solutions allows for a collaboration driven investment decision on traditional metrics such 2 emissions. between the client, risklab and AllianzGI with the as financial risk and return. reduction of the carbon footprint goal of developing investment strategies that To deliver on these ambitions, we plan to add further of the portfolio by meet specific client sustainability needs. resources and intensify the close collaboration 14,410 mtCO e To deliver on our ambition to offer outstanding between risklab and the rest of AllianzGI, in particular annually 2 sustainable investment advisory, we hired an the Sustainable and Impact Investing team. initial team of sustainability specialists and have started by expanding risklab’s tools and solutions in the first two pillars: transparency and actionable advice. We aim to help clients work within their own values framework rather than telling them what sustainability should mean to them. We support clients with different levels of experience

01 01.6 Shaping sustainable investing with our clients continued Principle 6 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Creating real impact in private markets 01.3 What sustainable investing Shaping pathways for a sustainable future With Allianz SE, we have committed to measurably means to us reduce the carbon footprint of our real assets portfolio 01.4 Acting on climate risks Helping our largest by growing our share in low GHG-emitting assets and opportunities client on its path and engaging with the companies we are invested in 01.5 Sustainability governance on decarbonisation. AllianzGI is also co-developing 01.6 Shaping sustainable investing to net zero dedicated impact investment strategies that foster the with our clients energy transition in developed and developing markets, 02 often partnering with global development banks Sustainable investing Managing over EUR 200 billion for our and organisations. shareholder, AllianzGI is a key partner in helping In November 2021, together with the International 03 Allianz to reach its ambitions across public and Finance Corporation and Hong Kong Monetary Active stewardship private markets. As one of the world’s leading insurance companies and a founding member Authority, AllianzGI set up the world’s first cross-sectoral 04 of the Net-Zero Asset Owner Alliance, Allianz portfolio of emerging-markets loans aligned with the AllianzGI as a sustainable business is pursuing ambitious sustainability targets for Paris Agreement. The strategy supports the IFC and its entire business. As one of several interim Allianz Group in making 1.5°C-aligned investments in 05 emerging markets. AllianzGI also announced at the Appendix goals, we are working with Allianz to reach a UN Climate Conference in Glasgow the launch of a new decarbonisation target of -25% greenhouse gas strategy – a public-private partnership that will invest emissions by the end of 2024 across listed equity in climate-focused private equity funds and projects and corporate bond investments that AllianzGI active in emerging markets and developing countries manages on behalf of Allianz, and by the end with a focus on climate mitigation, climate adaptation, of 2025 for infrastructure equity investments. and access to electricity. Our third-party clients will Allianz and AllianzGI are on track to achieve benefit from this commitment through the co-investment the interim goal of -25% without withdrawing opportunities that exist with Allianz. capital from hard-to-abate sectors. This is just a first step. We continue to engage with borrowers and partners to further increase the scope of assets and construct long-term portfolios and commitments to fulfil higher decarbonisation goals beyond 2025.

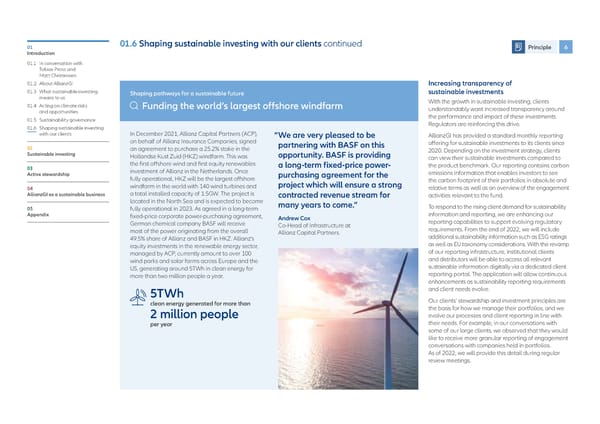

01 01.6 Shaping sustainable investing with our clients continued Principle 6 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Increasing transparency of 01.3 W hat sustainable investing Shaping pathways for a sustainable future sustainable investments means to us With the growth in sustainable investing, clients 01.4 Acting on climate risks Funding the world’s largest offshore windfarm understandably want increased transparency around and opportunities the performance and impact of these investments. 01.5 Sustainability governance Regulators are reinforcing this drive. 01.6 Shaping sustainable investing with our clients In December 2021, Allianz Capital Partners (ACP), “We are very pleased to be AllianzGI has provided a standard monthly reporting on behalf of Allianz Insurance Companies, signed partnering with BASF on this offering for sustainable investments to its clients since 02 an agreement to purchase a 25.2% stake in the 2020. Depending on the investment strategy, clients Sustainable investing Hollandse Kust Zuid (HKZ) windfarm. This was opportunity. BASF is providing can view their sustainable investments compared to 03 the first offshore wind and first equity renewables a long-term fixed-price power- the product benchmark. Our reporting contains carbon Active stewardship investment of Allianz in the Netherlands. Once purchasing agreement for the emissions information that enables investors to see fully operational, HKZ will be the largest offshore project which will ensure a strong the carbon footprint of their portfolios in absolute and 04 windfarm in the world with 140 wind turbines and relative terms as well as an overview of the engagement AllianzGI as a sustainable business a total installed capacity of 1.5GW. The project is contracted revenue stream for activities relevant to the fund. located in the North Sea and is expected to become many years to come.” 05 fully operational in 2023. As agreed in a long-term To respond to the rising client demand for sustainability Appendix fixed-price corporate power-purchasing agreement, Andrew Cox information and reporting, we are enhancing our German chemical company BASF will receive Co-Head of Infrastructure at reporting capabilities to support evolving regulatory most of the power originating from the overall Allianz Capital Partners. requirements. From the end of 2022, we will include 49.5% share of Allianz and BASF in HKZ. Allianz’s additional sustainability information such as ESG ratings equity investments in the renewable energy sector, as well as EU taxonomy considerations. With the revamp managed by ACP, currently amount to over 100 of our reporting infrastructure, institutional clients wind parks and solar farms across Europe and the and distributors will be able to access all relevant US, generating around 5TWh in clean energy for sustainable information digitally via a dedicated client more than two million people a year. reporting portal. The application will allow continuous enhancements as sustainability reporting requirements 5TWh and client needs evolve. clean energy generated for more than Our clients’ stewardship and investment principles are the basis for how we manage their portfolios, and we 2 million people evolve our processes and client reporting in line with per year their needs. For example, in our conversations with some of our large clients, we observed that they would like to receive more granular reporting of engagement conversations with companies held in portfolios. As of 2022, we will provide this detail during regular review meetings.

This is a modal window.

01 Introduction 02 Sustainable investing 02.1 Building our approach to sustainable investing 02.2 Sustainability research and data and analytics – our strong foundation 02.3 Sustainability risk management 02.4 Sustainable investing categories 03 Active stewardship 04 AllianzGI as a sustainable business 05 Appendix AllianzGI has been at the forefront 1 of responsible investing since the EUR 303 billion >100 total assets under management mutual funds converted to a launch of our first sustainable in ESG and sustainable investments sustainable-focused investment investing portfolio in 1999. as at 31 December 2021 approach in 2021 Building on a strong foundation (45% of total assets under management) in environmentally and socially responsible investment (SRI), we aim to become a shaper of sustainable investing solutions across public and private markets – leading clients and companies on an inclusive transition pathway to a better future. 1 This figure includes EUR 156 billion of integrated ESG assets that are not considered sustainable according to EU Sustainable Finance Disclosure Regulation. 02 Sustainable investing

This is a modal window.

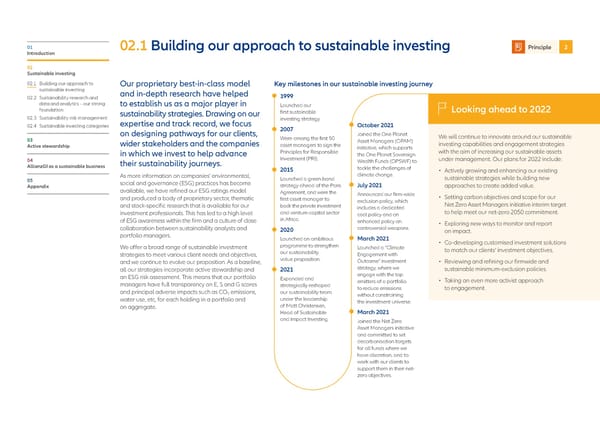

01 02.1 Building our approach to sustainable investing Principle 2 Introduction 02 Sustainable investing 02.1 Building our approach to Our proprietary best-in-class model Key milestones in our sustainable investing journey sustainable investing and in-depth research have helped 02.2 Sustainability research and 1999 data and analytics – our strong to establish us as a major player in Launched our foundation sustainability strategies. Drawing on our first sustainable Looking ahead to 2022 02.3 Sustainability risk management expertise and track record, we focus investing strategy. 02.4 Sustainable investing categories 2007 October 2021 on designing pathways for our clients, Were among the first 50 Joined the One Planet We will continue to innovate around our sustainable 03 wider stakeholders and the companies Asset Managers (OPAM) investing capabilities and engagement strategies Active stewardship asset managers to sign the initiative, which supports in which we invest to help advance Principles for Responsible the One Planet Sovereign with the aim of increasing our sustainable assets 04 their sustainability journeys. Investment (PRI). Wealth Funds (OPSWF) to under management. Our plans for 2022 include: AllianzGI as a sustainable business 2015 tackle the challenges of • Actively growing and enhancing our existing As more information on companies’ environmental, Launched a green bond climate change. sustainable strategies while building new 05 social and governance (ESG) practices has become July 2021 Appendix strategy ahead of the Paris approaches to create added value. available, we have refined our ESG ratings model Agreement, and were the Announced our firm-wide and produced a body of proprietary sector, thematic first asset manager to exclusion policy, which • Setting carbon objectives and scope for our and stock-specific research that is available for our back the private investment includes a dedicated Net Zero Asset Managers initiative interim target investment professionals. This has led to a high level and venture-capital sector coal policy and an to help meet our net-zero 2050 commitment. of ESG awareness within the firm and a culture of close in Africa. enhanced policy on • Exploring new ways to monitor and report collaboration between sustainability analysts and 2020 controversial weapons. on impact. portfolio managers. Launched an ambitious March 2021 We offer a broad range of sustainable investment programme to strengthen • Co-developing customised investment solutions Launched a “Climate to match our clients’ investment objectives. strategies to meet various client needs and objectives, our sustainability Engagement with and we continue to evolve our proposition. As a baseline, value proposition. Outcome” investment • Reviewing and refining our firmwide and all our strategies incorporate active stewardship and 2021 strategy, where we sustainable minimum-exclusion policies. an ESG risk assessment. This means that our portfolio Expanded and engage with the top managers have full transparency on E, S and G scores strategically reshaped emitters of a portfolio • Taking an even more activist approach and principal adverse impacts such as CO emissions, our sustainability team to reduce emissions to engagement. 2 without constraining water use, etc, for each holding in a portfolio and under the leadership the investment universe. on aggregate. of Matt Christensen, Head of Sustainable March 2021 and Impact Investing. Joined the Net Zero Asset Managers initiative and committed to set decarbonisation targets for all funds where we have discretion, and to work with our clients to support them in their net- zero objectives.