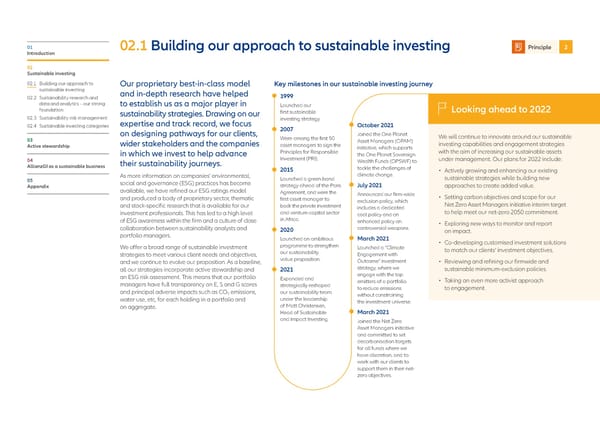

01 02.1 Building our approach to sustainable investing Principle 2 Introduction 02 Sustainable investing 02.1 Building our approach to Our proprietary best-in-class model Key milestones in our sustainable investing journey sustainable investing and in-depth research have helped 02.2 Sustainability research and 1999 data and analytics – our strong to establish us as a major player in Launched our foundation sustainability strategies. Drawing on our first sustainable Looking ahead to 2022 02.3 Sustainability risk management expertise and track record, we focus investing strategy. 02.4 Sustainable investing categories 2007 October 2021 on designing pathways for our clients, Were among the first 50 Joined the One Planet We will continue to innovate around our sustainable 03 wider stakeholders and the companies Asset Managers (OPAM) investing capabilities and engagement strategies Active stewardship asset managers to sign the initiative, which supports in which we invest to help advance Principles for Responsible the One Planet Sovereign with the aim of increasing our sustainable assets 04 their sustainability journeys. Investment (PRI). Wealth Funds (OPSWF) to under management. Our plans for 2022 include: AllianzGI as a sustainable business 2015 tackle the challenges of • Actively growing and enhancing our existing As more information on companies’ environmental, Launched a green bond climate change. sustainable strategies while building new 05 social and governance (ESG) practices has become July 2021 Appendix strategy ahead of the Paris approaches to create added value. available, we have refined our ESG ratings model Agreement, and were the Announced our firm-wide and produced a body of proprietary sector, thematic first asset manager to exclusion policy, which • Setting carbon objectives and scope for our and stock-specific research that is available for our back the private investment includes a dedicated Net Zero Asset Managers initiative interim target investment professionals. This has led to a high level and venture-capital sector coal policy and an to help meet our net-zero 2050 commitment. of ESG awareness within the firm and a culture of close in Africa. enhanced policy on • Exploring new ways to monitor and report collaboration between sustainability analysts and 2020 controversial weapons. on impact. portfolio managers. Launched an ambitious March 2021 We offer a broad range of sustainable investment programme to strengthen • Co-developing customised investment solutions Launched a “Climate to match our clients’ investment objectives. strategies to meet various client needs and objectives, our sustainability Engagement with and we continue to evolve our proposition. As a baseline, value proposition. Outcome” investment • Reviewing and refining our firmwide and all our strategies incorporate active stewardship and 2021 strategy, where we sustainable minimum-exclusion policies. an ESG risk assessment. This means that our portfolio Expanded and engage with the top managers have full transparency on E, S and G scores strategically reshaped emitters of a portfolio • Taking an even more activist approach and principal adverse impacts such as CO emissions, our sustainability team to reduce emissions to engagement. 2 without constraining water use, etc, for each holding in a portfolio and under the leadership the investment universe. on aggregate. of Matt Christensen, Head of Sustainable March 2021 and Impact Investing. Joined the Net Zero Asset Managers initiative and committed to set decarbonisation targets for all funds where we have discretion, and to work with our clients to support them in their net- zero objectives.

Allianz GI Sustainability and Stewardship Report 2021 Page 23 Page 25

Allianz GI Sustainability and Stewardship Report 2021 Page 23 Page 25