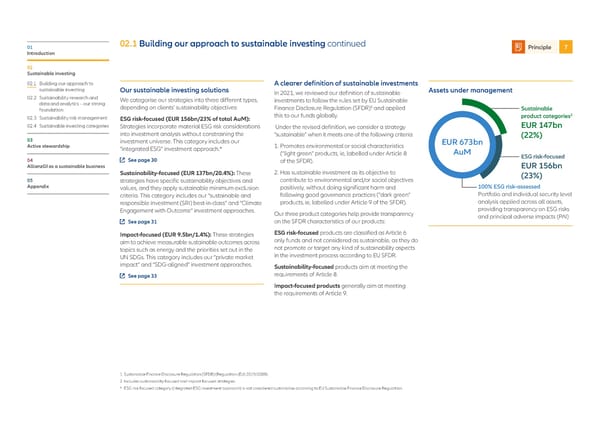

01 02.1 Building our approach to sustainable investing continued Principle 7 Introduction 02 Sustainable investing 02.1 Building our approach to A clearer definition of sustainable investments sustainable investing Our sustainable investing solutions In 2021, we reviewed our definition of sustainable Assets under management 02.2 Sustainability research and We categorise our strategies into three different types, investments to follow the rules set by EU Sustainable data and analytics – our strong depending on clients’ sustainability objectives: Finance Disclosure Regulation (SFDR)1 and applied Sustainable foundation 02.3 Sustainability risk management ESG risk-focused (EUR 156bn/23% of total AuM): this to our funds globally. product categories2 02.4 Sustainable investing categories Strategies incorporate material ESG risk considerations Under the revised definition, we consider a strategy EUR 147bn into investment analysis without constraining the “sustainable” when it meets one of the following criteria: (22%) 03 investment universe. This category includes our EUR 673bn Active stewardship “integrated ESG” investment approach.* 1. Promotes environmental or social characteristics AuM (“light green” products, ie, labelled under Article 8 ES risocused 04 See page 30 of the SFDR). AllianzGI as a sustainable business EUR 16bn Sustainability-focused (EUR 137bn/20.4%): These 2. Has sustainable investment as its objective to (23%) 05 strategies have specific sustainability objectives and contribute to environmental and/or social objectives Appendix values, and they apply sustainable minimum exclusion positively, without doing significant harm and 1% ES risassessed criteria. This category includes our “sustainable and following good governance practices (“dark green” Portfolio and individual security level responsible investment (SRI) best-in-class” and “Climate products, ie, labelled under Article 9 of the SFDR). analysis applied across all assets, Engagement with Outcome” investment approaches. Our three product categories help provide transparency providing transparency on ESG risks on the SFDR characteristics of our products: and principal adverse impacts (PAI) See page 31 Impact-focused (EUR 9.5bn/1.4%): These strategies ESG risk-focused products are classified as Article 6 aim to achieve measurable sustainable outcomes across only funds and not considered as sustainable, as they do topics such as energy and the priorities set out in the not promote or target any kind of sustainability aspects UN SDGs. This category includes our “private market in the investment process according to EU SFDR. impact” and “SDG-aligned” investment approaches. Sustainability-focused products aim at meeting the See page 33 requirements of Article 8. Impact-focused products generally aim at meeting the requirements of Article 9. 1 Sustainable Finance Disclosure Regulation (SFDR) (Regulation (EU) 2019/2088). 2 Includes sustainability-focused and impact-focused strategies. * ESG risk-focused category (integrated ESG investment approach) is not considered sustainable according to EU Sustainable Finance Disclosure Regulation.

Allianz GI Sustainability and Stewardship Report 2021 Page 24 Page 26

Allianz GI Sustainability and Stewardship Report 2021 Page 24 Page 26