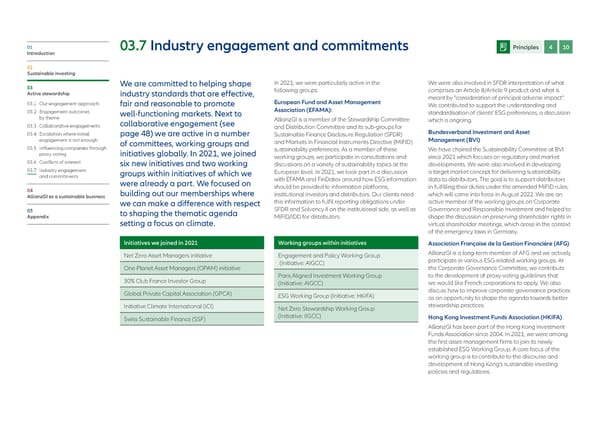

01 03.7 Industry engagement and commitments Principles 4 10 Introduction 02 Sustainable investing 03 We are committed to helping shape In 2021, we were particularly active in the We were also involved in SFDR interpretation of what Active stewardship industry standards that are effective, following groups: comprises an Article 8/Article 9 product and what is European Fund and Asset Management meant by “consideration of principal adverse impact”. 03.1 Our engagement approach fair and reasonable to promote We contributed to support the understanding and 03.2 Engagement outcomes well-functioning markets. Next to Association (EFAMA): standardisation of clients’ ESG preferences, a discussion by theme collaborative engagement (see AllianzGI is a member of the Stewardship Committee which is ongoing. 03.3 Collaborative engagements and Distribution Committee and its sub-groups for 03.4 E scalation where initial page 48) we are active in a number Sustainable Finance Disclosure Regulation (SFDR) Bundesverband Investment and Asset engagement is not enough of committees, working groups and and Markets in Financial Instruments Directive (MiFID) Management (BVI) 03.5 I nfluencing companies through sustainability preferences. As a member of these We have chaired the Sustainability Committee at BVI proxy voting initiatives globally. In 2021, we joined working groups, we participate in consultations and since 2021 which focuses on regulatory and market 03.6 Conflicts of interest six new initiatives and two working discussions on a variety of sustainability topics at the developments. We were also involved in developing 03.7 Industry engagement groups within initiatives of which we European level. In 2021, we took part in a discussion a target market concept for delivering sustainability and commitments with EFAMA and FinDatex around how ESG information data to distributors. The goal is to support distributors were already a part. We focused on should be provided to information platforms, in fulfilling their duties under the amended MiFID rules, 04 building out our memberships where institutional investors and distributors. Our clients need which will come into force in August 2022. We are an AllianzGI as a sustainable business we can make a difference with respect this information to fulfil reporting obligations under active member of the working groups on Corporate 05 to shaping the thematic agenda SFDR and Solvency II on the institutional side, as well as Governance and Responsible Investment and helped to Appendix MiFID/IDD for distributors. shape the discussion on preserving shareholder rights in setting a focus on climate. virtual shareholder meetings, which arose in the context of the emergency laws in Germany. Initiatives we joined in 2021 Working groups within initiatives Association Française de la Gestion Financière (AFG) Net Zero Asset Managers initiative Engagement and Policy Working Group AllianzGI is a long-term member of AFG and we actively (Initiative: AIGCC) participate in various ESG-related working groups. At One Planet Asset Managers (OPAM) initiative the Corporate Governance Committee, we contribute Paris Aligned Investment Working Group to the development of proxy-voting guidelines that 30% Club France Investor Group (Initiative: AIGCC) we would like French corporations to apply. We also Global Private Capital Association (GPCA) discuss how to improve corporate governance practices ESG Working Group (Initiative: HKIFA) as an opportunity to shape the agenda towards better Initiative Climate International (iCl) Net Zero Stewardship Working Group stewardship practices. Swiss Sustainable Finance (SSF) (Initiative: IIGCC) Hong Kong Investment Funds Association (HKIFA) AllianzGI has been part of the Hong Kong Investment Funds Association since 2004. In 2021, we were among the first asset management firms to join its newly established ESG Working Group. A core focus of the working group is to contribute to the discourse and development of Hong Kong’s sustainable investing policies and regulations.

Allianz GI Sustainability and Stewardship Report 2021 Page 60 Page 62

Allianz GI Sustainability and Stewardship Report 2021 Page 60 Page 62