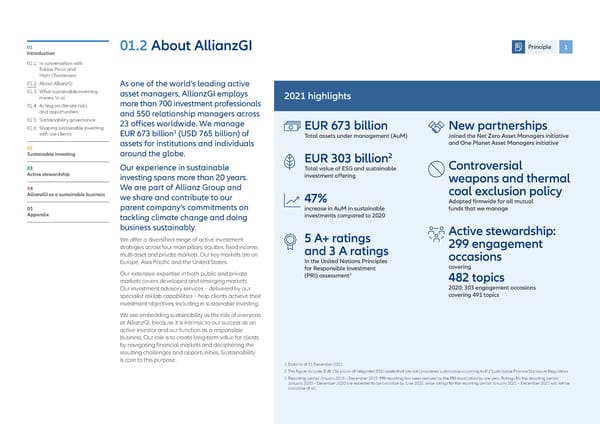

01 01.2 About AllianzGI Principle 1 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI As one of the world’s leading active 01.3 W hat sustainable investing asset managers, AllianzGI employs 2021 highlights means to us more than 700 investment professionals 01.4 Acting on climate risks and opportunities and 550 relationship managers across 01.5 Sustainability governance 23 offices worldwide. We manage 01.6 Shaping sustainable investing 1 EUR 673 billion New partnerships with our clients EUR 673 billion (USD 765 billion) of Total assets under management (AuM) Joined the Net Zero Asset Managers initiative assets for institutions and individuals and One Planet Asset Managers initiative 02 Sustainable investing around the globe. 2 EUR 303 billion Controversial 03 Our experience in sustainable Total value of ESG and sustainable Active stewardship investing spans more than 20 years. investment offering weapons and thermal 04 We are part of Allianz Group and coal exclusion policy AllianzGI as a sustainable business we share and contribute to our 47% parent company’s commitments on Adopted firmwide for all mutual 05 increase in AuM in sustainable funds that we manage Appendix tackling climate change and doing investments compared to 2020 business sustainably. Active stewardship: We offer a diversified range of active investment 5 A+ ratings 299 engagement strategies across four main pillars: equities, fixed income, and 3 A ratings multi asset and private markets. Our key markets are on occasions Europe, Asia Pacific and the United States. In the United Nations Principles for Responsible Investment covering Our extensive expertise in both public and private 3 (PRI) assessment 482 topics markets covers developed and emerging markets. Our investment advisory services – delivered by our 2020: 303 engagement occasions specialist risklab capabilities – help clients achieve their covering 491 topics investment objectives, including in sustainable investing. We see embedding sustainability as the role of everyone at AllianzGI, because it is intrinsic to our success as an active investor and our function as a responsible business. Our role is to create long-term value for clients by navigating financial markets and deciphering the resulting challenges and opportunities. Sustainability is core to this purpose. 1 Data as at 31 December 2021. 2 This figure includes EUR 156 billion of integrated ESG assets that are not considered sustainable according to EU Sustainable Finance Disclosure Regulation. 3 Reporting period January 2019 – December 2019. PRI reporting has been delayed by the PRI Association by one year. Ratings for the reporting period January 2020 – December 2020 are expected to be available by June 2022, while ratings for the reporting period January 2021 – December 2021 will not be available at all.

Allianz GI Sustainability and Stewardship Report 2021 Page 7 Page 9

Allianz GI Sustainability and Stewardship Report 2021 Page 7 Page 9