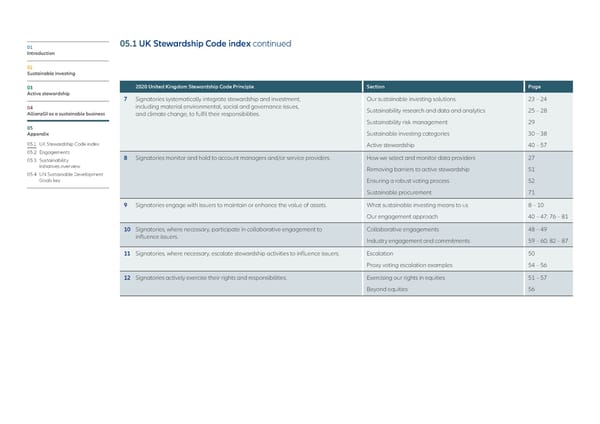

01 05.1 UK Stewardship Code index continued Introduction 02 Sustainable investing 03 2020 United Kingdom Stewardship Code Principle Section Page Active stewardship 7 Signatories systematically integrate stewardship and investment, Our sustainable investing solutions 23 – 24 04 including material environmental, social and governance issues, Sustainability research and data and analytics 25 – 28 AllianzGI as a sustainable business and climate change, to fulfil their responsibilities. Sustainability risk management 29 05 Appendix Sustainable investing categories 30 – 38 05.1 UK Stewardship Code index Active stewardship 40 – 57 05.2 Engagements 05.3 Sustainability 8 Signatories monitor and hold to account managers and/or service providers. How we select and monitor data providers 27 initiatives overview Removing barriers to active stewardship 51 05.4 U N Sustainable Development Goals key Ensuring a robust voting process 52 Sustainable procurement 71 9 Signatories engage with issuers to maintain or enhance the value of assets. What sustainable investing means to us 8 – 10 Our engagement approach 40 – 47; 76 – 81 10 Signatories, where necessary, participate in collaborative engagement to Collaborative engagements 48 – 49 influence issuers. Industry engagement and commitments 59 – 60; 82 – 87 11 Signatories, where necessary, escalate stewardship activities to influence issuers. Escalation 50 Proxy voting escalation examples 54 – 56 12 Signatories actively exercise their rights and responsibilities. Exercising our rights in equities 51 – 57 Beyond equities 56

Allianz GI Sustainability and Stewardship Report 2021 Page 76 Page 78

Allianz GI Sustainability and Stewardship Report 2021 Page 76 Page 78