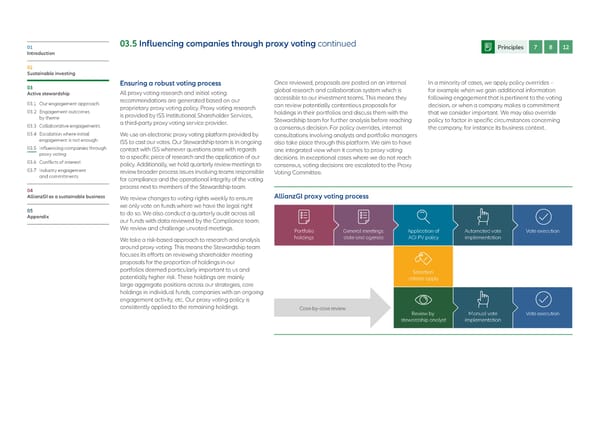

01 03.5 Influencing companies through proxy voting continued Principles 7 8 12 Introduction 02 Sustainable investing Ensuring a robust voting process Once reviewed, proposals are posted on an internal In a minority of cases, we apply policy overrides – 03 global research and collaboration system which is for example when we gain additional information Active stewardship All proxy voting research and initial voting accessible to our investment teams. This means they following engagement that is pertinent to the voting 03.1 Our engagement approach recommendations are generated based on our can review potentially contentious proposals for decision, or when a company makes a commitment 03.2 Engagement outcomes proprietary proxy voting policy. Proxy voting research holdings in their portfolios and discuss them with the that we consider important. We may also override by theme is provided by ISS Institutional Shareholder Services, Stewardship team for further analysis before reaching policy to factor in specific circumstances concerning 03.3 Collaborative engagements a third-party proxy voting service provider. a consensus decision. For policy overrides, internal the company, for instance its business context. 03.4 E scalation where initial We use an electronic proxy voting platform provided by consultations involving analysts and portfolio managers engagement is not enough ISS to cast our votes. Our Stewardship team is in ongoing also take place through this platform. We aim to have 03.5 Influencing companies through contact with ISS whenever questions arise with regards one integrated view when it comes to proxy voting proxy voting to a specific piece of research and the application of our decisions. In exceptional cases where we do not reach 03.6 Conflicts of interest policy. Additionally, we hold quarterly review meetings to consensus, voting decisions are escalated to the Proxy 03.7 Industry engagement review broader process issues involving teams responsible Voting Committee. and commitments for compliance and the operational integrity of the voting 04 process next to members of the Stewardship team. AllianzGI as a sustainable business We review changes to voting rights weekly to ensure AllianzGI proxy voting process we only vote on funds where we have the legal right 05 to do so. We also conduct a quarterly audit across all Appendix our funds with data reviewed by the Compliance team. We review and challenge unvoted meetings. Portfolio General meetings: Application of Automated vote Vote execution We take a risk-based approach to research and analysis holdings date and agenda AGI PV policy implementation around proxy voting. This means the Stewardship team focuses its efforts on reviewing shareholder meeting proposals for the proportion of holdings in our portfolios deemed particularly important to us and election potentially higher risk. These holdings are mainly criteria apply large aggregate positions across our strategies, core holdings in individual funds, companies with an ongoing engagement activity, etc. Our proxy voting policy is consistently applied to the remaining holdings. Case-by-case review eview by anual vote Vote execution stewardship analyst implementation

Allianz GI Sustainability and Stewardship Report 2021 Page 53 Page 55

Allianz GI Sustainability and Stewardship Report 2021 Page 53 Page 55