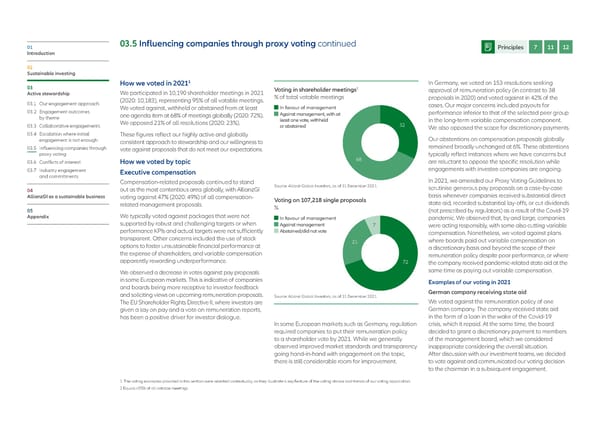

01 03.5 Influencing companies through proxy voting continued Principles 7 11 12 Introduction 02 Sustainable investing 1 In Germany, we voted on 153 resolutions seeking 03 How we voted in 2021 2 Active stewardship We participated in 10,190 shareholder meetings in 2021 Voting in shareholder meetings approval of remuneration policy (in contrast to 38 (2020: 10,183), representing 95% of all votable meetings. % of total votable meetings proposals in 2020) and voted against in 42% of the 03.1 Our engagement approach We voted against, withheld or abstained from at least In favour of management cases. Our major concerns included payouts for 03.2 Engagement outcomes one agenda item at 68% of meetings globally (2020: 72%). Against management, with at performance inferior to that of the selected peer group by theme least one vote, withheld in the long-term variable compensation component. 03.3 Collaborative engagements We opposed 21% of all resolutions (2020: 23%). or abstained 32 We also opposed the scope for discretionary payments. 03.4 E scalation where initial These figures reflect our highly active and globally engagement is not enough consistent approach to stewardship and our willingness to Our abstentions on compensation proposals globally 03.5 Influencing companies through vote against proposals that do not meet our expectations. remained broadly unchanged at 6%. These abstentions proxy voting typically reflect instances where we have concerns but 03.6 Conflicts of interest How we voted by topic 68 are reluctant to oppose the specific resolution while 03.7 Industry engagement Executive compensation engagements with investee companies are ongoing. and commitments In 2021, we amended our Proxy Voting Guidelines to Compensation-related proposals continued to stand Source: Allianz Global Investors, as of 31 December 2021. 04 out as the most contentious area globally, with AllianzGI scrutinise generous pay proposals on a case-by-case AllianzGI as a sustainable business voting against 47% (2020: 49%) of all compensation- basis whenever companies received substantial direct related management proposals. Voting on 107,218 single proposals state aid, recorded substantial lay-offs, or cut dividends 05 % (not prescribed by regulators) as a result of the Covid-19 Appendix We typically voted against packages that were not In favour of management pandemic. We observed that, by and large, companies supported by robust and challenging targets or when Against management 7 were acting responsibly, with some also cutting variable performance KPIs and actual targets were not sufficiently Abstained/did not vote compensation. Nonetheless, we voted against plans transparent. Other concerns included the use of stock 21 where boards paid out variable compensation on options to foster unsustainable financial performance at a discretionary basis and beyond the scope of their the expense of shareholders, and variable compensation remuneration policy despite poor performance, or where apparently rewarding underperformance. 72 the company received pandemic-related state aid at the We observed a decrease in votes against pay proposals same time as paying out variable compensation. in some European markets. This is indicative of companies Examples of our voting in 2021 and boards being more receptive to investor feedback German company receiving state aid and soliciting views on upcoming remuneration proposals. Source: Allianz Global Investors, as of 31 December 2021. The EU Shareholder Rights Directive II, where investors are We voted against the remuneration policy of one given a say on pay and a vote on remuneration reports, German company. The company received state aid has been a positive driver for investor dialogue. in the form of a loan in the wake of the Covid-19 In some European markets such as Germany, regulation crisis, which it repaid. At the same time, the board required companies to put their remuneration policy decided to grant a discretionary payment to members to a shareholder vote by 2021. While we generally of the management board, which we considered observed improved market standards and transparency inappropriate considering the overall situation. going hand-in-hand with engagement on the topic, After discussion with our investment teams, we decided there is still considerable room for improvement. to vote against and communicated our voting decision to the chairman in a subsequent engagement. 1 The voting examples provided in this section were selected contextually, as they illustrate a key feature of the voting stance and trends of our voting application 2 Equals c95% of all votable meetings.

Allianz GI Sustainability and Stewardship Report 2021 Page 55 Page 57

Allianz GI Sustainability and Stewardship Report 2021 Page 55 Page 57