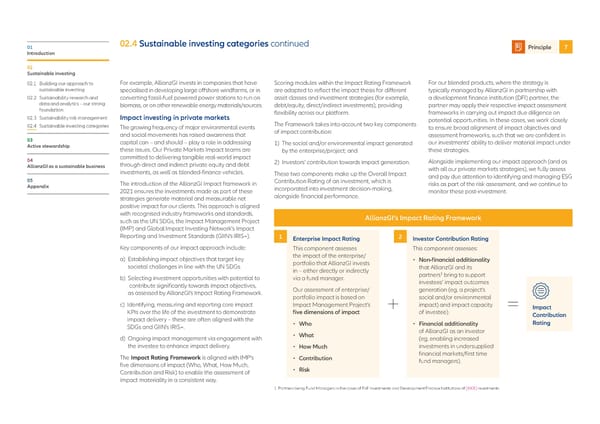

01 02.4 Sustainable investing categories continued Principle 7 Introduction 02 Sustainable investing 02.1 Building our approach to For example, AllianzGI invests in companies that have Scoring modules within the Impact Rating Framework For our blended products, where the strategy is sustainable investing specialised in developing large offshore windfarms, or in are adapted to reflect the impact thesis for different typically managed by AllianzGI in partnership with 02.2 Sustainability research and converting fossil-fuel powered power stations to run on asset classes and investment strategies (for example, a development finance institution (DFI) partner, the data and analytics – our strong biomass, or on other renewable energy materials/sources. debt/equity, direct/indirect investments), providing partner may apply their respective impact assessment foundation flexibility across our platform. frameworks in carrying out impact due diligence on 02.3 Sustainability risk management Impact investing in private markets potential opportunities. In these cases, we work closely 02.4 Sustainable investing categories The growing frequency of major environmental events The Framework takes into account two key components to ensure broad alignment of impact objectives and and social movements has raised awareness that of impact contribution: assessment frameworks, such that we are confident in 03 capital can – and should – play a role in addressing 1) The social and/or environmental impact generated our investments’ ability to deliver material impact under Active stewardship these issues. Our Private Markets Impact teams are by the enterprise/project; and these strategies. 04 committed to delivering tangible real-world impact 2) Investors’ contribution towards impact generation. Alongside implementing our impact approach (and as AllianzGI as a sustainable business through direct and indirect private equity and debt with all our private markets strategies), we fully assess investments, as well as blended-finance vehicles. These two components make up the Overall Impact and pay due attention to identifying and managing ESG 05 The introduction of the AllianzGI Impact framework in Contribution Rating of an investment, which is risks as part of the risk assessment, and we continue to Appendix 2021 ensures the investments made as part of these incorporated into investment decision-making, monitor these post-investment. strategies generate material and measurable net alongside financial performance. positive impact for our clients. This approach is aligned with recognised industry frameworks and standards, AllianzGI’s Impact Rating Framework such as the UN SDGs, the Impact Management Project (IMP) and Global Impact Investing Network’s Impact Reporting and Investment Standards (GIIN’s IRIS+). 1 Enterprise Impact Rating 2 Investor Contribution Rating Key components of our impact approach include: This component assesses This component assesses: a) Establishing impact objectives that target key the impact of the enterprise/ • Non-financial additionality societal challenges in line with the UN SDGs. portfolio that AllianzGI invests that AllianzGI and its in – either directly or indirectly partners1 bring to support b) Selecting investment opportunities with potential to via a fund manager. investees’ impact outcomes contribute significantly towards impact objectives, Our assessment of enterprise/ generation (eg, a project’s as assessed by AllianzGI’s Impact Rating Framework. portfolio impact is based on social and/or environmental c) Identifying, measuring and reporting core impact Impact Management Project’s impact) and impact capacity Impact KPIs over the life of the investment to demonstrate five dimensions of impact of investee). Contribution impact delivery – these are often aligned with the • Who • Financial additionality Rating SDGs and GIIN’s IRIS+. of AllianzGI as an investor d) Ongoing impact management via engagement with • What (eg, enabling increased the investee to enhance impact delivery. • How Much investments in undersupplied The Impact Rating Framework is aligned with IMP’s • Contribution financial markets/first time five dimensions of impact (Who, What, How Much, fund managers). Contribution and Risk) to enable the assessment of • Risk impact materiality in a consistent way. 1 Partners being Fund Managers in the cases of FoF investments and Development Finance Institutions of [XXX] investments

Allianz GI Sustainability and Stewardship Report 2021 Page 37 Page 39

Allianz GI Sustainability and Stewardship Report 2021 Page 37 Page 39