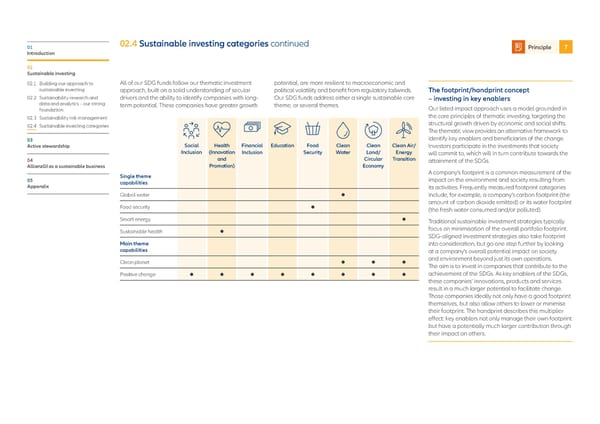

01 02.4 Sustainable investing categories continued Principle 7 Introduction 02 Sustainable investing 02.1 Building our approach to All of our SDG funds follow our thematic investment potential, are more resilient to macroeconomic and sustainable investing approach, built on a solid understanding of secular political volatility and benefit from regulatory tailwinds. The footprint/handprint concept 02.2 Sustainability research and drivers and the ability to identify companies with long- Our SDG funds address either a single sustainable core –investing in key enablers data and analytics – our strong term potential. These companies have greater growth theme, or several themes. Our listed impact approach uses a model grounded in foundation 02.3 Sustainability risk management the core principles of thematic investing, targeting the 02.4 Sustainable investing categories structural growth driven by economic and social shifts. The thematic view provides an alternative framework to 03 identify key enablers and beneficiaries of the change. Active stewardship Social Health Financial Education Food Clean Clean Clean Air/ Investors participate in the investments that society Inclusion (Innovation Inclusion Security Water Land/ Energy will commit to, which will in turn contribute towards the 04 and Circular Transition attainment of the SDGs. AllianzGI as a sustainable business Promotion) Economy Single theme A company’s footprint is a common measurement of the 05 capabilities impact on the environment and society resulting from Appendix its activities. Frequently measured footprint categories Global water include, for example, a company’s carbon footprint (the Food security amount of carbon dioxide emitted) or its water footprint (the fresh water consumed and/or polluted). Smart energy Traditional sustainable investment strategies typically Sustainable health focus on minimisation of the overall portfolio footprint. SDG-aligned investment strategies also take footprint Main theme into consideration, but go one step further by looking capabilities at a company’s overall potential impact on society Clean planet and environment beyond just its own operations. The aim is to invest in companies that contribute to the Positive change achievement of the SDGs. As key enablers of the SDGs, these companies’ innovations, products and services result in a much larger potential to facilitate change. Those companies ideally not only have a good footprint themselves, but also allow others to lower or minimise their footprint. The handprint describes this multiplier effect: key enablers not only manage their own footprint but have a potentially much larger contribution through their impact on others.

Allianz GI Sustainability and Stewardship Report 2021 Page 35 Page 37

Allianz GI Sustainability and Stewardship Report 2021 Page 35 Page 37