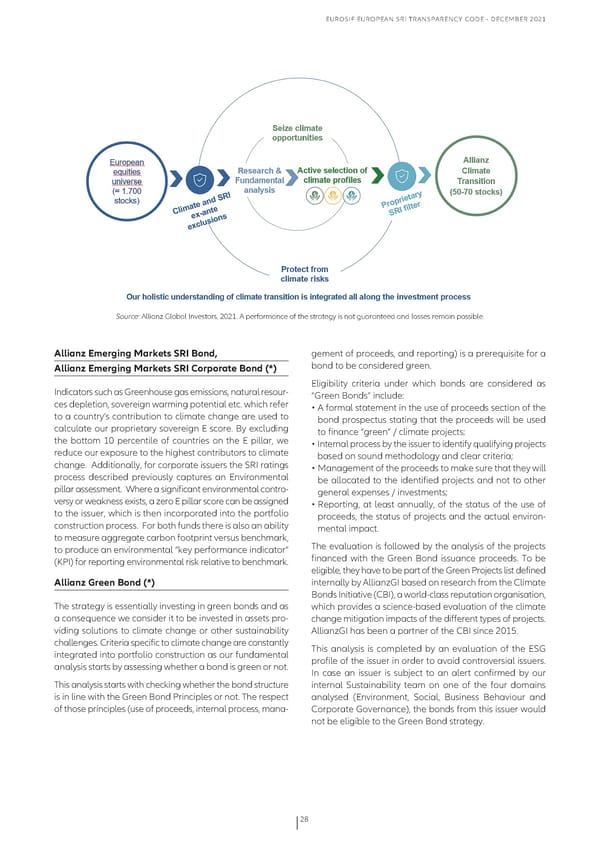

EuRoSIf EuRopEaN SRI TRaNSpaRENcy coDE - DEcEmbER 2021 Source: allianz Global Investors, 2021. a performance of the strategy is not guaranteed and losses remain possible. Allianz Emerging Markets SRI Bond, gement of proceeds, and reporting) is a prerequisite for a Allianz Emerging Markets SRI Corporate Bond (*) bond to be considered green. Eligibility criteria under which bonds are considered as Indicators such as Greenhouse gas emissions, natural resour- “Green bonds” include: ces depletion, sovereign warming potential etc. which refer • a formal statement in the use of proceeds section of the to a country’s contribution to climate change are used to bond prospectus stating that the proceeds will be used calculate our proprietary sovereign E score. by excluding to finance “green” / climate projects; the bottom 10 percentile of countries on the E pillar, we • Internal process by the issuer to identify qualifying projects reduce our exposure to the highest contributors to climate based on sound methodology and clear criteria; change. additionally, for corporate issuers the SRI ratings • management of the proceeds to make sure that they will process described previously captures an Environmental be allocated to the identified projects and not to other pillar assessment. Where a significant environmental contro- general expenses / investments; versyor weakness exists, a zero E pillar score can be assigned • Reporting, at least annually, of the status of the use of to the issuer, which is then incorporated into the portfolio proceeds, the status of projects and the actual environ- construction process. for both funds there is also an ability mental impact. to measure aggregate carbon footprint versus benchmark, to produce an environmental “key performance indicator” The evaluation is followed by the analysis of the projects (KpI) for reporting environmental risk relative to benchmark. financed with the Green bond issuance proceeds. To be eligible, they have to be part of the Green projects list defined Allianz Green Bond (*) internally by allianzGI based on research from the climate bonds Initiative (cbI), a world-class reputation organisation, The strategy is essentially investing in green bonds and as which provides a science-based evaluation of the climate a consequence we consider it to be invested in assets pro- change mitigation impacts of the different types of projects. viding solutions to climate change or other sustainability allianzGI has been a partner of the cbI since 2015. challenges. criteria specific to climate change are constantly This analysis is completed by an evaluation of the ESG integrated into portfolio construction as our fundamental profile of the issuer in order to avoid controversial issuers. analysis starts by assessing whether a bond is green or not. In case an issuer is subject to an alert confirmed by our This analysis starts with checking whether the bond structure internal Sustainability team on one of the four domains is in line with the Green bond principles or not. The respect analysed (Environment, Social, business behaviour and of those principles (use of proceeds, internal process, mana- corporate Governance), the bonds from this issuer would not be eligible to the Green bond strategy. 28

Eurosif European SRI Transparency Code Page 27 Page 29

Eurosif European SRI Transparency Code Page 27 Page 29