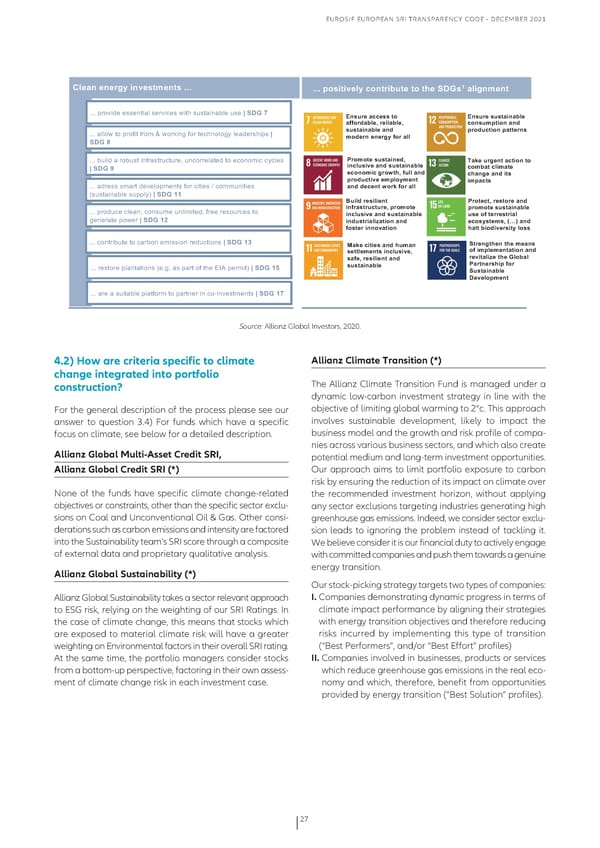

EuRoSIf EuRopEaN SRI TRaNSpaRENcy coDE - DEcEmbER 2021 0 0 0 0 0 0 0 0 !"#$%&#%#'()&*%+#,-.#%-,&/// 9 ///&01,*-*+#")&21%-'*34-#&-1&-5#&678, $"*(%.#%- ???0@4#A&'(0(>>($)&*+0>(4A&6(>08&)70>B>)*&$*C+(0B>(0D0678&E :%,4'#&$22#,,&-1& :%,4'#&,4,-$*%$3"#& $;;1'<$3"#=&'#"*$3"#=& 21%,4.0-*1%&$%<& ???0*++#80)#0@4#%&)0%4#50E08#4F&$30%#40)(67$#+#3G0+(*'(4>7&@>0D0 ,4,-$*%$3"#&$%<& 0'1<42-*1%&0$--#'%, 678&F .1<#'%&#%#'()&;1'&$"" ???0CB&+'0*04#CB>)0&$%4*>)4B6)B4(H0B$6#44(+*)('0)#0(6#$#5&606G6+(>0 @'1.1-#&,4,-$*%#<=& D$B#&4'(#%-&$2-*1%&-1& D0678&H *%2"4,*+#&$%<&,4,-$*%$3"#& 21.3$-&2"*.$-#& #21%1.*2&('1A-5=&;4""&$%<& 25$%(#&$%<&*-,& 0'1<42-*+#&#.0"1).#%-& *.0$2-, ???0*'4(>>0>5*4)0'(A(+#@5($)>0%#406&)&(>0K06#55B$&)&(>0 $%<&<#2#%-&A1'B&;1'&$"" I>B>)*&$*C+(0>B@@+GJ0D0678&99 >4*"<&'#,*"*#%-& @'1-#2-=&'#,-1'#&$%<& ???0@4#'B6(06+(*$H06#$>B5(0B$+&5&)('H0%4((04(>#B46(>0)#0 *%;'$,-'42-4'#=&0'1.1-#& 0'1.1-#&,4,-$*%$3"#& 3($(4*)(0@#8(40D0678&9M *%2"4,*+#&$%<&,4,-$*%$3"#& 4,#&1;&-#''#,-'*$"& *%<4,-'*$"*?$-*1%&$%<& #21,),-#.,=&JKL&$%<& ;1,-#'&*%%1+$-*1% 5$"-&3*1<*+#',*-)&"1,, ???06#$)4&CB)(0)#06*4C#$0(5&>>&#$04('B6)&#$>0D0678&9G C$B#&2*-*#,&$%<&54.$%& 6-'#%(-5#%&-5#&.#$%,& ,#--"#.#%-,&*%2"4,*+#=& 1;&*.0"#.#%-$-*1%&$%<& ,$;#=&'#,*"*#%-&$%<& '#+*-$"*?#&-5#&8"13$"& ???04(>)#4(0@+*$)*)&#$>0I(?3?0*>0@*4)0#%0)7(0.1,0@(45&)J0D0678&9I ,4,-$*%$3"# @$'-%#',5*0&;1'& 64,-$*%$3"#& 7#+#"10.#%- ???0*4(0*0>B&)*C+(0@+*)%#450)#0@*4)$(40&$06#L&$A(>)5($)>0D0678&9E ; 0 0 0 0 Source: allianz Global Investors, 2020. 4.2) How are criteria specific to climate Allianz Climate Transition (*) change integrated into portfolio construction? The allianz climate Transition fund is managed under a dynamic low-carbon investment strategy in line with the for the general description of the process please see our objective of limiting global warming to 2°c. This approach answer to question 3.4) for funds which have a specific involves sustainable development, likely to impact the focus on climate, see below for a detailed description. business model and the growth and risk profile of compa- nies across various business sectors, and which also create Allianz Global Multi-Asset Credit SRI, potential medium and long-term investment opportunities. Allianz Global Credit SRI (*) our approach aims to limit portfolio exposure to carbon risk by ensuring the reduction of its impact on climate over None of the funds have specific climate change-related the recommended investment horizon, without applying objectives or constraints, other than the specific sector exclu- any sector exclusions targeting industries generating high sions on coal and unconventional oil & Gas. other consi- greenhouse gas emissions. Indeed, we consider sector exclu- derations such as carbon emissions and intensity are factored sion leads to ignoring the problem instead of tackling it. into the Sustainability team’s SRI score through a composite We believe consider it is our financial duty to actively engage of external data and proprietary qualitative analysis. with committed companies and push them towards a genuine Allianz Global Sustainability (*) energy transition. our stock-picking strategy targets two types of companies: allianz Global Sustainability takes a sector relevant approach I. companies demonstrating dynamic progress in terms of to ESG risk, relying on the weighting of our SRI Ratings. In climate impact performance by aligning their strategies the case of climate change, this means that stocks which with energy transition objectives and therefore reducing are exposed to material climate risk will have a greater risks incurred by implementing this type of transition weighting on Environmental factors in their overall SRI rating. (“best performers”, and/or “best Effort” profiles) at the same time, the portfolio managers consider stocks II. companies involved in businesses, products or services from a bottom-up perspective, factoring in their own assess- which reduce greenhouse gas emissions in the real eco- ment of climate change risk in each investment case. nomy and which, therefore, benefit from opportunities provided by energy transition (“best Solution” profiles). 27

Eurosif European SRI Transparency Code Page 26 Page 28

Eurosif European SRI Transparency Code Page 26 Page 28