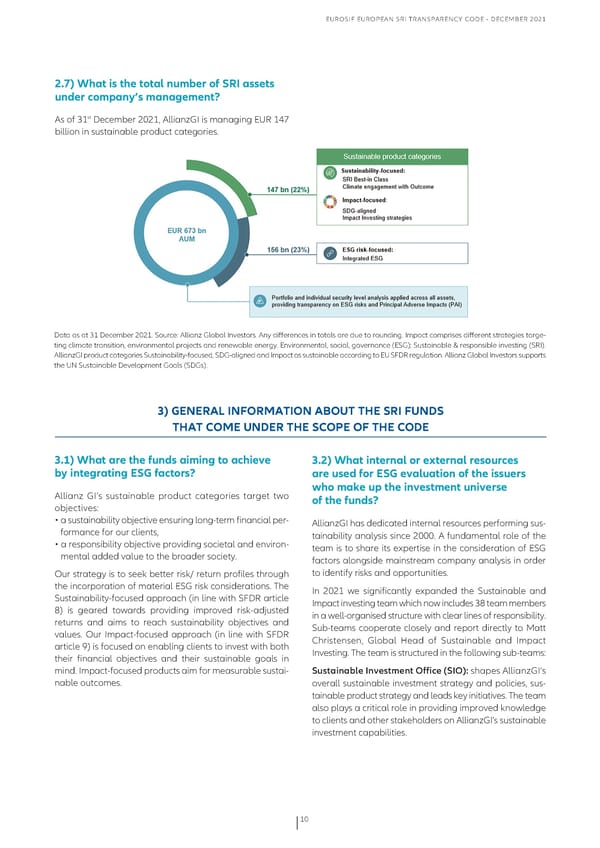

EuRoSIf EuRopEaN SRI TRaNSpaRENcy coDE - DEcEmbER 2021 2.7) What is the total number of SRI assets under company’s management? as of 31st December 2021, allianzGI is managing EuR 147 billion in sustainable product categories. Data as at 31 December 2021. Source: allianz Global Investors. any differences in totals are due to rounding. Impact comprises different strategies targe- ting climate transition, environmental projects and renewable energy. Environmental, social, governance (ESG); Sustainable & responsible investing (SRI). allianzGI product categories Sustainability-focused, SDG-aligned and Impact as sustainable according to Eu SfDR regulation. allianz Global Investors supports the uN Sustainable Development Goals (SDGs). 3) GENERAL INFORMATION ABOUT THE SRI FUNDS THAT COME UNDER THE SCOPE OF THE CODE 3.1) What are the funds aiming to achieve 3.2) What internal or external resources by integrating ESG factors? are used for ESG evaluation of the issuers allianz GI’s sustainable product categories target two who make up the investment universe objectives: of the funds? • a sustainability objective ensuring long-term financial per- allianzGI has dedicated internal resources performing sus- formance for our clients, tainability analysis since 2000. a fundamental role of the • a responsibility objective providing societal and environ- team is to share its expertise in the consideration of ESG mental added value to the broader society. factors alongside mainstream company analysis in order our strategy is to seek better risk/ return profiles through to identify risks and opportunities. the incorporation of material ESG risk considerations. The In 2021 we significantly expanded the Sustainable and Sustainability-focused approach (in line with SfDR article Impact investing team which now includes 38 team members 8) is geared towards providing improved risk-adjusted in a well-organised structure with clear lines of responsibility. returns and aims to reach sustainability objectives and Sub-teams cooperate closely and report directly to matt values. our Impact-focused approach (in line with SfDR christensen, Global Head of Sustainable and Impact article 9) is focused on enabling clients to invest with both Investing. The team is structured in the following sub-teams: their financial objectives and their sustainable goals in mind. Impact-focused products aim for measurable sustai- Sustainable Investment Office (SIO): shapes allianzGI’s nable outcomes. overall sustainable investment strategy and policies, sus- tainable product strategy and leads key initiatives. The team also plays a critical role in providing improved knowledge to clients and other stakeholders on allianzGI’s sustainable investment capabilities. 10

Eurosif European SRI Transparency Code Page 9 Page 11

Eurosif European SRI Transparency Code Page 9 Page 11