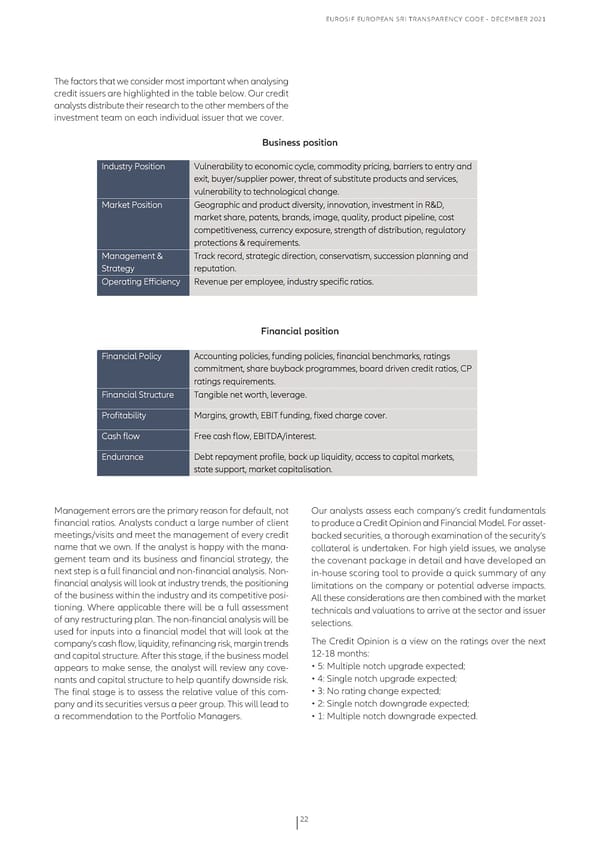

EuRoSIf EuRopEaN SRI TRaNSpaRENcy coDE - DEcEmbER 2021 The factors that we consider most important when analysing credit issuers are highlighted in the table below. our credit analysts distribute their research to the other members of the investment team on each individual issuer that we cover. Business position Financial position management errors are the primary reason for default, not our analysts assess each company’s credit fundamentals financial ratios. analysts conduct a large number of client to produce a credit opinion and financial model. for asset- meetings/visits and meet the management of every credit backed securities, a thorough examination of the security’s name that we own. If the analyst is happy with the mana- collateral is undertaken. for high yield issues, we analyse gement team and its business and financial strategy, the the covenant package in detail and have developed an next step is a full financial and non-financial analysis. Non- in-house scoring tool to provide a quick summary of any financial analysis will look at industry trends, the positioning limitations on the company or potential adverse impacts. of the business within the industry and its competitive posi- all these considerations are then combined with the market tioning. Where applicable there will be a full assessment technicals and valuations to arrive at the sector and issuer of any restructuring plan. The non-financial analysis will be selections. used for inputs into a financial model that will look at the company’s cash flow, liquidity, refinancing risk, margin trends The credit opinion is a view on the ratings over the next and capital structure. after this stage, if the business model 12-18 months: appears to make sense, the analyst will review any cove- • 5: multiple notch upgrade expected; nants and capital structure to help quantify downside risk. • 4: Single notch upgrade expected; The final stage is to assess the relative value of this com- • 3: No rating change expected; pany and its securities versus a peer group. This will lead to • 2: Single notch downgrade expected; a recommendation to the portfolio managers. • 1: multiple notch downgrade expected. 22

Eurosif European SRI Transparency Code Page 21 Page 23

Eurosif European SRI Transparency Code Page 21 Page 23